Market making in cryptocurrency is crucial for liquidity, reducing volatility, and improving market efficiency. As the digital asset space grows, seamless trading experiences are in high demand. Market makers play a key role by offering continuous buy and sell quotes, ensuring there's always a counterparty for trades.

This article explores the basics of crypto market making, various strategies, and the benefits for the digital asset industry.

What is Market Making in Crypto?

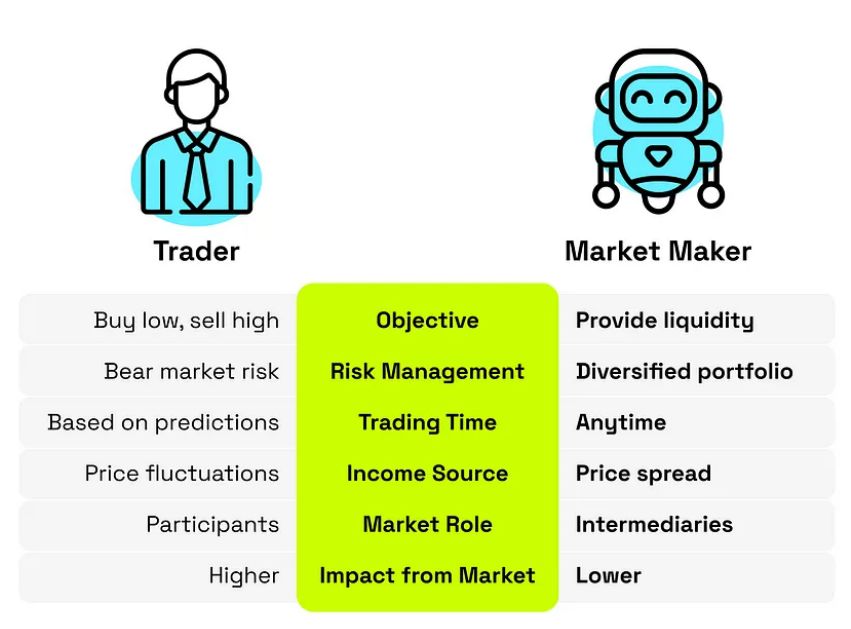

At its core, market making in crypto aims to narrow the bid-ask spread—the difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask). By doing so, market makers enhance the trading experience by providing tighter spreads and deeper liquidity, which helps reduce volatility and stabilize prices. This is especially important in the cryptocurrency market making, known for its high volatility and rapid price fluctuations.

Crypto market makers operate by continuously updating their buy and sell orders based on current market conditions, using sophisticated algorithms and trading strategies. These strategies might include statistical arbitrage, algorithmic trading, and other quantitative techniques to optimize their positions and manage risk.

One of the key features of crypto market making is the ability to provide continuous quotes. Market makers must be prepared to buy and sell the asset at all times, which means they often hold significant inventories of the asset they are making a market for. This practice requires a deep understanding of market dynamics, access to capital, and robust risk management frameworks.

In return for their market making services crypto, market makers earn profits from the spread between their buy and sell orders. While the profit per trade might be small, the high frequency of trades can lead to substantial cumulative gains. Additionally, exchanges often incentivize market makers through rebates, reduced trading fees, or other financial incentives to ensure a steady supply of liquidity on their platforms.

How Does Crypto Market Making Work?

Cryptocurrency market making involves a series of sophisticated processes and strategies aimed at providing liquidity and ensuring efficient market functioning. Is crypto market making profitable? Crypto market making can be profitable due to the cumulative gains from high-frequency trading and the incentives provided by exchanges. By leveraging advanced crypto market making technology and risk management strategies, crypto market makers can achieve substantial profits over time.

Continuous Quoting

Market makers provide continuous buy and sell quotes for specific cryptocurrencies. This means they are always ready to buy at a bid price and sell at an ask price. The difference between these two prices is known as the bid-ask spread. By maintaining tight spreads, market makers help to minimize transaction costs for traders and enhance market efficiency.

