Picking a Web3 influencer succeeds or fails a launch. The right pick fills Discords and waitlists; the wrong one burns budget and credibility. We've worked on a ton of campaigns at FINPR, so we made a simple playbook that you can implement today. Where to find good candidates, quick filters that save hours, deep checks. Use it to hire smarter and spend less.

Where to Find Candidates

1) X (Twitter) – fast signal, easy outreach

Start here. Search by chain, niche, and use cases. Add hashtags and terms your users care about. Then go to Advanced Search and sort by terms, language, and date to find people who regularly tweet about your topic. Save shortlists as public or private Lists so that your team can follow them in one feed.

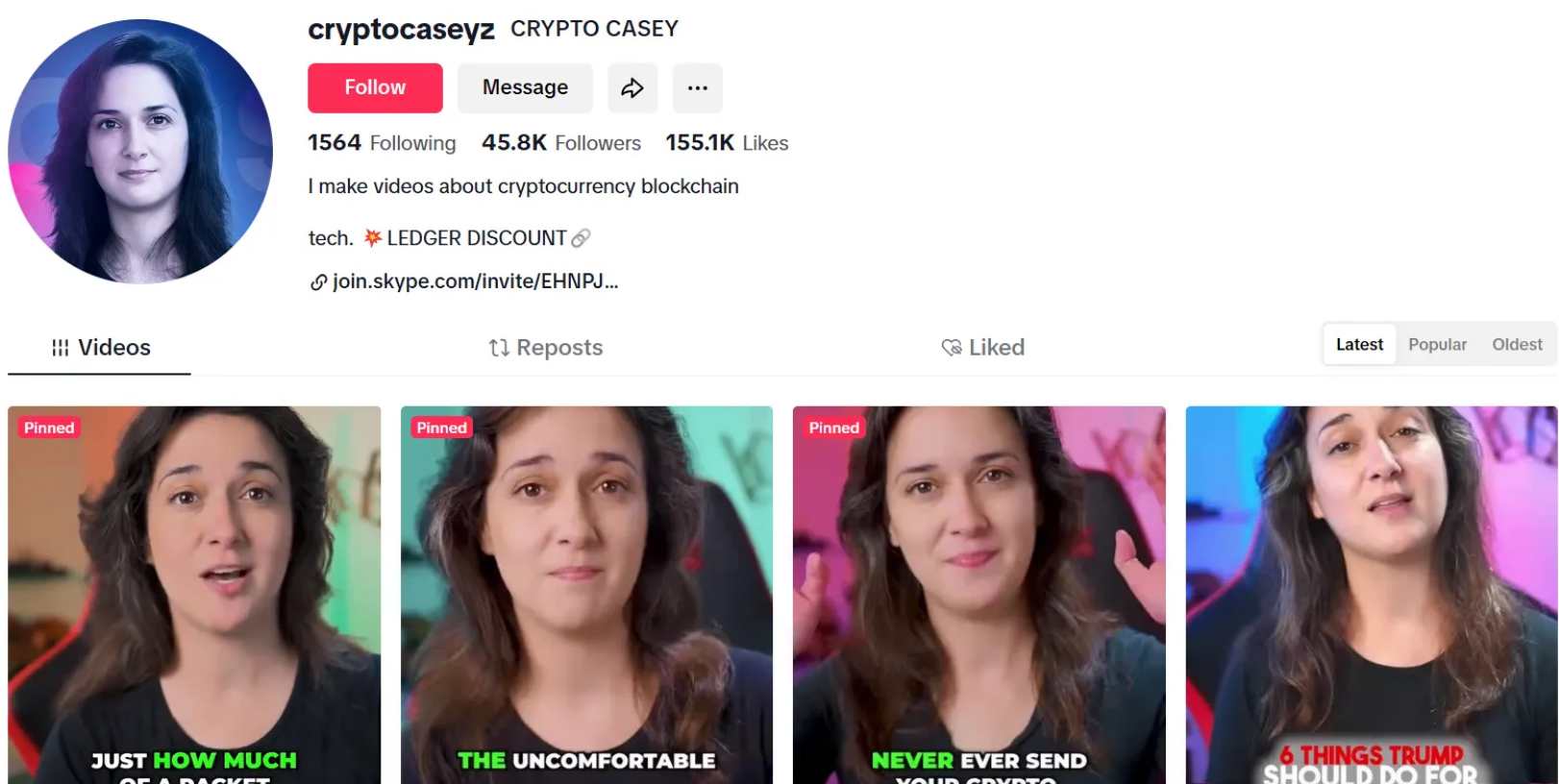

2) YouTube and TikTok – explanatory styles and how-to's

Look for creators who produce how-to content: staking guides, airdrop tutorials, wallet setup, security tips. Sort by recent uploads. Filter by latest posts. Scroll through comments for signs of a real audience with real questions. DM or email from channel About page to start a thread.

3) Telegram and Discord – community first creators

Crypto exists in chats. Lists of Telegram crypto channels pre-curated are a quick means to map out niches, then you can examine posting fashion, admin guidelines, and interaction before reaching out to them. For Discord, use discoverable servers and follow Discord's Discovery rules; authors who have active, public servers are likely to want to work with you.

4) Reddit – topic experts and popular commenters

Scan outsize crypto subreddits for regular helpers and analysts. People who write coherent, sourced comments and AMAs will cross-post to X or have streams. Reddit's audience is huge and active, so you can find niche voices there and then track them to other platforms for a full picture.

5) Creator databases – fast shortlists, fast fraud checks

Creator databases enable you to search by platform, country, follower range, and keywords in bio, then assess audience quality and growth. Pull 20–50 matching profiles, export, and go on to vet.

Pass Filters

Start with speed, not spreadsheets. Scan through every creator and decide if you want to take a second look. This is how we approach it at FINPR.

Activity and cadence

Are they posting this week? Any extended gaps that are more than a month? YouTube creators must have some new long vids within the last two months. X and TikTok must show consistent posting, not random activity. If crypto is their core topic and featured in all recent posts, keep them on the list.

- Last post between 7–14 days.

