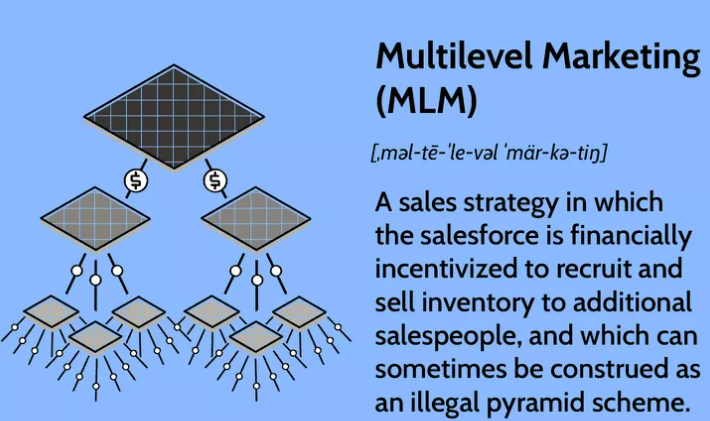

In recent years, the cryptocurrency space has grown exponentially, captivating investors, tech enthusiasts, and financial professionals alike. With the rise of blockchain-based projects, another trend has emerged: Crypto Multi-Level Marketing (MLM). This unique blend of cryptocurrency and traditional network marketing has generated both interest and skepticism. But what exactly is Crypto MLM, and how does it work?

This article explores the fundamentals of Crypto MLM, how it differs from conventional MLM, the benefits and risks involved, and key factors to consider before joining a crypto-based MLM venture.

How Crypto MLM Works

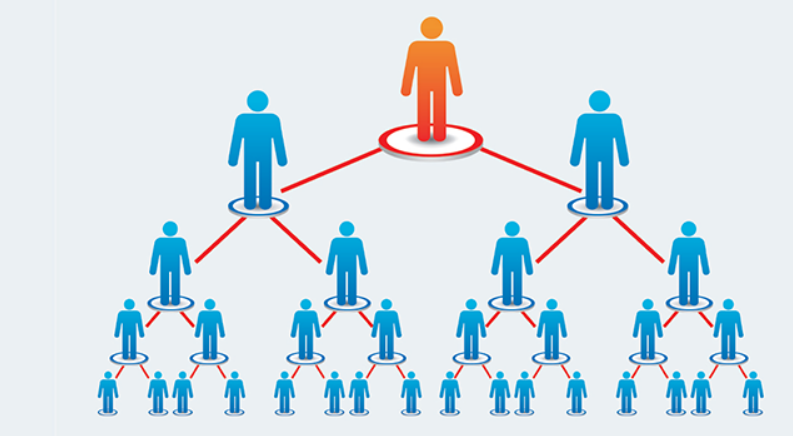

Crypto MLM structures are designed to attract participants through promises of returns based on both direct investment and the recruitment of additional members. Here are the key components:

Referral Structure:

In a Crypto MLM, participants recruit new members who, in turn, recruit additional participants, forming a downline. Each new member's entry typically involves a buy-in fee, often paid in cryptocurrency. Recruiters then earn rewards based on the investments made by these recruits. Referral rewards are structured in tiers, meaning participants earn from both their direct recruits (first-level referrals) and the recruits brought in by those referrals (second-level, third-level, etc.).

In a Crypto MLM, participants recruit new members who, in turn, recruit additional participants, forming a downline. Each new member's entry typically involves a buy-in fee, often paid in cryptocurrency. Recruiters then earn rewards based on the investments made by these recruits. Referral rewards are structured in tiers, meaning participants earn from both their direct recruits (first-level referrals) and the recruits brought in by those referrals (second-level, third-level, etc.).

Compensation Models:

- Direct Commission: Members receive a percentage of the buy-in amount paid by each new recruit they bring in. This commission is usually a one-time payment or spread out over specific milestones.

