Dive into the digital universe of crypto minting, where new tokens are born within a blockchain! Unlike traditional coin creation, crypto minting is a decentralized, digital, and often programmable action, typically executed through smart contracts.

Minting is crucial in the crypto sphere, transforming assets into a digital format on a blockchain. It not only safeguards the asset but also simplifies its transfer and trade online. Stay tuned as we decode the complexities in the digital realm together!

The Essence of Minting in Crypto

The Process Explained

Minting in cryptocurrencies refers to the creation of new digital tokens or coins, a process that is inherently different from the physical creation of currency. Unlike traditional money minting, which involves physical manufacturing, minting crypto is a purely digital and decentralized process. It typically occurs in a blockchain network, which is a distributed ledger technology that ensures the security, transparency, and immutability of data.

The process begins with the creation of a smart contract. A smart contract is a self-executing contract where the terms are directly written into code. It governs the rules and conditions for minting new tokens. For instance, it may define the total supply of the tokens, their value, and how they can be used or transferred. Once the smart contract is deployed on the blockchain, it can create (mint) new tokens, adhering to the predefined rules.

In the context of decentralized finance (DeFi) and other decentralized applications (dApps), minting can be initiated by a user interacting with a smart contract, triggering the process. The newly tokens are then added to the circulating supply and can be used as a medium of exchange, a store of value, or a unit of account within the network.

The Significance of Minting

It plays a crucial role in the cryptocurrency ecosystem for several reasons:

- Tokenization of Assets: It allows for the tokenization of assets, converting both tangible (like real estate) and intangible (like copyrights) assets into digital tokens on the blockchain. This tokenization facilitates the easy and secure transfer of ownership and enables assets to be divided into smaller, more accessible units.

- Creation of Utility Tokens: Through minting, platforms can create utility tokens that can be used within a specific blockchain ecosystem. These tokens can serve various purposes, such as granting access to specific services, acting as a medium of exchange, or enabling governance within the platform.

- Fundraising and ICOs: Minting is pivotal in Initial Coin Offerings (ICOs) targeting and other fundraising strategies in the crypto space. New tokens can be created and sold to investors to raise capital for various projects.

- Enabling Decentralized Finance (DeFi): Minting is fundamental in the DeFi sector, enabling the creation of various financial instruments such as stablecoins, lending platforms, and decentralized exchanges.

- NFT Creation: Minting is also essential in the creation of Non-Fungible Tokens (NFTs), which represent ownership or proof of authenticity of unique items or content on the blockchain.

Differentiating from Mining

The Mining Process

Crypto mining is a process that involves validating transactions and adding them to a blockchain, or public ledger. The mining process requires a network of computers, often referred to as nodes, to solve complex mathematical problems. Once these problems are solved, the miner gets rewarded with the crypto. Bitcoin mining, for instance, involves solving cryptographic puzzles, a process known as Proof of Work (PoW), to add a new block to the Bitcoin chain and is rewarded with newly created Bitcoin and transaction fees.

Mining serves two primary purposes: it validates and processes transactions, thereby maintaining the integrity and security of the network, and it releases new coins into circulation, controlling the supply of the crypto.

Key Differences and Similarities

- Creation of New Tokens/Coins: Minting involves process of creating new crypto coins (tokens), often in a predefined manner governed by smart contracts, while mining involves earning coins as rewards for validating transactions and adding new blocks to the chain.

- Energy Consumption: Cryptocurrency mining, especially in PoW systems, is notoriously energy-intensive, requiring substantial computational power to solve cryptographic puzzles. Mint coins, on the other hand, is not computationally intensive and is thus more energy-efficient.

- Accessibility: Mining requires significant investment in specialized hardware and consumes a lot of electricity, making it less accessible to the average individual. Cryptocurrency minting can typically be done with regular computer systems and does not require substantial energy, making it more accessible.

- Involvement in Network Security: Mining plays a crucial role in securing the network and validating transactions, whereas minting does not involve transaction validation in most cases.

- Use of Smart Contracts: Minting often involves the use of smart contracts to create new tokens, while mining does not involve smart contracts in the creation of new coins.