- Regular beat for the last 8–12 weeks. No long gaps.

- Format combination that fits your plan: threads, shorts, long video, live.

Fit and format

Match your niche and your format. DeFi requires threads, tutorials, and live demos. If you're NFT or gaming, streams and short clips are better. Hire creators whose natural tone already matches your plan. You'll approve faster and get neater results.

- At least half of your current crypto or your local (L2, DeFi, wallets, security, gaming, AI x crypto) posts.

- Your recent posts fit into your phase: launch, growth, or education.

- Clear point of view. No random cut and paste of headlines.

Feel genuine engagement

Skim comments, not just the like count. Do people engage with the content, comment back and forth, play with the tool, join the Discord? Healthy trends look like this: on X, likes in low single digits percentage of followers on several posts; on YouTube, recent views at 5–15% of subs; on TikTok, views approximate or surpass follower number on good clips. Click through some of the frequent commenters. Real avatars, real timelines.

- X: likes for each 1,000 followers above 2 on recent posts.

- TikTok/Reels/Shorts: close to or above number of followers on latest 12 videos.

- YouTube: views-to-subs ratio of over 10% on last 60-day posts.

It is important to look at the quality of audience engagement.

We don't just look at the number of subscribers/views/likes/comments, we look at their quality. Do the comments look like spam? Are they real people or bots? Is there a connection between the comment and the influencer's post/video? Are there discussions on the topic raised? Comments like “LFG” or “Great review” are not likely to be left by genuinely interested people.

Nowadays, you can fake absolutely anything.

Promo cleanliness and safety

Ads should be marked. No fabricated "just purchased" storylines. Look at past promos and the comments underneath them. If you see rugs, paid flags with insane claims, or drama bait, skip. Check pinned posts and bio for shady partners or constantly fighting other content creators. You want someone who will be able to do an AMA without a mess.

Red flags for authenticity:

- Sudden follower spikes with flat engagement.

- Copy "nice project" or emoji comment alone.

- Weekly contests.

- Same caption on many accounts at the same time.

- Too much referral shill without disclosure.

Brand safety scan:

- No hate, scams, or shock content.

- Previously paid promos identified as such.

- No double pumps or "buy now" pressure on thin coins.

- Clean link stack (no evil shorteners).