Inventory Management

To effectively make a market, market makers must hold an inventory of the cryptocurrency they are trading. This inventory management is crucial as it allows them to fulfill their buy and sell orders. Market makers must balance their inventory to avoid excessive exposure to price movements, which requires sophisticated risk management techniques.

Algorithmic Trading

Cryptocurrency market making is often powered by algorithmic trading. Market makers use advanced algorithms to update their quotes in real-time based on current market conditions. These algorithms analyze various factors such as market depth, order flow, and price volatility to determine optimal bid and ask prices. This ensures that the market maker can respond quickly to market changes and maintain tight spreads.

Arbitrage Opportunities

Market makers often exploit arbitrage opportunities to profit from price discrepancies between different exchanges or trading pairs. By simultaneously buying low on one exchange and selling high on another, market makers can lock in risk-free profits. This activity also contributes to price convergence across different markets, enhancing overall market efficiency.

Rebate Programs

Many cryptocurrency market making exchanges offer rebate programs to incentivize market makers. These rebates are typically a percentage of the trading fees generated by the market maker’s activity. By participating in these programs, market makers can reduce their overall trading costs and improve profitability. This mutually beneficial arrangement ensures that exchanges maintain high liquidity levels while market makers earn additional income.

Risk Management

Effective risk management is essential for market makers. Given the inherent volatility in the crypto markets, market makers must implement strategies to mitigate potential losses. This includes setting limits on inventory exposure, using stop-loss orders, and employing hedging techniques. Advanced risk management systems help market makers to maintain their operations even in highly volatile conditions.

Profit Generation

Market makers generate profits primarily from the bid-ask spread. Although the profit per transaction may be small, the high frequency of trades can lead to significant cumulative earnings. Additionally, by providing liquidity and maintaining tight spreads, market makers can attract more traders to the exchange, further increasing their trading volume and potential profits.

Technological Infrastructure

Robust crypto market making technology infrastructure is critical. High-frequency trading requires low-latency connections to exchanges, powerful computational resources, and reliable data feeds. Market makers invest heavily in crypto market making technology to ensure they can execute trades quickly and efficiently, maintaining a competitive edge in the market.

Who Are the Market Makers in Crypto?

Market makers in the crypto industry can be broadly categorized into different types of entities, each playing a vital role in ensuring liquidity and efficient market functioning:

- Specialized Trading Firms: These firms, also known as proprietary trading firms, are among the most prominent market makers in the crypto space. They leverage sophisticated algorithms and high-frequency trading strategies to provide continuous buy and sell quotes on various cryptocurrency exchanges. Some well-known examples include Jump Trading, DRW, and Alameda Research.

- Cryptocurrency Exchanges: Exchanges can provide tighter bid-ask spreads and a more seamless trading experience for their users. This practice also helps exchanges to attract more traders and increase their trading volumes. Notable exchanges such as Binance, Coinbase, and Kraken have dedicated market-making teams or partnerships with external market makers to fulfill this role.

- Hedge Funds and Investment Firms: These entities use their substantial capital reserves and advanced trading strategies to provide liquidity in the markets. Firms like Galaxy Digital and Pantera Capital are examples of investment firms that participate in market making in crypto, leveraging their market insights and resources to facilitate trades and earn profits from the bid-ask spread.

- Individual Traders: Individual traders also participate in market making, especially on decentralized exchanges (DEXs). On these platforms, users can provide liquidity by depositing their assets into liquidity pools. In return, they earn fees generated from trades that occur within the pool. This decentralized approach to market making in crypto is facilitated by automated market maker (AMM) protocols such as Uniswap, SushiSwap, and Balancer.

- Liquidity Provider Networks: They consist of multiple market makers who collectively ensure sufficient liquidity across various trading platforms. These networks, such as Wintermute and B2C2, often operate on a global scale, providing liquidity to multiple exchanges simultaneously. These networks can offer deeper liquidity and tighter spreads, enhancing the overall trading environment.

- Broker-Dealers: These entities facilitate trading for their clients by continuously quoting buy and sell prices for cryptocurrencies. Broker-dealers often serve institutional clients, providing tailored liquidity solutions and executing large orders with minimal market impact. Firms like Genesis Trading and Cumberland are examples of broker-dealers that engage in market making activities.

