In the fast-paced world of digital finance, Real-World Asset (RWA) coins are making waves. These coins represent physical assets like real estate, commodities, bonds, and equities, brought onto the blockchain through tokenization. This process turns traditionally illiquid assets into digital tokens, boosting liquidity, transparency, and accessibility.

RWAs bridge the gap between traditional finance (TradFi) and decentralized finance (DeFi), democratizing access to high-value investments. By leveraging blockchain, RWAs enhance the efficiency and security of asset management, making investment opportunities more inclusive.

The key appeal of RWA coins is their real-world backing, offering stability in the often volatile DeFi space. So what, in essence, are these assets?

Understanding Real-World Assets (RWAs)

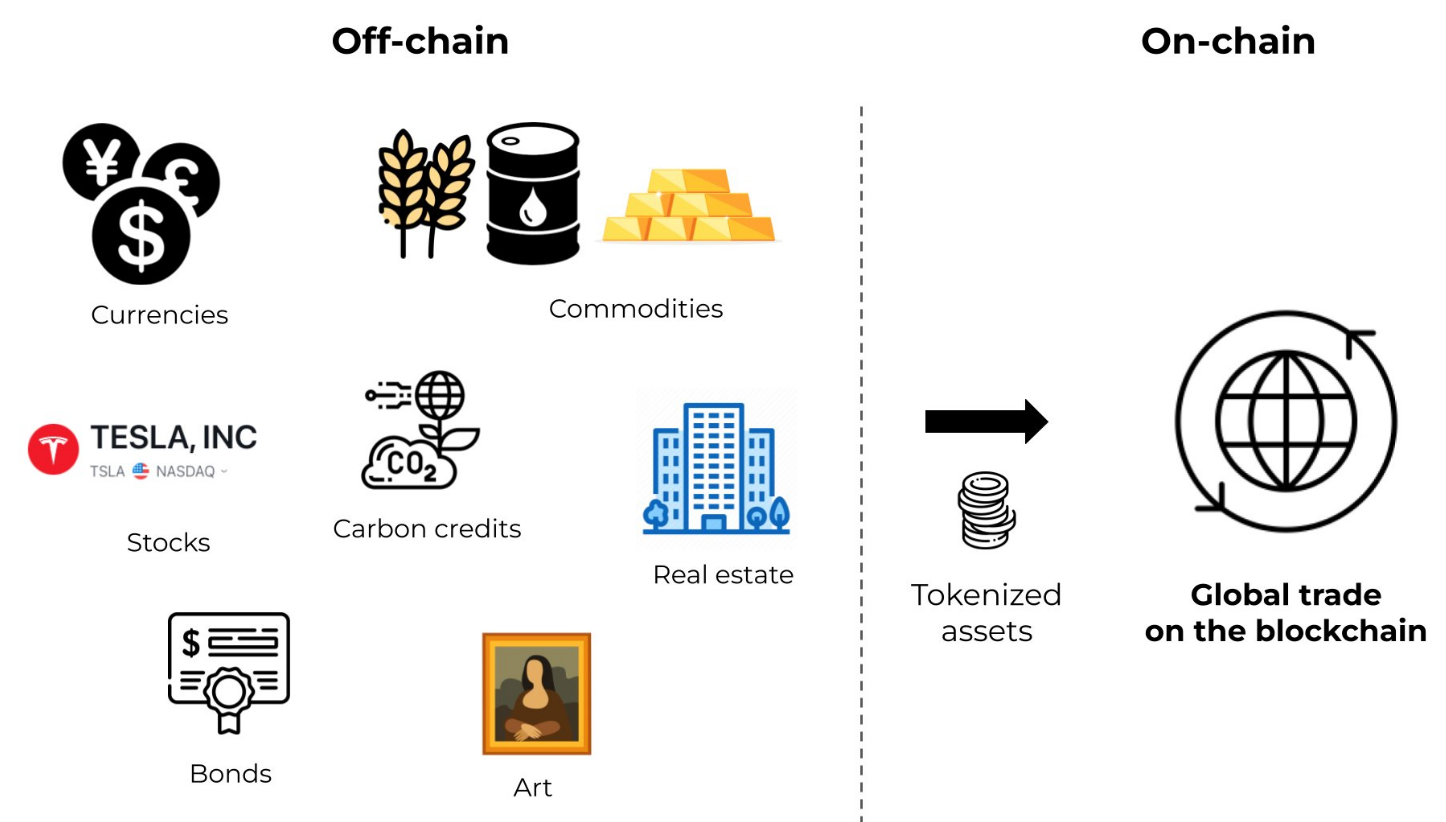

