We all think about the idea of virtual worlds for an incredibly long time. Switch back to the last century. Science fiction writers dreamed of the chance of this virtual socialization. And we must admit that humanity has come closer to this than ever before. And all this thanks to metaverses.

But why? It is important to understand one key thing: a single virtual world can never be a metaverse. A metaverse is about the interconnection of several virtual worlds, if not all of them at once.

We all spend a good chunk of our time on the internet every day (watching videos on YouTube / just browsing social media). Instead of just watching your friends' posts on Instagram, you can interact with them in real time. Instead of just watching through a screen, you can immerse in metaverse environment for the most realism. It is a virtual universe where everyone can interact with other people, exchanging data and values.

It is a kind of a digital version of the world as we know it today: continents, countries, cities, villages, and regions. Each is autonomous, but contributes to the overall picture. And users can explore deeper if they buy land, create experiences for other players, and monetize their experiences. There is no predetermined gameplay. Instead, it is a world where players decide and create what they want to see.

Today, we're listing the best worlds in the metaverse, each with a variety of features and benefits.

What Is the Metaverse Today?

What actually is the metaverse? Well, if we think of the internet as something that we look at, the metaverse is a version of the internet that we're inside. The idea is that we will experience the virtual space as an avatar — a virtual version of ourselves that we control as we explore this new online frontier.

The metaverse is a spatial construct, as opposed to the previous web, which was really a very linear, kind of 2D, flat thing. Developers want this one to be immersive. Now, of course, it doesn't mean it has to be virtual reality — it could also just be on a phone or on a desktop computer.

This technology is rapidly expanding. You can see those ultra-fast internet connections, virtual-reality headgear, and permanent, always-on online worlds already operational. Although the metaverse is significantly more vast than a video game, it appears that the gaming world has already embraced it.

It can elevate the virtual-reality experience to a new level, allowing players to float into the virtual environment to do anything from buying land and hosting parties to even getting married using digital avatars.

The metaverse is being developed further using mixed-reality technology, which blends VR and AR. With the elements of touch and smell being a part of the metaverse experience, the immersion is further enhanced by haptic feedback, which provides vibrations for certain actions.

Types of Metaverse Projects

What kinds of projects are out there?

Virtual Worlds and Social Hubs

These are the digital spots where meeting people is the whole point. Picture logging into a space where you can just be with others, without any required game or specific goal. You customize an avatar and step into a persistent online environment. Places like VRChat or Horizon Worlds show this off - you might find yourself at a live comedy show, a virtual dance club, or a quiet cafe to chat with friends. The energy comes from shared experiences and casual interaction.

Gaming-First Projects

Metaverse gaming projects are built as engaging game worlds where you have adventures, compete, earn real rewards (projects like Axie Infinity or Star Atlas). You dive into stories, tackle challenges, and build strategies, often with a community of fellow players. The economy usually ties directly to gameplay, where items you earn or craft can be traded or sold. It's a blast if you love games that evolve and where your investment of time can lead to owning unique digital stuff.

Digital Real Estate-Focused Ecosystems

Here, the spotlight is on virtual land. The key activity is owning, developing, and trading parcels of digital property. What else? In Decentraland or The Sandbox, you can buy a plot, construct a building, or lease out space. The community treats these areas as scarce, valuable lots. You might see people opening art galleries, setting up advertising billboards, or hosting exclusive parties on their land. It attracts those interested in design, development, and the pure economics of a digital property market.

Top Metaverse Projects to Watch in 2025

1. Decentraland (MANA, Ethereum) – First Decentralized Virtual World

Decentraland is one of top metaverse crypto projects. What can you do there? Buy land, construct buildings, create games, and sell objects. Decentraland is a virtual reality platform based on the Ethereum, it allows users to create, test, and monetize content and apps. MANA is the native coin for all transactions there.

In this virtual world, users purchase plots of land that they can then navigate, build on, and monetize. Since opening to the public in February 2020, users have created a wide range of experiences on their LAND plots, including interactive games, expansive 3D scenes, and various other interactive experiences.

In short, this project can be described as the social network of the future, where you can go with friends to play pool, visit a nightclub, or attend a new smartphone launch event. It is ideal for various social activities, which it handles quite well.

