The crypto revolution is transforming the way we think about money and technology, and launching your own token is a key part of this dynamic shift. This article demystifies the process, offering practical insights into token creation. Prepare to embark on your journey into the exciting world of blockchain.

Pre-Launch Planning and Strategy

Before a crypto token sees the light of day, the groundwork you lay is essential to its long-term success. Pre-launch planning and strategy involves not only technical preparation but also thorough market analysis, legal and regulatory research, and the creation of a solid business foundation. Here’s how to approach this critical phase:

Defining Your Token’s Purpose and Use Case

- Clarify Your Vision: Start by identifying the specific problem your token will solve or the value it will add to an ecosystem. Is your token meant to facilitate payments, provide access to a decentralized application, or empower community governance? A clearly articulated purpose is your project's north star.

- Craft a Unique Value Proposition: Detail how your token stands out from existing alternatives. A compelling whitepaper can serve as the blueprint for your token, explaining its functionality, benefits, and real-world applications. For example, many successful token launches begin by addressing a well-defined market gap or inefficiency, setting the stage for investor and user interest.

Conducting Market Research

- Analyze Market Trends: Look at current trends in the crypto space — ranging from DeFi and NFTs to the growing influence of meme coins. Understand the competitive landscape and determine where your token fits. Resources like CoinMarketCap or CoinTelegraph offer insights into market trends and token performance.

- Identify Your Target Audience: Determine who will benefit from your token. Create detailed user personas that consider demographics, technical proficiency, and the specific pain points your token addresses. Effective market research should reveal both the size of your addressable market and the unique opportunities available.

Legal and Regulatory Research

- Understand the Regulatory Environment: Navigating the complex legal landscape is paramount. Crypto tokens can fall under various regulatory regimes depending on their structure and use case. Familiarize yourself with securities laws (e.g., the Howey Test in the U.S.), anti-money laundering (AML) requirements, and other relevant regulations. Websites like Global Legal Insights and recent analyses from legal experts provide up-to-date guidance on these matters.

- Consult with Legal Experts: Given the rapid evolution of crypto regulations, working with attorneys experienced in blockchain law can help you structure your token offering correctly and avoid costly pitfalls. Ensuring compliance early on not only protects your project but also builds investor confidence.

Forming a Legal Entity

- Choose a Crypto-Friendly Jurisdiction: The location where you establish your legal entity can have significant implications for regulatory compliance and operational flexibility. Jurisdictions like Switzerland, Singapore, or states such as Wyoming and Florida in the U.S. are known for their crypto-friendly environments.

- Establish the Right Structure: Create a legal entity that safeguards the interests of founders, investors, and users. This may involve setting up a corporation, foundation, or decentralized autonomous organization (DAO), depending on your strategic goals and regulatory requirements. A well-structured entity lays a robust foundation for future token offerings and business growth.

Technical Development of Your Token

1. Conceptualization & Planning

Before writing any code, it’s essential to define your token’s purpose and how it will function within its ecosystem. Key planning steps include:

- Defining the Use Case: Decide if your token will serve as a utility token, a security token, a governance mechanism, or even as a reward system. This decision drives many of the technical parameters later on.

- Tokenomics Design: Determine the total supply (fixed or inflationary), distribution strategy (team, community, reserves), and mechanisms like burning or minting. A well-thought-out tokenomics model helps ensure long-term value and stability.

This early planning phase sets the stage for technical development by aligning your project goals with the right design decisions.

2. Choosing a Blockchain Platform

Selecting the right blockchain is akin to choosing the proper foundation for a building. Considerations include:

Platform Compatibility & Standards:

- Ethereum is popular due to its robust smart contract capabilities and standards like ERC-20 for fungible tokens and ERC-721 for non-fungible tokens.

- Binance Smart Chain (BSC) offers lower transaction fees and faster block times, making it a cost-effective alternative.

- Solana, Cardano, or Polygon are also strong candidates, especially if scalability or energy efficiency is a priority.

Transaction Costs & Scalability: Ensure the platform’s network fees and speed align with your project’s requirements.

Developer Ecosystem: A platform with extensive documentation, libraries, and community support (such as Ethereum) can dramatically ease the development process.

Your platform choice affects not only the token’s performance but also its integration with existing wallets and exchanges.