- Algorithmic Trading Bots: With the rise of automation in trading, algorithmic trading bots have become increasingly popular. These bots are designed to perform market-making functions by automatically placing and adjusting orders based on predefined strategies and market conditions. Bots like Hummingbot and KoinKnight enable users to participate in market making in crypto on various exchanges.

How Crypto Market Making Can Help Your Product

Market making can be a transformative factor for any crypto product, whether it’s a new token, a DEX, or a trading platform. Here’s how engaging in or partnering with market makers can significantly benefit your product:

Enhanced Liquidity

Liquidity is the lifeblood of any trading market. For a new token or trading platform, the presence of market makers ensures that there is always a market for the asset, meaning buyers and sellers can execute trades quickly and at fair prices. Enhanced liquidity reduces the risk of price slippage, making your product more attractive to both retail and institutional investors.

Improved Price Stability

Cryptocurrencies are notorious for their volatility. Market makers help to mitigate this by continuously providing buy and sell orders, which dampens large price swings caused by significant trades. This stability is crucial for building investor confidence and fostering long-term engagement with your product.

Narrower Bid-Ask Spreads

Market makers work to narrow the bid-ask spread, which is the difference between the highest price a buyer is willing to pay and the lowest price a seller is willing to accept. Tighter spreads mean lower transaction costs for traders, making your platform more competitive and appealing to a broader user base.

Increased Trading Volume

Higher liquidity and tighter spreads typically lead to increased trading volume. For exchanges and trading platforms, this can result in higher revenue from trading fees. For token projects, increased trading activity can enhance visibility and credibility in the market, attracting more investors and users.

Attraction of Institutional Investors

Institutional investors often seek markets with high liquidity and stability. By ensuring that your product benefits from professional market making services crypto, you can make it more attractive to large-scale investors who bring significant capital and further stability to the market.

Better User Experience

A seamless and efficient trading experience is crucial for user retention. Market makers contribute to this by ensuring that trades can be executed quickly and at predictable prices. This positive user experience can lead to higher user satisfaction, repeat engagement, and word-of-mouth promotion.

Boosting Initial Coin Offerings (ICOs) and Token Sales

For projects launching new tokens, having market makers can be especially beneficial during the initial offering phases. Market makers can provide the necessary liquidity and price support, ensuring that the token launch is smooth and that new investors can buy and sell the token without significant price disruption.

Increased Trust and Credibility

A liquid market with stable prices fosters trust among users and investors. Knowing that there is always a market for an asset and that price swings are minimized can increase the perceived legitimacy and reliability of your product. This trust can be a significant differentiator in the competitive crypto market.

Facilitating Market Entry

For new products entering the crypto market, gaining traction can be challenging. Crypto market makers can help by ensuring that there is immediate liquidity and trading activity, making it easier for new entrants to establish themselves and gain early adopters.

Data and Insights

Professional market makers often provide valuable market data and insights. By working with them, you can gain a better understanding of market dynamics, trading patterns, and investor behavior. This information can be crucial for refining your product strategy and making informed decisions.

Conclusion

Market making plays a pivotal role in the cryptocurrency ecosystem, providing the necessary liquidity, stability, and efficiency that modern digital asset markets require. By understanding the basics of market making, the types of market makers, and the numerous benefits they bring, stakeholders can appreciate the essential function these entities serve in the crypto space.

Crypto market makers help maintain tighter bid-ask spreads, reducing price volatility, and fostering an environment that attracts both retail and institutional investors. For new token projects, market makers are indispensable in ensuring a smooth launch and sustained trading activity post-launch.

In summary, market making is not just a technical necessity but a strategic advantage in the competitive landscape of cryptocurrencies. Embracing market making strategies and partnerships can provide substantial benefits, ensuring your product remains viable, attractive, and resilient in the ever-changing world of digital assets. To know more about implementing blockchain technology in your business, you can always contact crypto consulting services.