Real-World Assets (RWAs) are tangible and intangible assets that exist outside the digital spectrum but can be represented digitally through the process of tokenization. These assets include a wide range of categories such as real estate properties, commodities like gold and oil, financial instruments like bonds and equities, and other physical assets. The main characteristic of RWAs is their intrinsic value derived from their physical existence and utility in the real world.

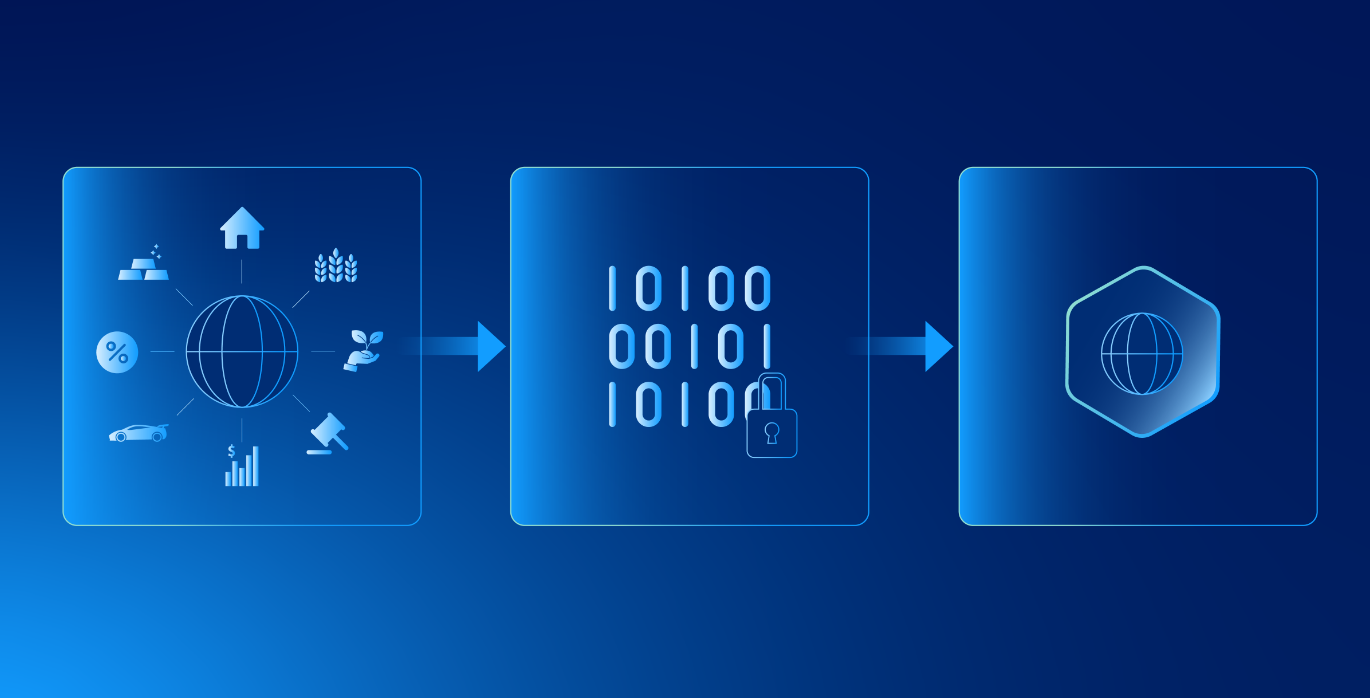

Tokenization is the process of converting real-world assets into digital tokens that are recorded and transacted on a blockchain. This involves creating a digital representation of the asset, which can then be divided into smaller units called tokens. Each token represents a fractional ownership of the asset, enabling broader participation and investment opportunities.

