Pepe coin, the meme-inspired cryptocurrency, has achieved remarkable success by recently surpassing over half a million in market capitalization just two weeks after its launch. Despite its impressive performance, perpetual futures associated with the coin are still experiencing negative funding rates, reflecting the prevalence of bearish positions in the derivatives market.

Perpetual futures contracts are contractual agreements that allow traders to buy or sell underlying assets at a predetermined price without an expiration date. These contracts charge funding rates to holders of both long (bullish) and short (bearish) positions to maintain the asset's market value in sync with the spot market.

Alex from Scimitar Capital has reported that Pepe traders have conducted over 400,000 transactions on Uniswap, resulting in gas worth approximately $10 million being burned. But what's behind the market rise, let's see.

What’s Going on With Pepe Token From a PR Point of View?

Pepe token's social media activity began long before its launch, with shillers already active on Twitter.

These shillers utilized influencers and key opinion leaders (KOLs) to create hype around the token before it was even available for purchase. They aimed to increase the token's visibility and attract potential buyers. By enlisting the support of high-profile individuals in the cryptocurrency community, the shillers were able to establish a strong network of supporters, fueling the token's popularity.

However, the use of influencers to promote cryptocurrency has been a controversial practice, with some suggesting that it can create a false sense of demand and lead to price manipulation. Despite this, the seller's efforts proved successful, with the token achieving significant growth in the first few weeks following its launch.

As social media continues to play a crucial role in the cryptocurrency market, we will likely see similar marketing tactics employed by future token launches.

Here are the tools that used PR to boost Pepe token’s hype:

- Twitter influencers, who claim that “the dog days are over” refer to DogeCoin;

- PR publications and press releases, that hit approx. 2 weeks before the hype.

Concluding the above-mentioned, we can say that from a very big distance, it all seems like organic hype, but if we look closely, we will see this.

Why and For What Pepe Was Created and Hyped?

