When the ICO boom fizzled out and regulators tightened their grip, many predicted the end of public token sales. Yet IEOs — Initial Exchange Offerings — have re-emerged as the crypto world’s answer to credibility and liquidity in one neat package. In 2025, getting listed on a launchpad is only half the battle; the real challenge is earning enough trust and buzz to fill your hard cap before the timer hits zero. This guide shows you exactly how to get there.

Why Marketing Makes — or Breaks — an IEO

An IEO may have cutting-edge technology, strong tokenomics, and a top-tier team — but without a solid marketing strategy, even the most promising projects can sink into obscurity. In the competitive crypto landscape, where hundreds of projects are launched annually and investor attention is fleeting, marketing becomes the catalyst that determines whether an IEO thrives or fails.

1. Visibility Is Everything in a Crowded Market

IEOs are not conducted in a vacuum. By the time a project launches on an exchange, it's already vying for attention among thousands of tokens listed across global platforms. A strong marketing campaign ensures the project gains visibility across communities, investor groups, and media outlets.

- Without marketing, even the best IEO may go unnoticed, suffering from low participation and minimal token demand.

- With strategic marketing, awareness is built early, often months in advance, creating anticipation and a strong launch narrative.

2. Building Trust in a Trustless Environment

Crypto investors are naturally skeptical. Rug pulls, scams, and failed promises have hardened the average retail and institutional buyer. A well-executed marketing campaign isn’t just about hype — it’s about building credibility:

- Thought leadership content, AMA sessions, transparent tokenomics, and a robust online presence give the project legitimacy.

- PR placements in credible media, endorsements by influencers, and a strong whitepaper strategy signal professionalism and trustworthiness.

Without this, investors may hesitate to participate or altogether avoid committing capital.

3. Community Momentum Fuels IEO Success

IEOs often rely on community-driven momentum. Telegram groups, Twitter spaces, Discord servers, and Reddit threads often act as real-time barometers of investor enthusiasm. A solid marketing strategy nurtures these communities from day one:

- Consistent engagement through educational posts, sneak peeks, and token utility discussions.

- Gamification elements like quizzes, bounty campaigns, and whitelist contests to convert followers into brand advocates.

Without a loyal and engaged community, IEO participation can be tepid, leading to unsold tokens and loss of exchange interest.

4. The Exchange Alone Is Not Enough

Even if a project is launching on a prominent exchange, relying solely on the platform’s audience is a critical error. Exchanges list dozens of IEOs; only those with buzz and demand attract significant attention. Marketing ensures your project stands out in this noise.

- Pre-IEO buzz drives pre-registration numbers and whitelist interest.

- Exchange partners often promote projects more actively when they see strong independent marketing traction.

Without external marketing, an IEO can become "just another listing" on an overloaded platform.

5. Token Price and Post-IEO Growth Depend on Narrative

IEO success isn't limited to the fundraising round. Post-IEO performance determines investor satisfaction and long-term success. If token prices dip immediately, it reflects poorly on the project. Marketing helps maintain demand and project momentum post-launch:

- Ongoing updates, partnerships, and exchange listings should be marketed actively to retain investor interest.

- Narrative control through storytelling (e.g., solving real-world problems, building in the bear market) helps maintain price stability.

Without a post-IEO marketing strategy, projects often lose traction, and token value can plummet — hurting credibility and deterring future investors.

6. It Shapes Perception, Which Shapes Reality

In crypto, perception can be as powerful as fundamentals. If a project is perceived as valuable, active, and visionary, it draws organic investor interest. Effective marketing shapes this perception across every touchpoint — from whitepapers to social media to influencer commentary.

- A clear, professional brand identity builds trust.

- Messaging consistency across all channels signals maturity.

- Emotional appeal and storytelling create believability and excitement.

Projects that neglect marketing often appear unfinished, unprofessional, or unserious — regardless of their actual potential.