3. Smart Contract Development

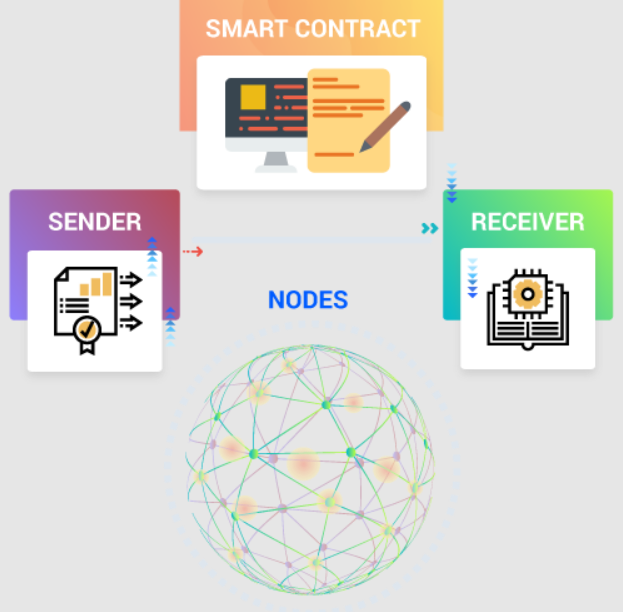

At the heart of any crypto token is its smart contract, which automates the token’s rules and transactions. Key steps include:

Programming Languages & Frameworks: On Ethereum, developers typically use Solidity to code smart contracts. Frameworks such as Truffle or Hardhat can streamline the development process.

Token Standards:

- For fungible tokens, implement standards like ERC-20, which define essential functions such as transfers, balance tracking, and allowances.

- If you’re working with unique digital assets (e.g., NFTs), you might use standards like ERC-721 or ERC-1155.

Coding Best Practices:

- Modularize your code to separate concerns (e.g., token logic, access control, and administrative functions).

- Write comprehensive tests for each function using unit testing tools to catch vulnerabilities early.

Smart contracts are immutable once deployed — rigorous testing and clear logic are paramount to prevent costly mistakes.

4. Testing on the TestNet

Before a mainnet deployment, it’s critical to run your token through a variety of tests:

- Deploy on a Test Network: Use platforms like Ethereum’s Ropsten, Rinkeby, or Binance Smart Chain’s testnet to simulate real-world conditions without risking actual funds.

- Simulate Transactions & Scenarios: Ensure that transfers, minting, burning, and other token operations perform as intended under various load conditions.

- Security Audits: Have third-party auditors review your smart contracts to identify potential vulnerabilities. This step is essential to avoid exploits and “rug pulls.”

Deploying on a TestNet allows you to iterate quickly and address issues before your token goes live on a main blockchain network.

5. Infrastructure & Integration

Beyond the smart contract itself, your token must interface seamlessly with the broader ecosystem:

- Node Setup & APIs: Decide whether you’ll run your own nodes or rely on third-party providers (e.g., Infura for Ethereum). Establish APIs that connect your smart contracts to user-facing applications, trading platforms, or even cross-chain bridges.

- Wallet Integration: Ensure compatibility with popular wallets like MetaMask, Trust Wallet, or native wallets provided by the blockchain (e.g., Daedalus for Cardano).

- Blockchain Explorers: Integrate with explorers like Etherscan or BscScan, so users can verify transactions and token statistics in real time.

Building robust infrastructure ensures that your token not only functions in isolation but also interacts smoothly with exchanges, dApps, and the end user’s experience.

6. Deployment & Post-Launch Considerations

After thorough testing and integration, it’s time to deploy your token:

- Mainnet Deployment: Deploy your smart contracts on the chosen main network. Double-check parameters like token name, symbol, and supply before finalizing.

- Listing on Exchanges: Work on getting your token listed on both centralized (CEX) and decentralized exchanges (DEX) to ensure liquidity and broader access.

- Monitoring & Maintenance: Use blockchain analytics tools to monitor trading volume, user adoption, and security incidents. Be prepared to adapt your tokenomics or smart contract parameters (via upgradable contracts or governance mechanisms) as the market evolves.

Deployment is just the beginning — ongoing support and community engagement are key to sustaining long-term success.

Designing a Robust Tokenomics Model

Step 1: Define Project Objectives and Market Research

- Identify Goals: Clearly articulate the problem your project addresses and the role tokens play in solving it.