- Type: Digital real estate

- Token: MANA

- Market Cap (2025): about $670M

- Chain: Ethereum with Polygon for transactions

- Main Use Case: pen virtual world with land, wearables, events

- Key Features: NFT land ownership, creator tools, DAO

- 2025 Highlights: Metaverse Fashion Week 2025 and Art Week 2025

2. The Sandbox (SAND, Ethereum) – User-Generated Gaming & Voxel Assets

The Sandbox is a project with “pixel” graphics. A limited number of land plots is driving demand. Prices are rising tenfold. Players can create, own, and monetize their gaming experiences on the Ethereum and Polygon chains. It emphasizes user-generated content and play-to-earn (P2E) mechanics. The ecosystem is based on the SAND token to purchase assets and reward users.

Users can create their own game assets, which can then be used to create games, experiences, or events. In addition, users can sell their creations to other players through the official marketplace.

The Sandbox combines social and gaming elements, providing simple tools for non-technical people to create great content. I’d say, Sandbox is a metaverse for gamers.

If Decentraland is for socializing, then Sandbox is for gaming. With a bunch of modes, quests, and the ability to create your own adventures. It's cool, and it's very impressive.

- Type: Gaming

- Token: SAND

- Market Cap (2025): about $742M

- Chain: Ethereum (with Polygon support; team also teased own chain work)

- Main Use Case: UGC worlds, brand hubs, playable seasons

- Key Features: LAND NFTs, creator tools, brand partnerships

- 2025 Highlights: Alpha Season 6 with Cirque du Soleil and 250k SAND rewards

3. Otherside (APE, Ethereum) – Bored Ape Yacht Club's Interactive Metaverse

Go on to Otherside - virtual expansion of the hugely successful BAYC NFT collection from Yuga Labs. It is not traditional virtual worlds. Otherside integrates NFT ownership directly into the game. It allows holders of NFT collections to use their assets in the metaverse. The project aims to create a fully immersive, interoperable world. NFT holders can explore, socialize, build experiences together.

It provides real-time, large-scale multiplayer interaction capabilities, powered by Improbable’s M2 technology. Thousands of gamers interact in a high-fidelity 3D environment without lags as in traditional online games. With backing from some of the biggest players in Web3 (Animoca Brands and Andreessen Horowitz), Otherside is redefining how NFTs are integrated into the metaverse.

- Type: Gaming

- Token: ApeCoin (APE)

- Market Cap (2025): about $520M

- Chain: Ethereum

- Main Use Case: Large-scale multiplayer world with NFT avatars

- Key Features: 3D models for BAYC/MAYC/BAKC/CryptoPunks, ODK for creators

- 2025 Highlights: “Outbreak” open beta in Otherside and refocus on Otherside + BAYC

4. Axie Infinity (AXS, Ronin) – Play-to-Earn Pokémon-Style Battle Game

Personally, I like this so much. Axie Infinity blockchain-based game has popularized the P2E model. It allows players to earn real-world income though battling, breeding, trading digital creatures (Axies). Axie Infinity created an entire in-game economy, it attracted millions of users in regions where players could earn more than traditional wages.

The game’s metaverse expansion, "Axie Infinity: Origin", introduces new mechanics, they improve accessibility and stability. Axie’s approach has inspired numerous other blockchain games, the project is an innovator in NFT-based gaming.

- Type: Gaming

- Token: AXS

- Market Cap (2025): about $377M

- Chain: Ronin (app-chain by Sky Mavis)

- Main Use Case: Creature battler with play-to-own economy

- Key Features: Seasons, tournaments, marketplace, Ronin wallet

- 2025 Highlights: Origins Season 14 with 80k AXS prizes; Elite 4 postseason on Oct 5; Ronin grants and growth

5. Meta’s Horizon Worlds (Centralized) – Social VR Platform by Meta

Meta (formerly Facebook) is a key player in the metaverse space with Horizon Worlds, a social VR platform designed for exploration, gaming, and remote collaboration. Horizon Worlds and Meta’s Quest headsets is a centralized ecosystem that allow users create, interact, and socialize in VR environments.

Yes, Meta has faced criticism for low accessibility, high hardware costs, and early-stage development limitations. But it is still considered as ambitious project due to the company’s massive investment in AI, VR, AR technologies. Meta is developing Horizon Worlds as a dominant force in the social and business aspects of the metaverse.

- Type: Virtual world

- Token: -

- Market Cap (2025): -

- Chain: Centralized platform by Meta

- Main Use Case: Social VR creation and hangouts for Quest and mobile

- Key Features: New Horizon Engine for bigger worlds, higher player counts, faster loads

- 2025 Highlights: Horizon Engine announced at Meta Connect 2025

6. Roblox (RBLX, Centralized) – Massive User-Generated Content Gaming Universe

In 2025 this is still leads the industry. Yes, I am about Roblox, widely popular platform that allows users to create, share, and play games.