The tokenization process typically involves several steps:

- Acquisition of Assets: The initial step involves identifying and acquiring the physical asset to be tokenized.

- Digital Conversion: The asset is then digitally converted into tokens using blockchain technology.

- Issuance and Distribution: These tokens are issued on a blockchain platform and distributed to investors, who can buy, sell, or trade them like any other cryptocurrency.

Tokenized RWAs can span a diverse array of asset types. Some common examples include:

- Real Estate: Properties can be tokenized to allow fractional ownership, making it easier for small investors to participate in the real estate market.

- Commodities: Precious metals like gold can be tokenized, providing a secure and efficient way to trade and invest in these assets.

- Bonds and Equities: Financial instruments such as government bonds and corporate equities can be tokenized, enhancing their liquidity and accessibility to a global pool of investors.

Challenges and Risks

Regulatory Compliance

One of the most pressing challenges in the adoption of RWA coins is regulatory compliance. The regulatory landscape for tokenized assets is still evolving, with different jurisdictions imposing varying requirements. Navigating these regulations can be complex and time-consuming, and failure to comply can result in legal repercussions. Moreover, the lack of standardized global regulations can create uncertainty and limit the widespread adoption of RWA coins.

Security Concerns

While blockchain technology provides enhanced security, it is not without its risks. Ensuring the security of digital tokens and their linkage to the underlying physical assets is crucial. Vulnerabilities in smart contracts, potential hacking threats, and the challenge of securely managing both on-chain and off-chain components pose significant risks. Additionally, maintaining the integrity of the asset-token linkage is essential to prevent fraud and ensure that the digital tokens accurately represent the physical assets they are supposed to.

Liquidity Challenges

Although RWA coins aim to enhance liquidity, achieving sufficient market liquidity can be a challenge, especially in the early stages of market development. The success of tokenized assets depends on having an active and engaged market with enough buyers and sellers. Without sufficient liquidity, trading these assets can be difficult, leading to price volatility and potential losses for investors. Additionally, the fragmentation of tokenized assets across different platforms can further exacerbate liquidity challenges, making it harder for investors to find and trade these assets.

Market Maturity and Adoption

The market for RWA coins is still in its infancy, and widespread adoption will require significant maturation. This includes the development of robust infrastructure, standardized practices, and increased market awareness. The lack of a central marketplace for all RWAs and the diversity of platforms offering tokenized assets can lead to market fragmentation, making it harder for investors to navigate the space and for assets to achieve broad acceptance.

Benefits of RWA Coins

Enhanced Liquidity

One of the most significant advantages of RWA coins is the enhanced liquidity they bring to traditionally illiquid assets. By tokenizing assets like real estate, commodities, and bonds, RWA coins allow these assets to be traded on blockchain platforms, where they can be bought, sold, and exchanged more freely. This continuous trading, enabled by blockchain's 24/7 market operation, contrasts sharply with the limited liquidity found in traditional markets, where assets often take longer to trade due to various intermediaries and market hours.

Market making in the context of RWA coins involves ensuring liquidity and stable pricing, which is critical for attracting institutional investors and maintaining a healthy trading environment.

Fractional Ownership

RWA coins enable fractional ownership, making high-value assets accessible to a broader audience. By breaking down assets into smaller digital tokens, investors can purchase fractions of an asset rather than needing to buy the entire asset outright. This democratization of asset ownership lowers the barrier to entry, allowing more individuals to invest in assets that were previously out of reach due to their high cost. Fractional ownership is particularly beneficial in markets like real estate, where the capital requirement can be prohibitively high for individual investors.