Laying the Groundwork Before You Market

Before a single banner ad goes live, a successful IEO team must win a series of quiet battles: validating product-market fit, locking down bullet-proof tokenomics, passing regulatory muster, and choosing a launchpad that actually fits the project’s DNA. The payoff is huge — projects that invest in this groundwork consistently raise more, list faster, and suffer fewer post-listing sell-offs. The following checklist walks through each “pre-marketing” pillar so your IEO campaign launches on solid bedrock.

1. Map the Battlefield: Research & Competitor Intelligence

Start by quantifying real demand and benchmarking rivals. On Solana alone, six launchpads now fight for market share, with Pump.fun controlling ~84 % of new token launches while Raydium’s LaunchLab climbs on higher-quality metrics — insights that directly shape positioning and feature road-maps.

Go beyond headline volumes: scrape social-sentiment dashboards, Discord membership churn, and vesting-event calendars to see where investors are already over-exposed. A data-driven narrative here feeds every later PR hook and campaign KPI.

2. Engineer Robust Tokenomics & Narrative

Poorly balanced supply sinks more IEOs than bad marketing. Studies of 2024-2025 launches show projects with transparent, vesting-controlled distributions post higher long-term stability and community retention.

Aim for a cap table in which insiders hold <20 %, community and incentives ≥40 %, and all major buckets sit behind smart-contract cliffs. Communicate that logic early — investors reward clarity they can model.

3. Regulatory & Compliance Readiness

Marketing only works if the sale itself survives compliance reviews. Exchange check-lists now mirror full BSA/AML frameworks — renewed licences, independent audits, KYC tiering, and FinCEN CDD rules make the 2025 short-list.

High-tier launchpads such as Gate.io won’t even open a listing ticket until projects document AML flows and country blocks, so lock these policies before outreach begins.