- Binary Structure: In some Crypto MLMs, participants form two “legs” or downlines, with rewards based on maintaining a balance between the two. Earnings are often generated based on the performance of the weaker leg, incentivizing members to keep both legs active.

- Matrix Model: This structure limits the number of recruits each member can have in a single tier, such as a 3x3 or 5x5 structure, meaning three or five recruits per tier. This model encourages rapid growth in breadth, as participants seek to fill their designated spots.

Recruitment and Promotion Strategies:

- Incentive Programs: Crypto MLMs often promote special rewards for participants who reach particular milestones, such as recruiting a specific number of members within a certain timeframe.

- Digital Marketing: Participants commonly use social media, websites, and webinars to promote their programs, highlighting the potential returns and emphasizing the “ground-floor” opportunity.

- Cryptocurrency Tied Programs: In some cases, Crypto MLMs are linked to specific cryptocurrency projects or tokens. Members buy into the MLM program by purchasing these tokens, and their returns are tied to the token’s market performance.

These structures make Crypto MLMs potentially lucrative, especially for early adopters. However, they also bring significant risks and complexities, especially around sustainability and legitimacy.

Many blockchain development companies are increasingly involved in supporting the technological infrastructure behind crypto MLM platforms, enhancing their appeal and functionality.

Common Products and Services Offered in Crypto MLM

In the realm of crypto MLM, companies often offer products and services that promise to tap into the lucrative potential of cryptocurrency. Unlike traditional MLMs, which may sell tangible goods like health supplements or beauty products, crypto MLMs are often centered around digital products and services tied to blockchain technology, crypto education, and investment tools. Below are some of the most common offerings seen in crypto MLM programs.

1. Digital Currencies and Tokens

Many crypto MLMs revolve around promoting and selling their own digital currency or token. Participants are encouraged to buy and hold these tokens, which are often marketed as “the next big thing” in cryptocurrency. In some cases, these tokens are pegged to specific benefits or functionalities within the MLM ecosystem, creating demand among members. MLM companies frequently emphasize the potential for rapid appreciation of these tokens, encouraging participants to purchase large amounts and recruit others to do the same. However, in less legitimate schemes, these tokens can have little to no real value outside of the MLM network.

2. Crypto Mining Packages and Cloud Mining Services

Another popular offering in crypto MLMs is access to crypto mining services or cloud mining packages. These packages claim to give users a share in cryptocurrency mining operations without requiring the participants to manage or own physical mining equipment. By investing in a mining package, members are told they can earn a share of the profits generated by the company’s mining activities. Crypto MLMs that offer these packages typically promote them as a passive income source, but in many cases, these promises can be unrealistic or misleading due to the high energy and hardware costs associated with genuine mining operations.

3. Trading Bots and Automated Investment Platforms

Automated trading tools, often called trading bots, are a frequent product in crypto MLMs. These bots are algorithms designed to execute trades automatically on behalf of the user, with the promise of maximizing profit by reacting instantly to market changes. MLM companies often market these bots as highly profitable, requiring minimal effort or market knowledge. The allure of passive trading income can be highly attractive, especially for newcomers to crypto. However, it’s essential for potential users to exercise caution, as many trading bots lack transparency regarding their strategies and may not deliver the promised returns.

4. Crypto Education and Training Programs

Some crypto MLM programs offer courses, webinars, and training materials to help users learn about cryptocurrency, blockchain technology, and investment strategies. These educational packages are typically bundled as “crypto academies” or “blockchain universities” and are marketed as a way to empower members to make informed investment decisions. While there is real value in quality educational content, the courses offered by MLM companies are often overpriced and primarily serve as an entry point to promote other products within the MLM system. Additionally, the quality of these educational materials can vary widely, and some may lack depth or credibility.

