Market makers are the backbone of financial markets. They guarantee that there’s always a buyer or seller for an asset, stabilizing prices and reducing volatility. Without them, markets could become illiquid, increasing transaction costs and making trades more difficult.

In cryptocurrency markets, market makers play a similar role but face unique challenges. They handle high volatility and navigate decentralized exchanges, uncertain regulations, and rapid technological changes.

This article explores market makers in the cryptocurrency market. We’ll look at their roles, different types, key players, and their impact on the market. By the end, you'll understand why market makers are crucial to the crypto ecosystem.

Understanding Market Makers

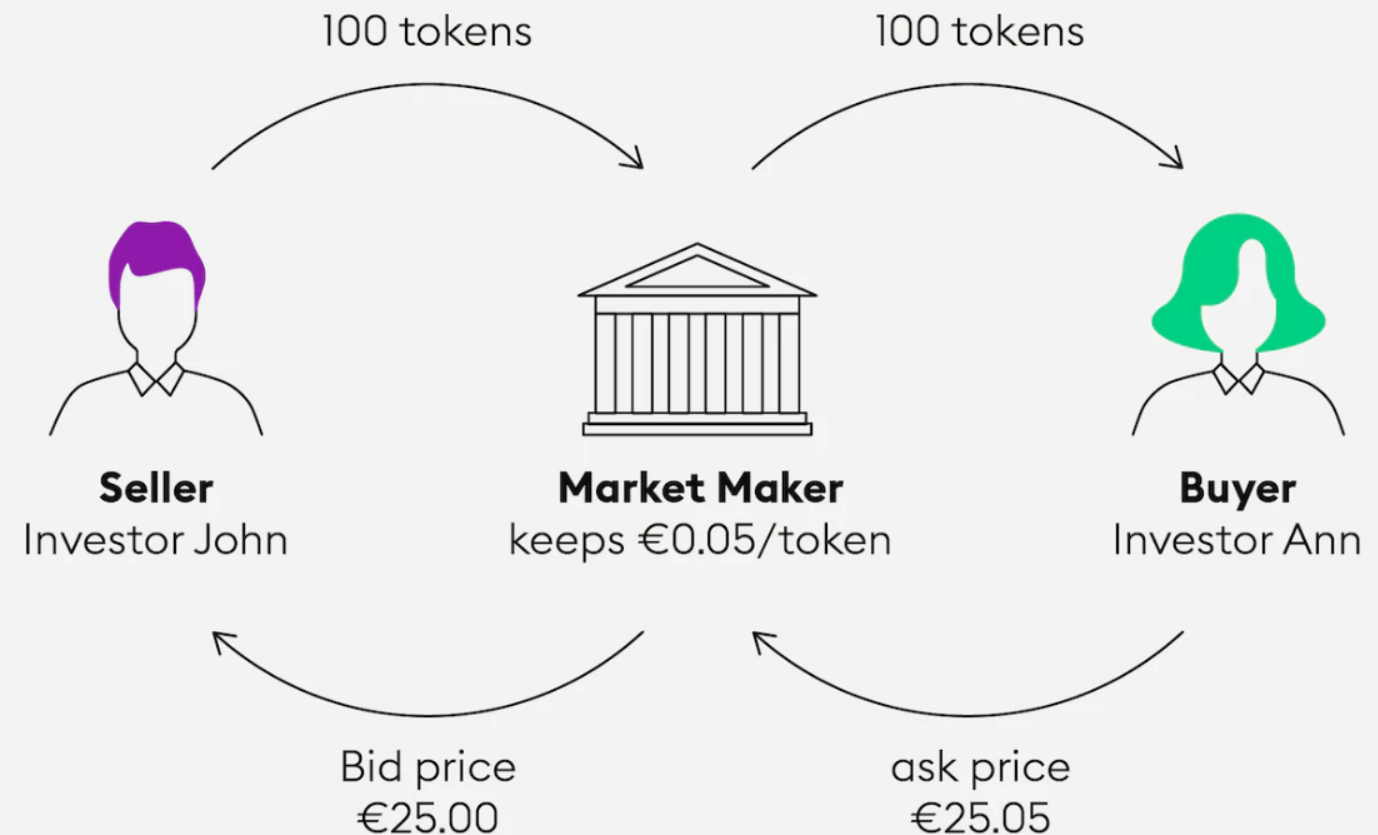

Market makers are individuals or entities that ensure smooth trading by constantly buying and selling assets at public prices. They keep markets efficient and liquid, enabling large orders without drastic price changes. Their profit comes from the bid-ask spread—the difference between their buying and selling prices.