Transparency and Security

Blockchain technology, the backbone of RWA coins, provides a transparent and secure framework for transactions. Every transaction is recorded on an immutable ledger, which is accessible to all participants, reducing the risk of fraud and enhancing trust. This transparency ensures that all stakeholders can verify the authenticity of transactions and the ownership of assets, thereby increasing confidence in the market. Additionally, the decentralized nature of blockchain reduces the likelihood of single points of failure, further enhancing security.

Accessibility and Inclusivity

RWA coins significantly increase the accessibility of high-value assets to a global audience. By leveraging blockchain technology, these assets can be accessed and traded by anyone with an internet connection, removing geographic and economic barriers that traditionally restricted access. This inclusivity not only broadens the investor base but also opens up new markets for asset issuers, fostering a more interconnected and robust global financial ecosystem.

Effective RWA marketing strategies are essential to educate investors about the benefits of tokenized assets and to drive widespread adoption in both traditional and decentralized finance markets.

Case Studies and Real-World Applications

The tokenization of RWAs has moved from theory to practice, with several successful implementations highlighting the transformative potential of this technology. Here are some notable case studies and real-world applications of RWA coins.

1. Real Estate Tokenization

Real estate is one of the most prominent sectors being transformed by RWA tokenization. Traditionally, real estate has been an illiquid and expensive market, accessible primarily to wealthy investors.

However, platforms like Centrifuge and Hamilton Lane have changed this narrative by enabling fractional ownership of real estate properties through tokenization. This approach lowers the barrier to entry, allowing a broader range of investors to participate in the real estate market with smaller amounts of capital. For instance, Hamilton Lane has tokenized parts of its flagship private equity fund on the Polygon blockchain, reducing the minimum investment from $5 million to $50,000, making it accessible to more investors.

2. Art and Collectibles

The art market, often characterized by high entry costs and exclusivity, has also seen the benefits of tokenization. Platforms like Sygnum have tokenized high-value artworks, such as Picasso's "Fillette au béret," allowing multiple investors to own fractional shares of these masterpieces. This democratizes art ownership and provides liquidity in a market that is traditionally difficult to enter and exit. Each transaction is transparently recorded on the blockchain, ensuring authenticity and preventing fraud.

3. Private Credit Markets

The private credit market has also embraced RWA tokenization, with platforms like Maple Finance and Goldfinch leading the way. These platforms allow businesses, especially those in emerging markets, to access capital by posting real-world collateral.

Maple Finance, for example, offers uncollateralized loans to institutional borrowers through a DeFi platform, while Goldfinch focuses on providing crypto-based loans to non-crypto businesses using real-world assets as collateral. These initiatives bridge the gap between traditional finance (TradFi) and decentralized finance (DeFi), offering higher returns for investors while supporting businesses that might otherwise struggle to secure funding.

4. Tokenized Treasury Bills

Another notable application is the tokenization of U.S. Treasury bills, which has been pioneered by platforms like Ondo Finance and OpenEden. These platforms allow investors to purchase tokenized Treasury bills using stablecoins like USDC. This not only brings a traditional financial product onto the blockchain but also enhances liquidity and accessibility for a global audience. The ability to invest in these government-backed securities through DeFi platforms offers a secure, yield-generating option for investors wary of the volatility in other crypto assets.

Closing Thoughts

By tokenizing tangible assets such as real estate, art, and financial instruments, RWA coins have the potential to revolutionize how these assets are managed, traded, and owned. The integration of RWAs into the DeFi ecosystem offers numerous benefits, including enhanced liquidity, fractional ownership, and greater accessibility for a global audience.

A successful crypto exchange listing of RWA tokens can significantly increase their visibility and trading volume, making them more accessible to a broader audience of investors. The future of RWAs looks promising, with ongoing innovations likely to drive further adoption and integration across various sectors, ultimately reshaping the global financial ecosystem.