It has been working for many years. Children create their own worlds and games and interact with each other. Roblox provides many-many development tools that enable creators to design immersive contents.

The platform's in-game currency, Robux, eases transactions to buy items, accessories, and get premium content. Developers can monetize their creations, earning Robux that can be exchanged for fiat money.

- Type: Virtual world

- Token: Robux (in-game currency, not crypto)

- Market Cap (2025): -

- Chain: Centralized UGC platform

- Main Use Case: Create and play UGC “experiences,” live economy for devs

- Key Features: Immersive ads, rewarded video ads, strong creator payouts

- 2025 Highlights: Q2 2025 bookings $1.44B and raised full-year outlook; record DAU growth

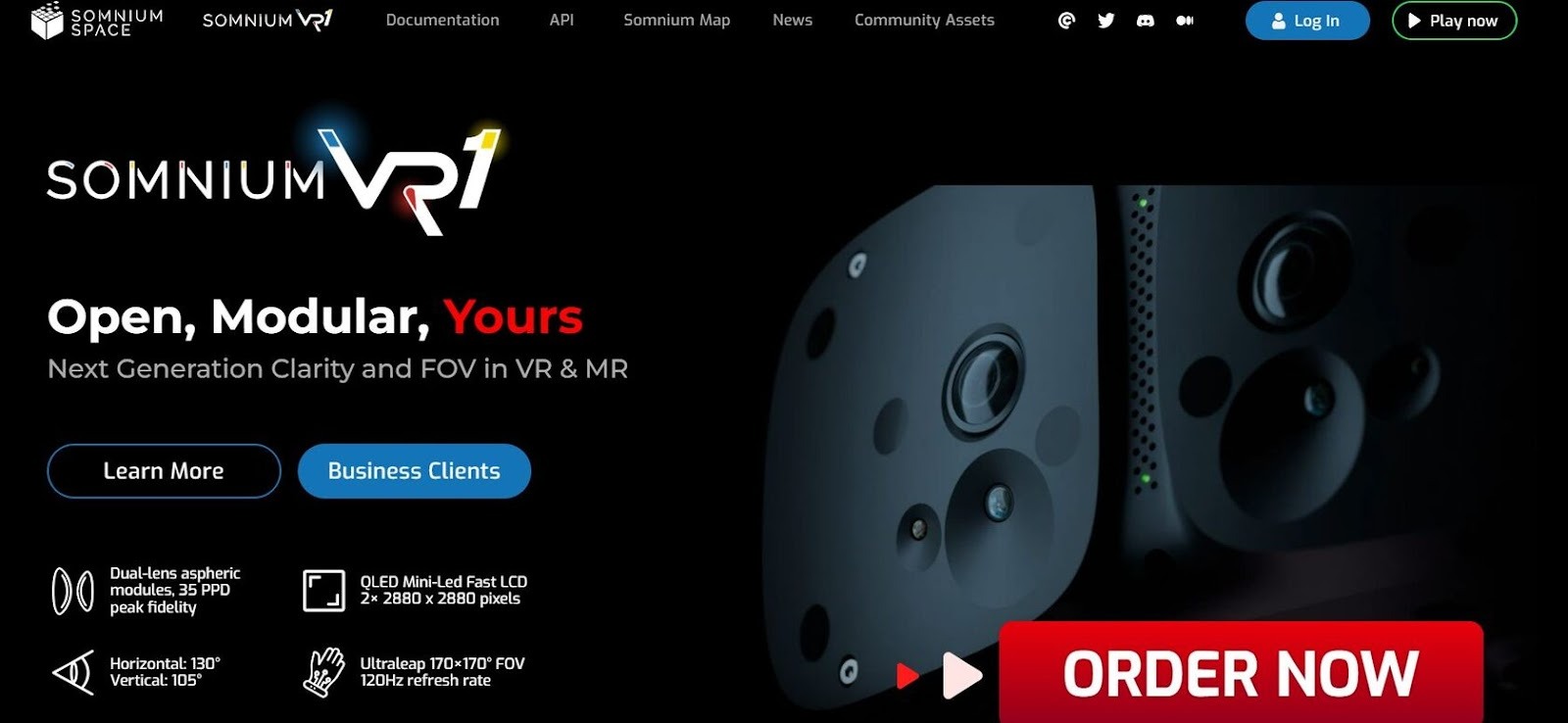

7. Somnium Space (CUBE, Ethereum) – Open, Persistent VR World

Somnium Space is an open-source social virtual reality world based on blockchain technology and entirely shaped by its users, allowing them to purchase digital land where they can build virtual reality homes and buildings.