5. Investment Packages and Profit-Sharing Plans

Crypto MLMs often promote various investment packages or profit-sharing plans, which promise steady returns over a fixed period. Participants are encouraged to invest in these packages, which are marketed as “low-risk” or “guaranteed” ways to earn passive income. These plans may involve staking, lending, or other forms of investment designed to generate returns through the pooled funds of the MLM participants. However, many of these packages are structured more like Ponzi schemes, where returns for existing members are paid using the investment of new recruits rather than from actual profit-generating activities.

6. NFTs and Digital Assets

Some crypto MLM companies have started incorporating NFT projects and other unique digital assets into their offerings. These NFTs are often promoted as exclusive, rare, or limited-edition collectibles that can appreciate over time. In these cases, participants are encouraged to buy, trade, and promote these NFTs within the MLM network. While NFTs can have legitimate value, particularly for digital art or collectibles, the NFTs offered in MLMs are often tied to the company’s internal ecosystem and may lack resale value outside the network. Additionally, these NFTs may have limited real-world utility or value.

7. Access to Exclusive Crypto Tools and Platforms

Many crypto MLMs market access to “exclusive” tools or platforms as a unique benefit for their members. These platforms can include market analysis tools, advanced portfolio trackers, or platforms for accessing early-stage token sales and ICOs (Initial Coin Offerings). The exclusivity of these tools is emphasized to create a sense of value, making participants feel they’re part of an elite group with access to opportunities that aren’t available to the public. However, in reality, these tools may be available for free or at a lower cost outside the MLM, and any actual value is often overstated.

How Crypto MLM Differs from Traditional MLM

Crypto MLM shares similarities with traditional MLM models but has distinct features:

- Product Type: Traditional MLMs usually focus on physical products (e.g., cosmetics, health supplements). In Crypto MLMs, the product is typically a cryptocurrency or blockchain-based token.

- Digital Transactions: Crypto MLM operates entirely online, with transactions made in cryptocurrency, which appeals to people who prefer digital, decentralized financial systems.

- Global Reach: The use of cryptocurrency allows for an international market without the limitations of currency exchange or banking restrictions.

- Investment-Based: Rather than buying consumables, participants in Crypto MLMs are investing in a digital asset that fluctuates in value, adding an investment layer that traditional MLMs typically lack.

- Risk Factors: Traditional MLMs carry financial risk in terms of product sales and recruitment challenges, but Crypto MLMs add the element of cryptocurrency volatility, creating an even higher-risk environment.

A well-defined crypto marketing strategy is essential for crypto MLM programs to attract and retain members, as it helps build credibility and foster network growth.

Why is Crypto MLM Growing in Popularity?

The popularity of crypto-based MLM schemes has surged in recent years, driven by several unique factors that attract a diverse group of people. Below are some of the key reasons why crypto MLM has become such a popular avenue for investment and networking.

1. Appeal of High Potential Returns

The allure of rapid and significant returns is one of the primary reasons for the popularity of crypto MLM. Cryptocurrency is already seen as a high-growth market with massive return potential, and MLM structures amplify this appeal. By promising participants the chance to earn passive income through recruiting others, crypto MLMs attract those looking for a quick path to financial gain. This “get-rich-quick” appeal often resonates with people who may be new to investing or less familiar with the risks involved in high-return schemes.

2. Decentralization and the Promise of Financial Freedom

Crypto MLMs capitalize on the narrative of decentralization associated with cryptocurrency. Many MLM promoters market these opportunities as a way to gain financial independence outside the traditional banking and investment systems. In a world where financial control is becoming a growing priority, the promise of bypassing banks and regulators for direct, peer-to-peer earnings is highly appealing. This attraction is especially strong among younger generations and in regions where traditional financial institutions may not be as accessible.

3. Technological Advancements Enabling Easy Access

The rise of blockchain and digital wallet technology has made it easier than ever to join and operate within a crypto MLM. Today, anyone with an internet connection and a digital wallet can participate, making crypto MLMs highly accessible. Smart contracts, digital tokens, and online payment systems also simplify and secure transactions, allowing MLM companies to automate processes and manage memberships seamlessly. These technologies make it easier for both new and experienced users to engage without requiring a high level of technical knowledge.