Role and Functions of Market Makers

Liquidity Provision

Market makers ensure there is sufficient liquidity in the market by being ready to buy and sell cryptocurrencies at any given time. This availability reduces the time it takes for traders to execute orders and ensures that trades can be made without significantly affecting the market price.

Bid-Ask Spread Management

Market makers profit from the bid-ask spread, which is the difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask). By continuously quoting both bid and ask prices, market makers help narrow this spread, making trading more efficient and cost-effective for other market participants.

Price Stabilization

Market makers play a crucial role in stabilizing prices by providing continuous buying and selling pressure. Their activities help to dampen extreme price fluctuations and contribute to smoother price movements, which is particularly important in the highly volatile crypto markets.

How Market Makers Operate

Order Books and Matching Engines

Market makers place their buy and sell orders on the order book of a cryptocurrency exchange. The matching engine of the exchange matches these orders with those of other traders. By placing large volumes of orders, market makers ensure that there is always a counterparty for other traders, facilitating seamless transactions.

Arbitrage Opportunities

Market makers often engage in arbitrage, which involves exploiting price differences of the same asset across different exchanges. By buying low on one exchange and selling high on another, they can make a profit while also helping to balance prices between exchanges, contributing to overall market efficiency.

Types of Market Makers in Crypto

Traditional Market Makers

Characteristics and Strategies

Traditional market makers in the cryptocurrency market operate similarly to those in traditional financial markets. These entities, typically large trading firms or financial institutions, employ sophisticated algorithms and high-frequency trading (HFT) strategies to provide liquidity. They continuously place buy and sell orders on various exchanges, profiting from the bid-ask spread. Traditional market makers often use advanced risk management techniques to hedge their positions and minimize exposure to market volatility.

Example Firms

Prominent traditional market makers in the crypto space include firms like Jane Street, Jump Trading, and Cumberland. These firms have extensive experience in financial markets and leverage their technological prowess to efficiently manage large volumes of trades.

Automated Market Makers (AMMs)

Definition and Key Features

Automated Market Makers (AMMs) are a revolutionary innovation in the decentralized finance (DeFi) ecosystem. Unlike traditional market makers, AMMs do not rely on order books. Instead, they use smart contracts to create liquidity pools, where users can trade directly against the pool. Prices in AMMs are determined algorithmically based on the ratio of tokens in the pool.

Popular AMM Protocols

- Uniswap: One of the most well-known AMM platforms, Uniswap uses a constant product market maker model, where the product of the quantities of two tokens in a liquidity pool remains constant.

- Balancer: This protocol allows for more flexible liquidity pools with multiple tokens and varying weights, offering a unique approach to automated market making.

- Curve Finance: Specializing in stablecoin trading, Curve Finance uses an algorithm optimized for low slippage and low fee transactions between stablecoins and other assets of similar value.

Benefits and Drawbacks

AMMs democratize market making by allowing anyone to become a liquidity provider (LP) and earn fees from trades. This decentralized approach enhances liquidity in the market. However, AMMs are also subject to risks such as impermanent loss, where LPs can lose value compared to simply holding their assets, and vulnerabilities in smart contract code that can be exploited by attackers.

Hybrid Market Makers

Combination of Traditional and Automated Approaches

Hybrid market makers leverage both traditional market making techniques and automated market making models. These entities might use sophisticated algorithms to trade on centralized exchanges while also providing liquidity to decentralized exchanges through AMMs. This hybrid approach allows them to capitalize on the benefits of both systems, such as high liquidity and decentralized trust.

Example Strategies

- Arbitrage: Hybrid market makers often engage in arbitrage, exploiting price discrepancies between centralized and decentralized exchanges to generate profit while also helping to equalize prices across markets.

- Liquidity Mining: By participating in liquidity mining programs on AMM platforms, hybrid market makers can earn additional rewards, enhancing their overall returns.

Advantages and Challenges

The hybrid approach allows market makers to maximize efficiency and profitability by tapping into diverse liquidity sources. However, it also requires sophisticated technology and risk management strategies to navigate the complexities of both centralized and decentralized markets.

Role of Exchanges in Supporting Market Makers

Centralized Exchanges

Centralized exchanges (CEXs) like Binance, Coinbase, and Kraken play a crucial role in supporting market makers by providing the necessary infrastructure and incentives. These exchanges often have their own in-house market making teams or partnerships with external market makers to ensure deep liquidity and tight spreads.