- Research Market Needs: Understand your target audience, analyze competitors, and identify opportunities for differentiation. This research informs token utility and distribution strategies.

Step 2: Choose the Token Type and Standard

- Token Types: Decide if your token is utility, security, or governance-based, and whether it should be fungible (e.g., ERC-20) or non-fungible (e.g., ERC-721).

- Blockchain Selection: Select a blockchain platform that aligns with your project’s technical and economic requirements.

Step 3: Design Supply, Distribution, and Incentive Mechanisms

- Determine Total Supply: Set a cap or mechanism for token issuance that balances scarcity with accessibility.

- Plan Distribution: Allocate tokens among stakeholders (team, investors, community) with clear vesting schedules.

- Incentive Systems: Develop economic incentives (staking, rewards) that encourage holding and participation, ensuring these rewards correlate with network value creation.

Step 4: Implement and Test via Smart Contracts

- Smart Contract Development: Encode all tokenomics parameters in secure, audited smart contracts.

- Stress Testing: Simulate various market conditions to test the robustness of the tokenomics model. Iterative testing helps identify and resolve potential vulnerabilities or imbalances.

Step 5: Monitor, Iterate, and Adapt

- Continuous Improvement: Regularly monitor market dynamics and network performance. Gather community feedback and be prepared to iterate your tokenomics design to adapt to changing conditions.

- Governance Adaptability: Use decentralized governance to update economic policies as needed, ensuring the model remains effective over time.

Crafting Your Go-To-Market Strategy

Before the launch, it’s crucial to shape a narrative that resonates with both early adopters and long-term investors. This isn’t about ticking boxes; it’s about creating a story that captures the imagination and clearly illustrates the problem you’re solving, the innovative solution you’re offering, and why now is the perfect moment for your token. Instead of relying on dry lists, think of this as a creative journey.

Develop engaging content — be it a dynamic whitepaper or a compelling video series — that lays the foundation for a vibrant community. Social media channels and crypto influencers play a key role here, as their authentic voices can amplify your message and bring diverse perspectives to your project.

When it comes time to actually launch, the execution should feel like a coordinated event rather than a series of isolated actions. Imagine your launch as a live performance where every element — from technical readiness to public communication — must harmonize. This might mean scheduling a live-streamed event, rolling out detailed guides on how to participate, and ensuring that your smart contracts are robust enough to handle high volumes of transactions without hiccups. The focus should be on creating an immersive experience that invites people to become part of your token’s ecosystem.

After launch, the strategy shifts to nurturing and expanding your community. Post-launch engagement is not merely about maintaining interest; it’s about evolving your project in response to real-world feedback. Continuous updates, interactive AMAs, and transparent progress reports become your tools for building trust and adapting to market changes. Your go-to-market strategy is a living document, one that should evolve with the ecosystem and always be ready to pivot based on emerging trends and investor feedback.

Legal, Regulatory, and Compliance Considerations

1. Token Classification and Jurisdiction Selection

Token Classification:

The first step is determining whether your token will be a utility token, a security token, or even an asset-backed token.

- Utility tokens provide access to a service or platform and generally do not promise profit. Proper documentation — especially a clear, factual whitepaper — is essential to reinforce that the token’s primary function is utility.

- Security tokens, however, represent an investment in a venture (often conferring profit-sharing rights or equity-like benefits) and must comply with existing securities laws, including registration with relevant authorities or securing a regulatory exemption.

Understanding the classification is critical because it informs every subsequent regulatory requirement and shapes your project’s legal structure.

Jurisdiction Analysis:

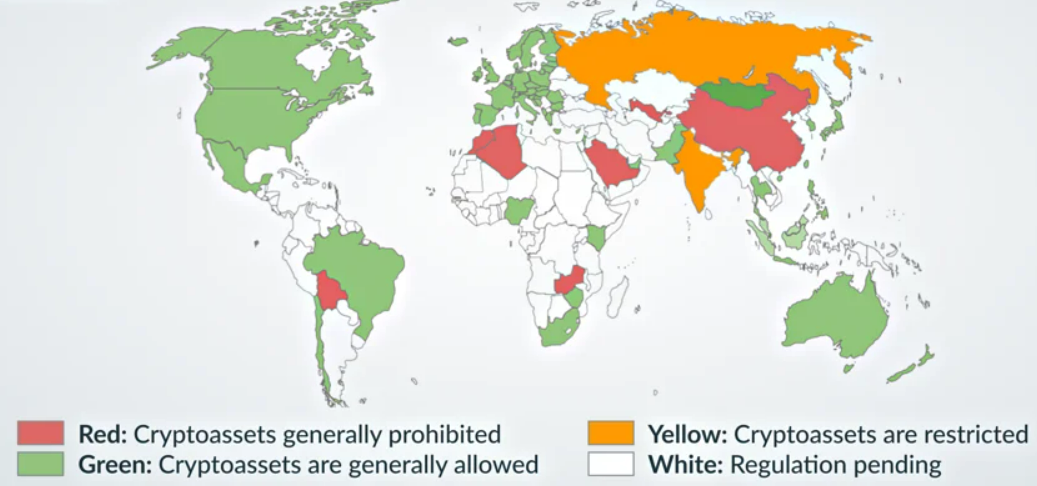

Different countries offer varying regulatory environments for crypto tokens. Projects should:

- Assess local regulations: Research whether the jurisdiction treats tokens as securities, commodities, or a separate digital asset class.

- Consider registration and licensing requirements: Some regions—like the United States under the SEC or the European Union with MiCA — impose strict registration or licensing obligations.

- Factor in tax implications: Jurisdictions differ in how they tax digital asset transactions and capital gains.

- Selecting a crypto-friendly jurisdiction or establishing a dual structure (for domestic and international markets) can reduce compliance complexity.

2. Licensing, Registration, and Documentation

Licensing and Registration Requirements:

For security tokens, you may need to:

- Register with securities regulators (or secure an exemption, e.g. Regulation D or Regulation A+ in the US) to legally raise capital.

- Obtain broker-dealer licenses if your platform facilitates token trading, as well as money transmitter licenses if the business handles fiat or cryptocurrency transfers on behalf of customers.

- Projects issuing utility tokens, while facing lighter scrutiny, must still adhere to consumer protection laws and AML/KYC obligations.

Legal Documentation:

Robust legal documentation is crucial and should include:

- A whitepaper that clearly explains the token’s purpose, functionalities, and limitations, avoiding language that might imply an investment return if not intended.

- Terms of service, disclaimers, and risk disclosures that comply with consumer protection and financial regulations.

- Engaging legal counsel to review these documents can help mitigate risks of later enforcement action.

3. AML, KYC, and Data Protection

AML/KYC Procedures:

Regulators require crypto token issuers and exchanges to implement rigorous AML and KYC processes:

- Customer Identification: Use third-party verification tools to ensure that users are properly identified.

- Monitoring and Reporting: Establish systems to detect suspicious transactions and comply with local and international AML guidelines.

- These measures not only protect against illicit activities but also build credibility with investors and regulators.

Data Protection:

Ensure compliance with data protection laws (like the GDPR in the EU) when collecting and processing user information. Implementing strong cybersecurity practices is also essential.

4. Tax Considerations

Tax Reporting and Obligations:

Crypto token transactions may be subject to taxation:

- Capital Gains Tax: Many jurisdictions treat gains from token sales as capital gains.

- Transaction Reporting: Detailed record-keeping is required for every token transaction, especially if tokens are exchanged for other currencies or used in transactions.

- International Taxation: Cross-border transactions introduce additional layers of complexity; consulting tax professionals experienced in digital assets is advisable.

5. International Regulatory Frameworks and Future Outlook

Cross-Border Considerations:

If your token will be available internationally, you must navigate different regulatory regimes. For example:

- European Union: The upcoming Markets in Crypto-Assets Regulation (MiCA) will set clear standards for token issuance, custody, and trading in the EU.

- Asia and Other Regions: Countries like Singapore and Switzerland offer relatively clear guidelines for crypto tokens but still require rigorous compliance.

Wrap Up

Launching a crypto token is a multifaceted journey that combines innovative technology, careful market research, robust legal frameworks, and dynamic marketing strategies. Equally critical is the seamless execution of your launch, which requires meticulous technical development, proactive legal compliance, and an engaging go-to-market strategy that captures and sustains community interest. By continuously adapting to feedback and regulatory shifts, you can build a resilient token ecosystem that not only attracts early adopters but also fosters long-term value for investors and users alike.