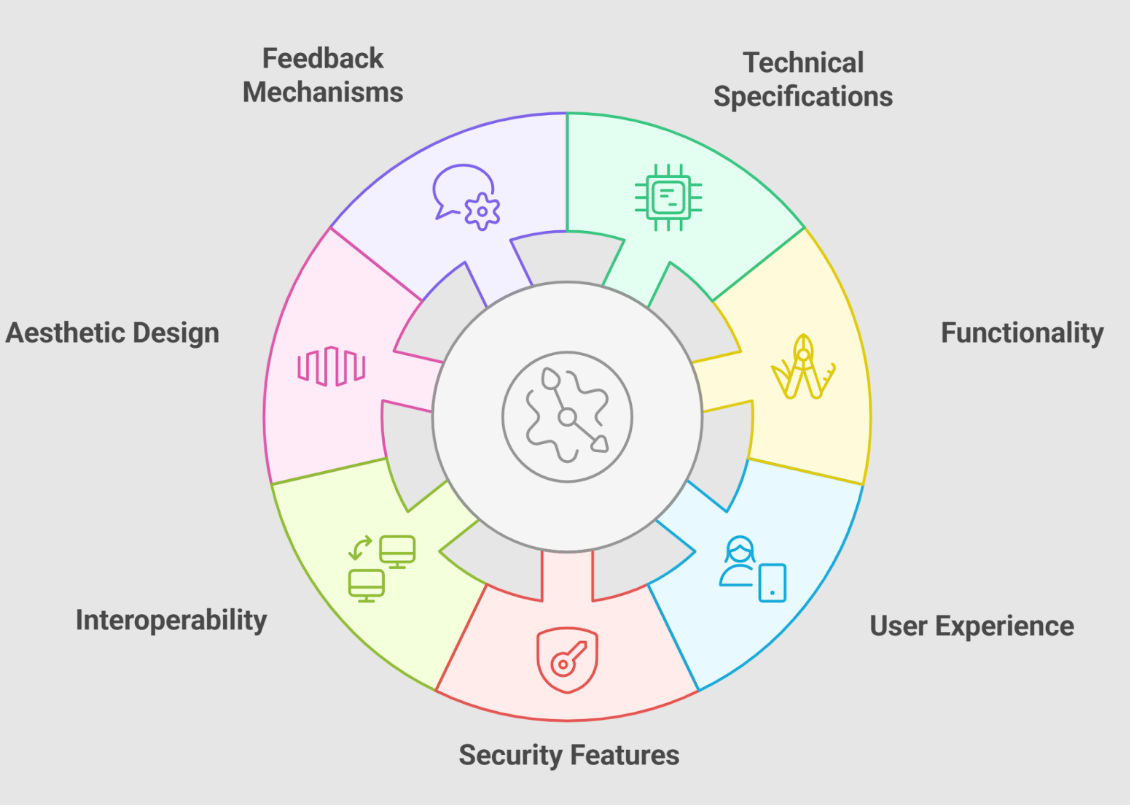

4. Craft the Identity: Branding & Core Messaging

Crypto buyers scan hundreds of decks a week; consistent visual identity and a single-sentence value promise stop the scroll. 2025 data shows campaigns that balance paid ads, influencer trust signals, and compliance disclaimers outperform “hype-only” efforts.

Define a tone of voice (technical? consumer-friendly?) and stick to it across Telegram, X and Medium — exchanges increasingly grade branding coherence during due-diligence interviews.

5. Authoritative Documentation: White- & Lite-Papers

A whitepaper is no longer optional marketing collateral — it is the first diligence artifact investors read and exchanges underwrite. Best-practice papers now cover problem statement, architecture, economics, roadmap, and risk factors in plain English.

Building a Results-Driven IEO Marketing Strategy

Define Success Up-Front

Set Hard-Cap & Liquidity KPIs

Layer on leading indicators such as “social velocity” (daily growth in Telegram/Discord members and X mentions) and conversion KPIs like whitelist sign-ups or exchange pre-funds. Exchanges increasingly request these metrics during diligence calls.

Choose Attribution Windows

Influencer ROI studies show most token purchases from KOL traffic happen within 48 hours of content going live; build tracking links and a post-to-sale look-back window that captures that surge.

Pinpoint & Segment Your Audience

Discord’s 196 million MAUs and Telegram’s TON-driven boom (30 M+ daily users for Notcoin alone) prove these channels remain the backbone for crypto user acquisition — plan dedicated mods and multilingual FAQ bots.

Timeline & Milestones

- T-60 days: Finalise tokenomics, security audit, and exchange LOI.

- T-45 days: Open private KOL round; begin influencer seeding.

- T-30 days: Roll out thought-leadership posts and community quests.

- T-14 days: Launch paid media; activate referral and bounty programs with anti-sybil checks.

- T-0: IEO goes live—spin up a 24/7 war-room for support, FUD response, and liquidity coordination.

- T+7 days: Release post-sale analytics, roadmap reaffirmation, and upcoming staking utility.

Mitigate Risk & Stay Compliant

- Google, Meta and TikTok all classify crypto fundraising as “restricted financial products,” requiring licence verification per jurisdiction — file applications at least four weeks pre-campaign.

- Document AML/KYC flows for each investor cohort; Gate.io Startup now requests screenshots of KYC tiers before approving listing.

A results-driven IEO marketing plan is an iterative loop: define measurable goals, fund the tactics that prove ROI fastest, double-down on segments that convert, and guard it all with bullet-proof compliance. Follow the framework above, and your campaign can move from hype to hard-cap without sacrificing trust or regulatory headroom.

Channel-by-Channel Tactical Playbook

A successful IEO campaign rarely wins on one “hero” channel. Instead, high-performing raises spread their story across community hubs, social video, trusted KOLs, earned media and hyper-targeted ads—while staying inside ever-tighter ad-policy guardrails. The playbook below breaks those channels into tactical blocks: what each does best, how to execute, and which metrics exchanges now look for before green-lighting your listing.

Social Media Surge — X, TikTok & Shorts

Virality now hinges on creator-led, personalised content:

- Do this: batch 15-second market-moving clips, post natively, and answer comments within 30 minutes to exploit TikTok’s velocity algorithm.