4. The Power of Online Communities and Social Media

Crypto MLM schemes have found a fertile ground for growth in online communities and social media platforms. Platforms like Twitter, Telegram, and Facebook are instrumental in promoting MLM programs, often targeting specific groups interested in crypto investments. These digital communities are highly engaged and provide an instant audience, which allows MLM marketers to easily recruit members. Social media influencers and crypto enthusiasts play a crucial role in creating hype, sharing testimonials, and reinforcing a sense of urgency to join, which in turn fuels the growth of these schemes.

5. Low Entry Barriers and Minimal Initial Investment Requirements

Crypto MLMs typically have low entry costs, which makes them attractive to people who might not have a lot of capital to invest. This low barrier to entry makes MLM programs particularly appealing to individuals in developing regions or those with limited access to traditional investment channels. Additionally, the digital nature of cryptocurrency and its 24/7 trading ability creates a sense of opportunity that is accessible at any time, without the restrictions of traditional investment markets.

6. The Promise of Passive Income

The concept of earning passive income is another strong motivator for individuals joining crypto MLM schemes. Most people are drawn to the idea of “earning while they sleep” or generating an income stream without continuous effort. Crypto MLM programs promise that participants can earn not only from their initial investments but also from the recruits they bring in. The prospect of growing income through network building, without actively managing investments, resonates with those looking for alternative ways to secure financial stability.

7. Early Success Stories and the "Fear of Missing Out" (FOMO)

High-profile success stories of individuals who have allegedly made fortunes through crypto MLMs contribute to their popularity. Testimonials and promotional materials often showcase these early successes, creating a powerful FOMO effect among potential recruits. Seeing others succeed — and the fear of missing a similar opportunity—encourages people to join. This psychological driver is particularly potent in the fast-paced and highly dynamic cryptocurrency market, where prices and opportunities can change rapidly.

These factors together contribute to the growing appeal of crypto MLM, creating a powerful mix of opportunity, accessibility, and psychological incentives that continue to attract new participants.

Risks and Red Flags in Crypto MLM

While crypto MLM programs offer exciting opportunities, they also come with significant risks. Participants should be aware of these risks and recognize the warning signs that may indicate a potentially harmful or fraudulent scheme. Here’s a closer look at the main risks and red flags associated with crypto MLMs:

1. High Risk of Scams and Ponzi Schemes

- Ponzi-Like Structures: Many crypto MLMs operate similarly to Ponzi schemes, where returns for existing members are paid from the investments of new recruits rather than genuine profit-generating activities.

- Promises of “Guaranteed” Returns: High or guaranteed returns are often unrealistic in the volatile crypto market. Promises of fixed profits are a major red flag, as legitimate investments rarely guarantee returns.

- Focus on Recruitment Over Product Value: If most of the income is generated by recruiting new members rather than actual product sales or investment growth, it may indicate a Ponzi scheme rather than a legitimate MLM.

2. Legal and Regulatory Concerns

- Lack of Regulatory Oversight: Many crypto MLMs operate in unregulated spaces or jurisdictions, making it difficult for participants to have legal recourse if something goes wrong.

- Risk of Shutdown by Authorities: Governments and regulatory bodies worldwide are increasingly scrutinizing crypto MLMs, especially those suspected of fraudulent activities, leading to possible shutdowns that leave participants with financial losses.

- Potential Legal Consequences for Participants: In some countries, promoting or participating in an illegal MLM scheme can have legal repercussions, including fines and penalties.

3. Volatile and Unpredictable Returns

- Dependence on Crypto Market Volatility: Cryptocurrency prices can fluctuate wildly, impacting the value of tokens or coins involved in MLMs. This volatility can result in significant losses, especially if members are encouraged to invest large sums.