Unlike most multiplayer VR games, where players are divided into sub-servers and mirror rooms, Somnium places all of its players in one huge world.

Players can buy virtual land and build whatever they want on it: a nightclub, an art gallery, a house — the possibilities are truly endless, as are the rewards for experienced users. You can access Somnium Space from your PC and mobile device.

And yes, one of the main features is the ability to connect in VR. This is done particularly well in this metaverse. For example, you can even play shooters with VR. But VR is not mandatory, although it is desirable. It is also worth noting the fairly good graphics compared to something like Decentraland. Overall, it is one of the best metaverses, which has already been used by various celebrities for their concerts and other events.

- Type: Digital real estate

- Token: CUBE

- Market Cap (2025): about $4.9M

- Chain: Ethereum

- Main Use Case: VR world with land, avatars, and creator tools

- Key Features: VR support, land NFTs, Unity-based SDK for custom worlds

- 2025 Highlights: Ongoing SDK and Worlds updates; active CUBE markets referenced on major trackers

8. Bloktopia (BLOK, Polygon) – 21-Level Virtual Skyscraper for Crypto Education

Bloktopia is a 21-level Polygon-based VR skyscraper. It is built on Unity and serves as a gateway to crypto content, mini-games, events, and branded areas. BLOK is the token that powers access and commerce in the world.

Land is sold as REBLOK NFTs and ad space as ADBLOK, both purchasable with BLOK. Anchor tenants from well-known crypto exchanges and brands have been solicited by the team for years, and its documents define joint and sole ownership plans for plots.

- Type: Digital real estate

- Token: BLOK

- Market Cap (2025): about $5.0M

- Chain: Multichain token live on BSC, Polygon, and Arbitrum

- Main Use Case: VR skyscraper hub with virtual real estate, learning, social, and ads

- Key Features: 21-level world, property NFTs, staking, events

- 2025 Highlights: Public 2025 roadmap posts and social updates teasing new zones, BLOK Games, BLOK Party

Is the Metaverse Still Relevant After the 2021 Hype?

Metaverses are still popular, especially the Roblox platform, which makes millions of dollars in profits every day.

At the same time, there is an opinion that the boom of this trend is not as predicted (which is true) and that this technology has faded away in the context of mass distribution.

It is still an emerging trend for years to come, the technology is truly innovative and has potential, but it has not spread as quickly as predicted in 2020-21. Projects’ CEOs said that in 2-3 years, most video calls and conferences would be in the metaverse, which is obviously not the case. The hype has subsided, with AI technologies temporarily taking the lead, but the industry's development is still going strong.

Main Risks and Challenges for Metaverse Projects

There are, however, a few concerns with the advent of the metaverse.

Users may be diverted onto a street or guided into a risky physical circumstance such as robbery or mugging as AR technology enters the picture. Businesses will need to make advanced preparations to ensure their AR and VR systems are not exploited — either internally by unethical management looking to violate the privacy of their co-workers and subordinates, or externally by hackers.

The problem is that when using different platforms, you need to create different accounts, avatars, and so on, and on top of that, the high entry threshold, the availability of equipment, is not accessible to everyone.

There is a lot of talk about a “unified metaverse”. But how is this possible when different countries and companies have their own interests?

A unified space is possible, but it will consist of subsystems - separate metaverses that are seamlessly connected to each other. For this to work, we need unified regulations, a common engine, or standards, as we have now on the internet: we can open a browser and go to different websites using a single tool - the browser. Companies are interested in allowing users to move between platforms while retaining their digital identity.

Conclusion: How to Choose Metaverse Projects to Follow

The metaverse is rapidly becoming a dynamic digital economy that is reshaping how people work, play, and connect. The rise of virtual real estate, NFT-powered economies, play-to-earn gaming, and digital commerce is already proving that the metaverse is a lucrative space for businesses and creators alike.

We hope you found this best metaverse projects 2025 ranking informative and helpful. Most of them show a stable development though the latest years that means that these projects have chances for bright future.

This industry is still in its early stages, but its impact on gaming, entertainment, social networking, education, and business is undeniable. As technology continues to evolve, the metaverse will become an integral part of our digital lives — blurring the line between the physical and virtual worlds.