- Avoid this: reposting long YouTube AMAs without edits—retention drops below 20 % past the 60-second mark.

PR & Earned Media

Crypto PR isn’t dead — just data-driven. PR campaigns that bundle influencer quotes with embargoed press releases deliver more headline pickups.

- Pitch exclusives to one mainstream tech or finance outlet 48 h before sale, then syndicate to crypto trades on T-1.

- Track coverage in a public doc — exchanges now ask for proof of press traction during listing interviews.

Content Marketing & SEO

Long-form explainers that weave tokenomics into a clear narrative still anchor discovery; 2025 strategy guides place SEO, influencer integration and community funnels as the top three organic growth levers.

- Optimise for “token-name + price + launchpad” keywords two weeks before T-0; Google rewards freshness and indexed depth.

Referral, Bounty & Airdrop Loops

Gamified quests on Zealy or Galxe generate the cheapest verified wallets; referral-based airdrops see up to 4× higher KYC completion than blanket giveaways when incentives vest post-listing.

- Publish anti-Sybil rules (one submission = one wallet) and tie rewards to on-chain activity to dodge bot farms.

Partnerships & Ecosystem Co-Marketing

Exchanges increasingly favour projects that ship co-campaigns with wallets, analytics dashboards or DeFi protocols — cross-emails can lift conversion 15-20 %. Add partner logos to your launchpad profile and pitch deck to signal ecosystem buy-in.

Post-IEO Growth Engine

A blockbuster raise is only the first checkpoint; the projects that survive the first 90 days are the ones that keep liquidity deep, ship roadmap items on schedule, reward long-term holders and stay relentlessly visible. Data from 2024-25 IEO cohorts show that teams which pair disciplined liquidity programs with steady product delivery and community incentives see two-to-three-times higher average ROI versus projects that “go quiet” after listing. The playbook below details the core engines that convert launch-day hype into durable network value.

What is the Post‑IEO Growth Engine?

The Post‑IEO Growth Engine refers to a coordinated, strategic campaign that occurs after the Initial Exchange Offering. Its goal is to capitalize on the IEO momentum to:

- Expand token utility

- Strengthen community engagement

- Ensure liquidity stability

- Build long-term credibility and roadmap achievement

Essentially, it's the engine that turns an initial token spike into lasting adoption and value.

Key Components of the Post‑IEO Growth Engine

Exchange Listings & Liquidity Management

- Multi‑exchange listing broadens access and trading volume

- Liquidity partnerships, market makers, or staking initiatives help stabilize price and reduce volatility.

Community Retention & Engagement

- Maintain active communities via Telegram, Discord, AMAs, and live Q&As.

- Launch loyalty programs (airdrops, staking rewards, referral bonuses) to retain token holders.

Regular Roadmap & Development Milestones

- Share frequent progress via blog posts, newsletters, and social updates to sustain trust.

- Transparency around fund allocation—show where IEO-raised funds are going.

Strategic Partnerships & Integrations

- Integrate token utility via DeFi platforms, wallets like Trust Wallet or MetaMask.

- Collaborate with crypto projects for cross‑campaigns to expand reach.

Ongoing Influencer & PR Campaigns

- Continue engagement with crypto influencers and targeted media to reach new audiences.

- Strike feature articles or interviews in niche and mainstream crypto outlets.

Data‑Driven Marketing and Iteration

- Track KPIs — user growth, engagement rates, liquidity metrics, sentiment — and adjust campaigns accordingly.

- Continuous optimization ensures campaigns stay effective and relevant.

Price Stabilization Mechanisms

- Use buy-back programs or treasury reserves to support price during dips.

- Maintain regulatory compliance to reduce risk and invite institutional participation .

Why the Post‑IEO Phase Matters

- Sustained Credibility: Regular updates and transparency signal trustworthiness .

- Enhanced Liquidity: Multi-exchange listings and staking boost volume and market stability.

- Community Loyalty: Continuous engagement converts initial investors into long-term advocates.

- Token Utility & Demand: New integrations and use cases drive token adoption.

