Coin listing is vital in the crypto world. It connects projects with potential investors, assuring legitimacy and potential. For projects, listing on an exchange enhances credibility and liquidity, making it easier for traders to buy and sell the coin. This attracts more participants, media coverage, and investor interest, boosting the project's visibility and acceptance.

Learn about the steps to prepare for a listing, how exchanges evaluate coins, and the benefits and challenges of getting listed. By the end, you'll understand the significance of coin listings and their impact on the crypto ecosystem.

Basic Concept of Coin Listing

Coin listing is the process by which a cryptocurrency is made available for trading on a cryptocurrency exchange. When a coin or token is listed, it means that users of the exchange can trade that coin against other cryptocurrencies or fiat currencies, depending on the pairs available on the platform. This is an essential step for any cryptocurrency project as it provides a platform for liquidity, visibility, and increased market access.

Listing a coin involves several technical and administrative steps, including integration with the exchange’s infrastructure, compliance with legal and regulatory requirements, and often, an application or vetting process. The listed coin can then be traded by the exchange’s user base, allowing for price discovery and increased market participation.

It is important to distinguish between a coin listing and an Initial Coin Offering (ICO).

An ICO is a fundraising mechanism where a new cryptocurrency project sells its tokens to early investors in exchange for capital, typically conducted before the project is fully developed. In contrast, a coin listing occurs after the ICO, when the token is made available for public trading on an exchange. While an ICO marketing campaign is about raising funds and generating initial interest, a coin listing program is about providing a marketplace for the token to be traded.

Types of Listings

There are primarily two types of cryptocurrency listings, each with its unique characteristics and implications for both the project and the investors.

Centralized Exchange Listings

Centralized exchanges (CEX) are traditional cryptocurrency exchanges where a central authority manages the operations. Examples include Binance, Coinbase, and Kraken. Listing on a centralized exchange often involves a rigorous application process, where the exchange evaluates the project's technology, team, market potential, and compliance with regulatory standards.

Advantages of listing on a CEX:

- Higher liquidity due to a larger user base

- Advanced trading features and tools

- Enhanced security and customer support

Disadvantages of listing on a CEX:

- Higher listing fees

- Potential regulatory scrutiny

- Centralized control over trading activities

Decentralized Exchange (DEX) Listings

Decentralized exchanges (DEX) operate without a central authority, using smart contracts to facilitate trading directly between users. Examples include Uniswap, SushiSwap, and PancakeSwap. Listing on a DEX is typically more accessible and involves fewer regulatory hurdles, as it often does not require formal approval from a central entity.

Advantages of listing on a DEX:

- Lower listing fees

- Greater control over the listing process

- Enhanced privacy and reduced regulatory oversight

Disadvantages of listing on a DEX:

- Lower liquidity compared to CEXs

- Limited trading features and tools

- Increased responsibility on users for security and trade management

The Process of Coin Listing

Preparation Before Listing

Before seeking a listing, a cryptocurrency project must undergo significant preparation:

- Development of the Coin/Token: Ensuring the technology is robust, secure, and functional.

- Creating a Whitepaper and Roadmap: Providing a detailed plan and vision for the project.

- Building a Community and Generating Interest: Engaging with potential users and investors through social media, forums, and marketing campaigns.

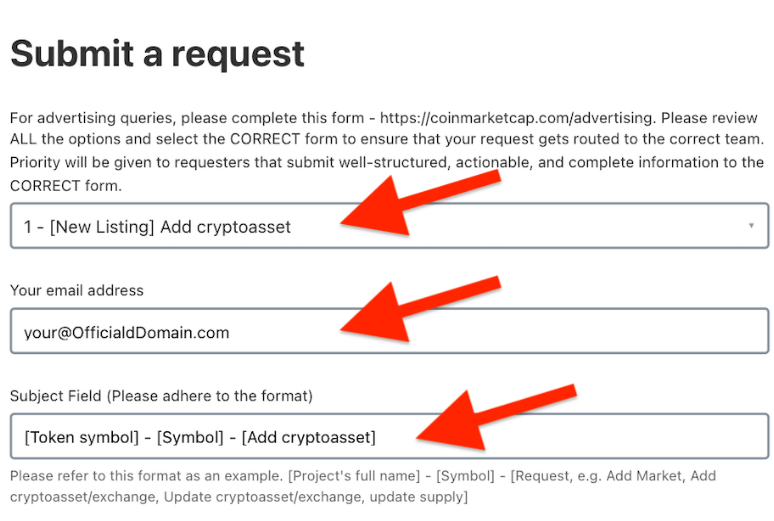

Application Process

Applying for a listing typically involves:

- Criteria Exchanges Use to Evaluate Coins: Exchanges assess the project’s legitimacy, technical soundness, team credentials, and market potential.