Decentralized Exchanges

Decentralized exchanges (DEXs) like Uniswap, SushiSwap, and Curve Finance rely on AMM protocols to facilitate trading. By providing a platform for AMMs, DEXs enhance market efficiency and enable users to trade directly from their wallets without the need for intermediaries.

How Market Makers Impact the Crypto Market

Enhancing Liquidity

Importance for Traders and Investors

Market makers play a critical role in enhancing liquidity in the crypto market. By continuously providing buy and sell orders, they ensure that there is always enough volume to accommodate trades of various sizes. This is especially important in a market as volatile and fragmented as cryptocurrency, where liquidity can vary significantly across different exchanges and trading pairs. Increased liquidity allows traders to execute orders quickly and at desired prices, reducing slippage and improving the overall trading experience.

Market Depth and Tight Spreads

The presence of market makers deepens the order book, which means there are more bids and asks at different price levels. This depth helps to stabilize the market by absorbing large trades without causing significant price fluctuations. Additionally, market makers help narrow the bid-ask spread, the difference between the highest price a buyer is willing to pay and the lowest price a seller is willing to accept. Tight spreads benefit traders by reducing transaction costs and making the market more efficient.

Influence on Price Discovery

How Market Makers Affect Prices

Market makers influence price discovery by constantly updating their bid and ask prices based on market conditions, order flow, and other relevant factors. Their activities help reflect the real-time supply and demand dynamics in the market. As market makers adjust their prices to stay competitive and manage risk, they contribute to the continuous process of finding the true market value of cryptocurrencies.

Price Stabilization

By providing liquidity and maintaining tight spreads, market makers help stabilize prices. They act as intermediaries, absorbing excess buy or sell pressure that could otherwise lead to extreme volatility. For instance, if there is a sudden surge in sell orders, market makers can buy these assets, preventing a steep price drop. Conversely, they can sell assets in response to a spike in buy orders, mitigating sharp price increases.

Reducing Volatility

Techniques Used to Stabilize Prices

Market makers employ several techniques to reduce volatility and stabilize prices in the crypto market. They use advanced algorithms to manage their inventory and hedge against market risks. By strategically placing orders and adjusting their positions, market makers can dampen the impact of large trades and sudden market movements. They also engage in arbitrage, buying assets on one exchange where prices are lower and selling them on another where prices are higher, thereby balancing prices across different platforms.

Impact on Market Sentiment

Stable prices and reduced volatility contribute to positive market sentiment. When traders and investors see that prices are not subject to extreme swings, they gain confidence in the market's stability and fairness. This confidence can attract more participants, further enhancing liquidity and creating a virtuous cycle that benefits the entire ecosystem.

Providing Market Efficiency

Facilitating Smooth Trading

Market makers facilitate smooth trading by ensuring that there are always buyers and sellers available. This constant presence allows for quick execution of trades, which is crucial in a fast-paced market like cryptocurrency. Efficient trading reduces the time and cost associated with executing orders, making the market more accessible and attractive to a wider range of participants.

Supporting Smaller and Emerging Assets

Market makers also support smaller and emerging cryptocurrencies that may not have high natural liquidity. By providing buy and sell orders for these assets, market makers help promote their adoption and growth. This support is vital for the diversification and expansion of the crypto market, enabling new projects to gain traction and build a user base.

Challenges Faced by Market Makers

Navigating Regulatory Uncertainties

One of the significant challenges market makers face in the crypto market is navigating the complex and often uncertain regulatory landscape. Regulations can vary widely by jurisdiction and are continuously evolving. Market makers must ensure compliance with local laws while managing the risks associated with regulatory changes. This requires staying informed about regulatory developments and adapting their strategies accordingly.

Addressing Technological and Security Risks

The crypto market is highly reliant on technology, making market makers vulnerable to technological failures and security breaches. Ensuring the robustness and security of their trading systems is paramount. Market makers must invest in cutting-edge technology to maintain high-speed trading capabilities and protect against cyber threats. Additionally, they must be prepared to handle issues like exchange outages and smart contract vulnerabilities, which can impact their operations.

Final Takeaways

Market makers are indispensable players in the cryptocurrency ecosystem, significantly contributing to the market's overall health and efficiency. Their roles in providing liquidity, stabilizing prices, and facilitating smooth trading are critical for maintaining a vibrant and accessible crypto market.

The rise of DeFi and the increasing popularity of AMMs indicate a shift towards more democratized and decentralized market-making approaches. This trend is likely to continue, with innovative solutions emerging to address the unique challenges of the crypto market.