- Investor Confidence: Clear roadmaps and fund usage reduce perceived risk.

How to Build an Effective Growth Engine

1. Develop a re‑launch roadmap

Outline 3-6 month plans: listings, protocol integrations, feature releases, and marketing milestones.

2. Allocate resources wisely

Dedicate budget for liquidity programs, content, marketing, community incentives, and paid media.

3. Coordinate with exchange partners

Engage listings, joint AMAs, and cross-promotions through your IEO exchange(s).

4. Set measurement goals

Track retention (% of holders after 30/90 days), monthly trading volume, website and community engagement.

5. Implement continuous iteration

Analyze campaign effectiveness monthly and pivot based on what moves KPIs.

Real‑World Impact

- Elrond, Matic, and BitTorrent experienced rapid initial IEO spikes followed by ecosystem expansion fueled by multi-exchange listings, staking mechanisms, strong community initiatives, and platform integrations.

- The result: price resilience, higher daily volumes, increased token utility, and sustained investor interest.

Common Pitfalls & How to Avoid Them

1. Ignoring Regulatory Reality

A single enforcement can freeze funds, stall trading, and drag founders into court. The SEC’s May 20 2025 fraud action against Unicoin—whose sale raised $100 million — shows how quickly an IEO can be halted when marketing claims overstep securities law.

How to stay safe: retain external counsel early, map every jurisdiction where ads or KOL posts will appear, and vet each promise (especially anything implying “returns”) before it leaves the draft folder.

2. Undisclosed Influencer Shilling

Regulators now treat stealth promotions as securities fraud. Kim Kardashian’s $1.26 million settlement for an un-labeled crypto ad is the cautionary tale every launch team should memorize.

How to stay safe: insist on written contracts that require “paid partnership” or #ad tags, give KOLs pre-approved disclosure copy, and archive every post link for audit defence.

3. Listing With Thin Order Books

Tokens that debut without a professional market-maker see bid-ask spreads widen beyond 10%, scaring off new buyers and triggering a price spiral. Liquidity studies stress that a ≤ 2% spread across the top five price levels is the new baseline for healthy markets.

How to stay safe: earmark 5–10% of the raise for liquidity provisioning, sign depth-target SLAs before T-0, and monitor spreads hourly for the first month.

4. Weak Vesting & Dump-Friendly Tokenomics

Poorly staggered unlocks invite day-one dumps that kneecap price and credibility. Token-economy guides for 2025 highlight gradual unlocks and insider liquid supply caps (< 20 %) as standard practice.

How to stay safe: publish a clear vesting chart with cliffs, limit private-sale allocations, and communicate the schedule visually in every deck and AMA.

5. Over-Hype & Vaporware Road-maps

“100×” slogans pump short-term FOMO but destroy post-listing sentiment; investor notes on hype-driven sectors show the sharpest six-month draw-downs when real progress lags the marketing.

How to stay safe: anchor messaging in specific, dated deliverables; launch a public milestone tracker, and celebrate shipped features—never speculative ROI.

6. Messaging Misfires & Ghost Communities

Inconsistent tone or long silences drain Telegram head-counts and lower exchange scoring during due-diligence.

How to stay safe: lock brand-voice guidelines early, schedule weekly AMAs/dev updates, and staff 24/7 moderators during launch week to keep median reply times under five minutes.

7. Security & Compliance Shortcuts

Global watchdogs now urge exchanges and issuers to prove robust KYC, AML, and code-audit standards before and after listing.

How to stay safe: complete a third-party smart-contract audit, publish the report, maintain an incident-response runbook, and rehearse crisis drills quarterly.

Key Takeaways

Marketing is the heartbeat that keeps an IEO alive from pre-sale whispers to post-listing growth. Nail your narrative, prove your compliance, and keep the community tuned in, and the exchange slot you fought so hard to win will transform into long-term market traction. Miss those beats, and even brilliant tech risks vanishing in the noise. The roadmap is in your hands — execute with precision.