- Required Documentation and Due Diligence: Providing necessary legal, technical, and financial documents for review.

- Common Hurdles and How to Overcome Them: Addressing potential issues such as regulatory compliance, technical integration, and market readiness.

Negotiation and Agreement

Once the application is approved:

- Terms of the Listing Agreement: Finalizing the conditions under which the coin will be listed, including trading pairs and market support.

- Fees Associated with Listing: Understanding and agreeing on the costs involved in the listing process.

- Potential Legal and Regulatory Considerations: Ensuring compliance with relevant laws and regulations to avoid future legal challenges.

And of course, processes such as coin listing must be accompanied by a PR campaign for a successful full launch.

Factors Influencing Coin Listings

Market Demand

Market demand is a crucial factor influencing the listing of a cryptocurrency on an exchange. Exchanges aim to list coins that have a substantial following and interest, as this translates to higher trading volumes and more active users on their platforms.

Importance of Community Support and Investor Interest

A strong, active community can significantly impact the decision to list a coin. High levels of engagement on social media platforms, active participation in community forums, and a large number of followers indicate strong market demand. Additionally, the presence of reputable investors and endorsements from influential figures in the crypto space can further validate the project's credibility and attract exchange interest.

Impact of Social Media and Influencer Endorsements

Social media plays a pivotal role in generating hype and awareness around a cryptocurrency. Influencer endorsements and positive coverage on platforms like Twitter, Reddit, and Telegram can drive market demand. Exchanges monitor these channels to gauge the popularity and potential trading activity of a coin.

Technology and Security

The underlying technology and security of a cryptocurrency are paramount in the listing process. Exchanges seek to list coins that offer innovative solutions and robust security features to protect their users and maintain the integrity of their platforms.

Technical Robustness of the Blockchain

Exchanges evaluate the technical foundation of a cryptocurrency, including its blockchain infrastructure, consensus mechanism, and scalability. Projects with advanced technological solutions, such as high transaction speeds, low fees, and unique features, are more likely to be listed. A thorough technical audit can demonstrate the project's viability and reduce the risk of technical failures post-listing.

Security Features and Audit Results

Security is a top priority for exchanges. Cryptocurrencies that have undergone rigorous security audits and have strong measures in place to prevent hacks and vulnerabilities are preferred. Audit reports from reputable firms can provide exchanges with confidence in the coin's security, making it a more attractive listing candidate.

Regulatory Compliance

Navigating the complex landscape of regulatory requirements is essential for getting a coin listed. Exchanges operate under various legal jurisdictions, and compliance with these regulations is crucial to avoid legal repercussions.

Navigating Different Regulations Across Jurisdictions

Cryptocurrencies must comply with the regulations of the countries in which the exchange operates. This includes adhering to anti-money laundering (AML) laws, know-your-customer (KYC) requirements, and other financial regulations. Understanding and meeting these regulatory standards can facilitate the listing process and reduce the risk of legal challenges.

Importance of Legal Advice and Compliance

Engaging with legal experts to ensure that the cryptocurrency project meets all regulatory requirements is vital. Legal advisors can help navigate the complexities of different jurisdictions, draft necessary documentation, and ensure ongoing compliance. Demonstrating a commitment to regulatory compliance can enhance the project's credibility and appeal to exchanges.

Last Word

Coin listing is a critical milestone for any cryptocurrency project, providing a gateway to greater market visibility, liquidity, and investor engagement. The dynamic nature of the market requires adaptation and deep knowledge and FINPR can assist you with the coin listing procedure.

By preparing thoroughly, understanding the market and regulatory landscape, and engaging with the community, you can navigate the listing process with confidence and achieve greater success in the cryptocurrency market.