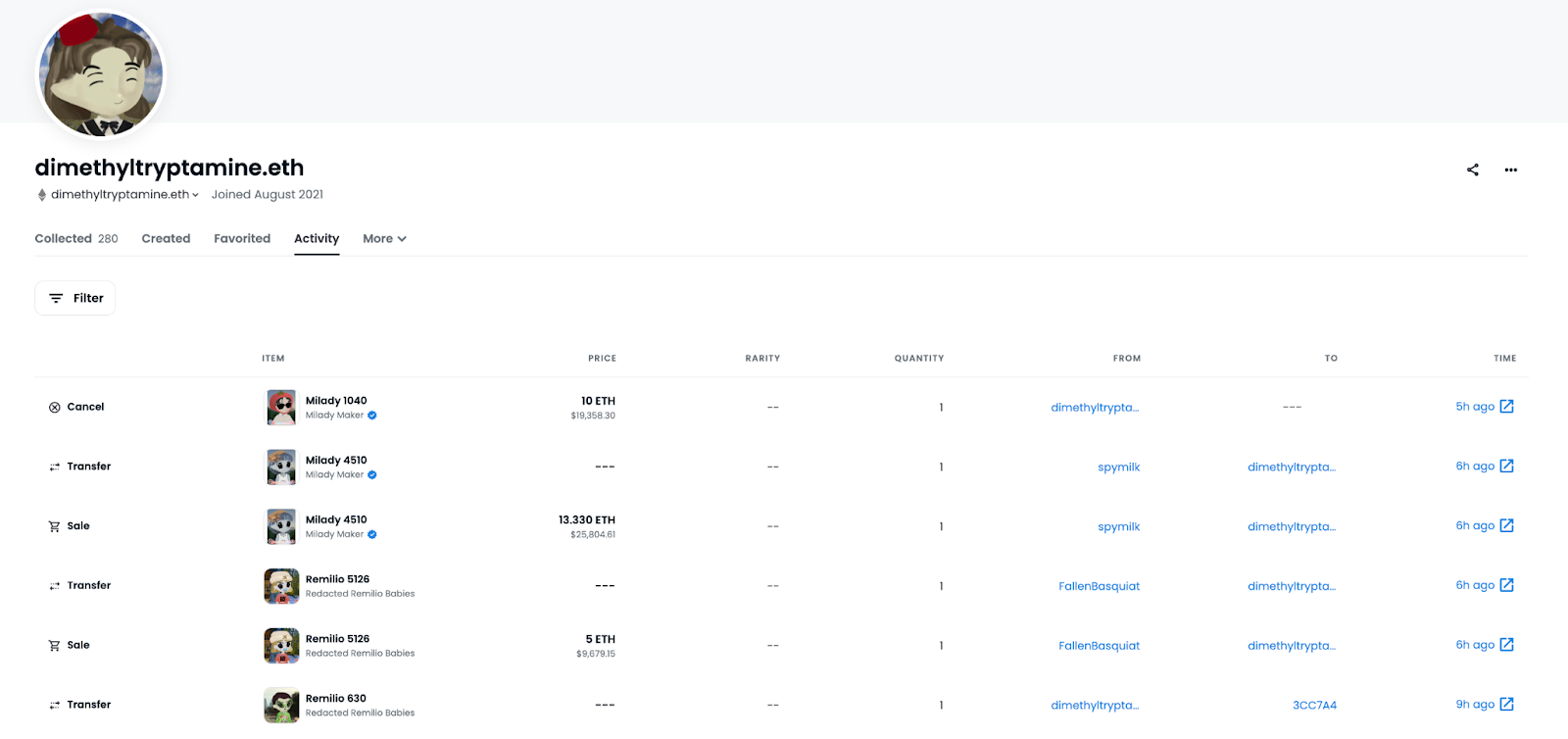

It has been revealed that 99% of PEPE tokens, worth around $8 million, are held in one account with the address dimethyltryptamine.eth.

This revelation has caused some concerns in the cryptocurrency community, as such a concentration of tokens could lead to issues with liquidity and potentially price manipulation. It is currently unclear who the owner of this account is and what their intentions are with the tokens. However, there is speculation that the owner is putting liquidity into NFTs of Milady Maker, a project that may have been created by the account owner themselves.

The high concentration of tokens in one account raises questions about the token's decentralized nature and highlights the risks associated with investing in cryptocurrency. Furthermore, the connection to Milady Maker and the potential self-creation of the project raises concerns over the legitimacy of the project and the potential for insider trading.

Nevertheless, it is important to note that the identity and motives of the account owner are unknown, and until more information is revealed, it is impossible to make a definitive judgment on their actions.

Nonetheless, the high concentration of tokens in one account serves as a warning to investors to exercise caution when investing in cryptocurrencies and to thoroughly research the background and distribution of tokens before making any investment decisions.

What PR Lesson Crypto Start-Ups Can Learn From Pepe Token PR Strategy?

The meteoric rise of Pepe coin provides important lessons for crypto start-ups seeking to launch their tokens. To generate demand for their product, start-ups should work closely with their PR agencies to identify technical and analytical influencers on Twitter and trusted analytical platforms.

These influencers can provide valuable insights to their followers and generate interest in the token. It's important to prioritize technical influencers over those who make empty noise on Twitter. In addition, PR agencies should also contact key opinion leaders (KOLs) on Twitter to promote the token. However, the KOLs must also be technical and knowledgeable about the product to be effective in their promotions.

Another crucial lesson is to launch the token on the right date. It's better to choose a time when news about traditional financial instruments is down, such as after a major event or announcement. For example, in the case of Pepe Coin, the launch happened during a lull in the news surrounding Silicon Valley Bank (SVB). This helped to draw more attention to the token, which eventually led to its massive success.

To ensure success for their tokens, start-ups can follow this checklist:

- Work with a PR agency to identify technical and analytical influencers on Twitter and trusted analytical platforms;

- Contact key opinion leaders (KOLs) on Twitter who are technical and knowledgeable about the product;

- Launch the token during a lull in the news about traditional financial instruments.

In conclusion, the Pepe Coin case provides important insights for crypto start-ups looking to launch their tokens. By working with technical and analytical influencers, prioritizing knowledgeable KOLs, and launching the token at the right time, start-ups can increase the likelihood of success for their product.

In conclusion, FINPR can provide valuable assistance to the blockchain, cryptocurrency, and NFT projects throughout the development process by helping to generate organic PR.

With expertise in working with technical and analytical influencers on Twitter, as well as trusted analytical platforms, FINPR can help startups create buzz and interest around their products before launch. Additionally, their ability to connect with key opinion leaders on social media and ensure that technical influencers are engaged, rather than those who make empty noise, can be a key differentiator in a crowded market.

By leveraging these strategies and launching at opportune times, startups can increase their chances of success and market acceptance. With FINPR's help, projects can ensure that their message is heard loud and clear and that they are set up for long-term growth and sustainability.