Advertising. All clients want their advertising to appear in the content natively, unobtrusively, as if the influencer themselves decided to talk about the project. Therefore, we manually look for and search for advertising posts/inserts in videos to ensure they are integrated smoothly.

Content quality assessment

- YouTube/TikTok: Are the videos edited well? Does the influencer carefully study the project before shooting the video? Do they stay on track during the video? Do they know what to say and when to say it? There are some influencers who just browse the website and read the text from the screen without adding anything of their own — we reject those right away.

- X: how often does the influencer write their opinion, share their thoughts; does the format of their posts change (if the content is all the same, then they have no personal connection with their audience); does their feed consist only of retweets of other people's posts or giveaways?

Credibility indicators

Speed tells: work with well-known projects, branded mentions from famous creators, step-by-step guides with on-screen walkthroughs or dashboards, public trader wallets. You don't need a PhD-level audit yet. You simply want proof they do the thing they claim to do.

Contact & commerce readiness

Do they make it easy to collaborate with them? Search for a business email, media kit, or rate card link. Region and time zone in bio help. If they hide contact info, search for slow starts and long tagback later.

- Contact email in bio or media kit link.

- Clearly listed past ads or partners.

- Pricing hint in highlights or Q&A saves you time later.

Pricing & Negotiation Playbook

Select a price model which is appropriate for the purpose

- Per view or CPM anchor – best suited for YouTube and Reels. Industry sources mirror YouTube is view-based-priced. $50–$100 per 1,000 views as a rule of thumb. Price bands by view count, from about $50 at 1–10k views to around $5k at 500k–1M.

- Per deliverable – flat fee per Reel, Story set, thread, or video. Micro creators typically $750–$5,000 per Reel and $500–$3,000 per Stories; mid-level $5k–$20k per Reel; macro $10k–$50k. Bundles usually discount 10–30 percent.

- Hybrid – lower fixed fee + performance kicker (per 1,000 views, per code redeemed, or per sign-up). Good for pre-testing and for creators whose reach varies.

Rapid calculation:

- Effective CPM = fee ÷ (real reach) × 1,000

- eCPV = fee ÷ views

- CAC from influencer = spend ÷ new sign-ups or wallets

Create a range first before you negotiate

- Pull last 10–20 posts. Note average views, clicks, and comment quality.

- Map to a target CPM/eCPV from your past paid social.

- Cap the initial quote. Offer a base based on those averages, then on top of that a clean bonus ladder. This hybrid strategy for both IG and YouTube.

Smart ways to lower cost without saying "lower the cost"

- Less time on video, but add a pinned comment with the link for 7 days.

- Less X thread frames, add a single repost at 24 hours.

- Push the post to a lighter day on their schedule for a better rate.

- Post two over the course of a month for a discount on a small package. Pay the first first, the second after the first does well.

Red flags in price talks

- “We don’t share stats”. Hard pass.

- “We delete promos after 24 hours”. Your link dies.

- “No edits, no disclosure”. Risky.

- “Same rate for all formats”. You’ll overpay on threads or shorts.

The Verdict: Agency vs In-House Working

You have two good choices. Assemble your own small KOL unit. Or rent one that already produces results weekly. Both can work. The right choice is dependent on stage, speed, and risk tolerance.

When in-house excels

You have a budget that is set, niched down, and time to train someone or two. You yearn for total tone control and long-term relationships. You’re fine building sheets, templates, and tracking from scratch. If that sounds like you, hire a KOL manager plus a part-time analyst. Give them a simple sprint: sourcing, first-pass filters, a test post every week, and one report every two weeks. Keep it tight and you’ll get a good engine in a quarter.

When an agency makes more sense

You need creators across different chains and geographies next week, not next quarter. You need pricing history, shortlists, and clean brief out the door in days. An agency already has creator conversations open, rate baselines, and make-good playbooks. That decreases trial spend and shortens the learning curve.

At FINPR agency, we have a screened bench of Web3 creators by niche and market – DeFi, NFTs, AI, gaming, metaverse – so you don't have to start from scratch. We can also organize a full marketing campaign: PR outreach, influencer marketing, content creation, crypto advertising.

If you have time to spare, a forbearing roadmap, and a single region, go in-house. If you need multi-region makers and measurable impact this quarter, bring in an agency. If you want control and speed, do the hybrid.