- Unpredictable Token Values: Many crypto MLMs create their own tokens, which may have little intrinsic value and are often highly susceptible to manipulation. These tokens can lose value rapidly, leading to losses for those who invest heavily in them.

- Unsustainable Growth Models: High returns often require rapid network growth, which may not be sustainable long-term. Once recruitment slows, the scheme can collapse, leaving participants with little to no return on their investment.

4. Lack of Transparency and Potential for Fraud

- Opaque Management Structures: Crypto MLMs often lack transparent information about the company’s leadership, financial records, or operational structure, making it challenging to assess legitimacy.

- Unclear Business Models: If the MLM cannot clearly explain how it generates profits outside of recruiting, it may be a sign of fraudulent activity. A legitimate business should have a clear, sustainable revenue model beyond bringing in new members.

- Anonymous or Unverifiable Leadership: Companies with anonymous founders or executives, or those that refuse to disclose key details about their team, raise concerns about legitimacy. Verifiable leadership is essential for trustworthiness.

5. Pressure Tactics and High-Pressure Sales

- Urgency and “Limited-Time” Offers: Crypto MLMs often use high-pressure tactics, such as emphasizing limited-time offers or “exclusive” opportunities, to create a sense of urgency. These tactics are designed to pressure individuals into making quick decisions without proper due diligence.

- Promises of Exclusivity: Emphasis on exclusivity and “insider” knowledge can be misleading, as it creates the illusion of a rare opportunity. This tactic is often used to build excitement and FOMO (fear of missing out) to drive recruitment and investment.

- Discouragement of Independent Research: MLMs that discourage members from seeking outside opinions or doing their own research may be trying to control the narrative and prevent members from learning about potential risks.

6. Unrealistic Income Projections and Misleading Claims

- Exaggerated Success Stories: Many crypto MLMs highlight testimonials or case studies of individuals who have supposedly achieved financial success through the program. These stories are often cherry-picked or exaggerated, creating unrealistic expectations for new members.

- Promises of Easy or Effortless Income: Claims that members can achieve wealth with minimal effort or skill are often misleading. Legitimate investments usually require a level of market knowledge and engagement, especially in the volatile crypto space.

- Minimal Transparency on Income Distribution: MLMs that don’t clearly explain how income is distributed, or how much members can realistically expect to earn, may be hiding the true difficulty of achieving significant returns.

7. High Fees and Complicated Withdrawal Processes

- High Joining or Maintenance Fees: Some crypto MLMs charge significant fees to join, maintain membership, or withdraw funds, which can quickly add up and eat into profits.

- Withdrawal Restrictions or Delays: Programs that make it difficult to withdraw earnings or impose lengthy waiting periods may be attempting to retain funds to sustain the network. Complicated or delayed withdrawals are a common red flag.

- Hidden Costs or Penalties: Many crypto MLMs have hidden costs that aren’t disclosed upfront. These fees may be charged for inactivity, transactions, or other activities, which can significantly reduce overall earnings.

In Conclusion

Crypto MLM presents a complex landscape of high potential rewards and equally significant risks. For many, the appeal of crypto MLM lies in the promise of rapid returns, the allure of passive income, and the chance to participate in the booming cryptocurrency market. These opportunities, combined with low entry barriers and global reach, make crypto MLM a tempting option for those seeking alternative financial growth.

However, crypto MLMs often operate in a legal gray area, with many programs veering into Ponzi scheme territory or relying on unsustainable growth models. The volatility of cryptocurrency markets, combined with the often opaque practices of MLMs, can result in considerable financial losses for participants. Recognizing the red flags — such as unrealistic income guarantees, high-pressure sales tactics, and lack of transparency — can help protect prospective members from scams and fraudulent schemes.

Ultimately, anyone considering crypto MLM should approach with caution. Conducting thorough research, seeking independent advice, and understanding the inherent risks are critical steps before investing.