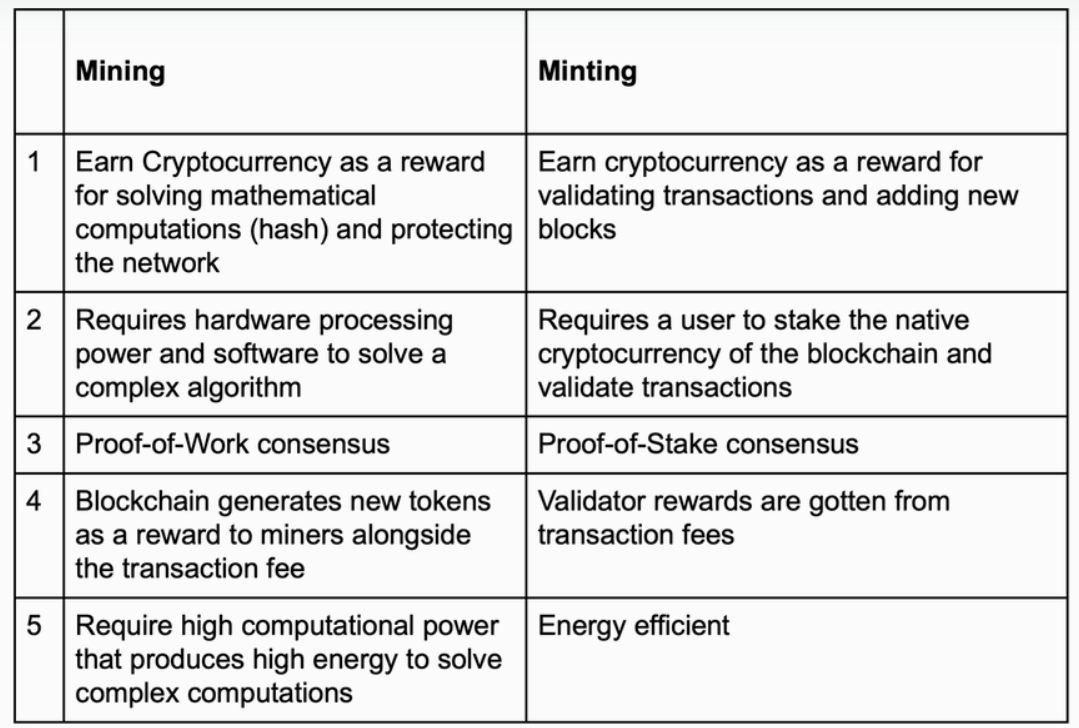

Technically, the two processes differ in the following:

Despite these differences, both processes serve as mechanisms to introduce new coins or tokens into circulation within their respective ecosystems and both are fundamental processes in the crypto world.

The Technical Realm of Crypto Minting

Smart Contracts

Smart contracts are self-executing contracts with the terms of the agreement directly written into lines of code. They are deployed on the blockchain and automatically execute actions when predefined conditions are met, without the need for an intermediary. In the context of minting, smart contracts define the rules for creating new tokens, such as the total supply, value, and distribution method, ensuring that the process is transparent, secure, and adheres to specified parameters.

Blockchain and Its Role

Blockchain technology is the backbone of crypto minting. It is a decentralized ledger that records all transactions across a network of computers, ensuring transparency, security, and immutability of data. When a new token is minted, the action is recorded on the blockchain, providing a verifiable and permanent record of the creation of the new token. The decentralized nature of blockchain ensures that the minting process is not controlled by a single entity and provides a secure environment where tokens can be minted and transacted.

The Minting Process: Step-by-Step

Pre-requisites for Minting

Before creating tokens, certain prerequisites need to be met:

- Smart Contract Development: A smart contract that defines the rules for minting needs to be developed and deployed on the blockchain.

- Blockchain Network: A blockchain network where the smart contract will be deployed and the tokens will be created and circulated.

- Wallet: A cryptocurrency wallet to store, receive, and send newly minted tokens.

- Gas Fees: Some blockchains require gas fees (transaction fees) to mint new tokens, which need to be paid in the native cryptocurrency of the blockchain.

The Minting Procedure

- Developing the Smart Contract: Define the rules for the new token, such as name, symbol, total supply, and functionality, and encode them into a smart contract.

- Deploying the Smart Contract: Deploy the smart contract on a blockchain by sending a transaction, including the smart contract code, to the network.

- Minting the Tokens: Once the smart contract is deployed, tokens can be created by interacting with the smart contract and invoking the minting function, which will create new tokens according to the rules defined in the smart contract.

- Distributing the Tokens: The newly created tokens can be sent or allocated to specific addresses or participants, as per the defined rules or distribution model.

Challenges and Solutions in Crypto Minting

Security is paramount in this process to safeguard against unauthorized crypto minting, smart contract vulnerabilities, and other potential threats. Employing rigorous smart contract auditing, implementing secure coding practices, and utilizing mechanisms like multi-signature wallets can enhance security.

While minting is less energy-intensive than mining, the overall energy consumption of blockchain networks can be a concern. Adopting and developing Proof of Stake (PoS) or other energy-efficient consensus mechanisms, and exploring layer 2 solutions can mitigate environmental impacts and enhance sustainability.

NFTs and the Art of Digital Minting

The Process of Minting NFTs

NFTs derive their value from their uniqueness and the demand in the market. They can represent various forms of digital and physical assets, such as art, music, video, virtual real estate, and more. The blockchain ensures the scarcity and ownership of the NFT, providing a decentralized ledger that verifies and authenticates the original creator and owner of the digital item.

Minting digital assets is an essential part of the NFT PR campaign and involves creating a digital token on the blockchain to represent a unique item or piece of content. The process typically involves:

- Creating or selecting a digital file to be tokenized.

- Uploading the file to an NFT marketplace or platform.

- Defining the properties of the NFT, such as name, description, and attributes.

- Minting the NFT by creating a new entry on the blockchain, which is facilitated by a smart contract.

- Listing the NFT for sale or auction on the marketplace.

The Impact of NFT Minting on the Art and Entertainment Industry

NFTs have empowered artists and creators by providing a new medium to monetize their work, retain more profits, and directly interact with collectors and fans. It also allows artists to program royalties into the NFT, ensuring they earn a percentage of sales whenever the NFT is resold.

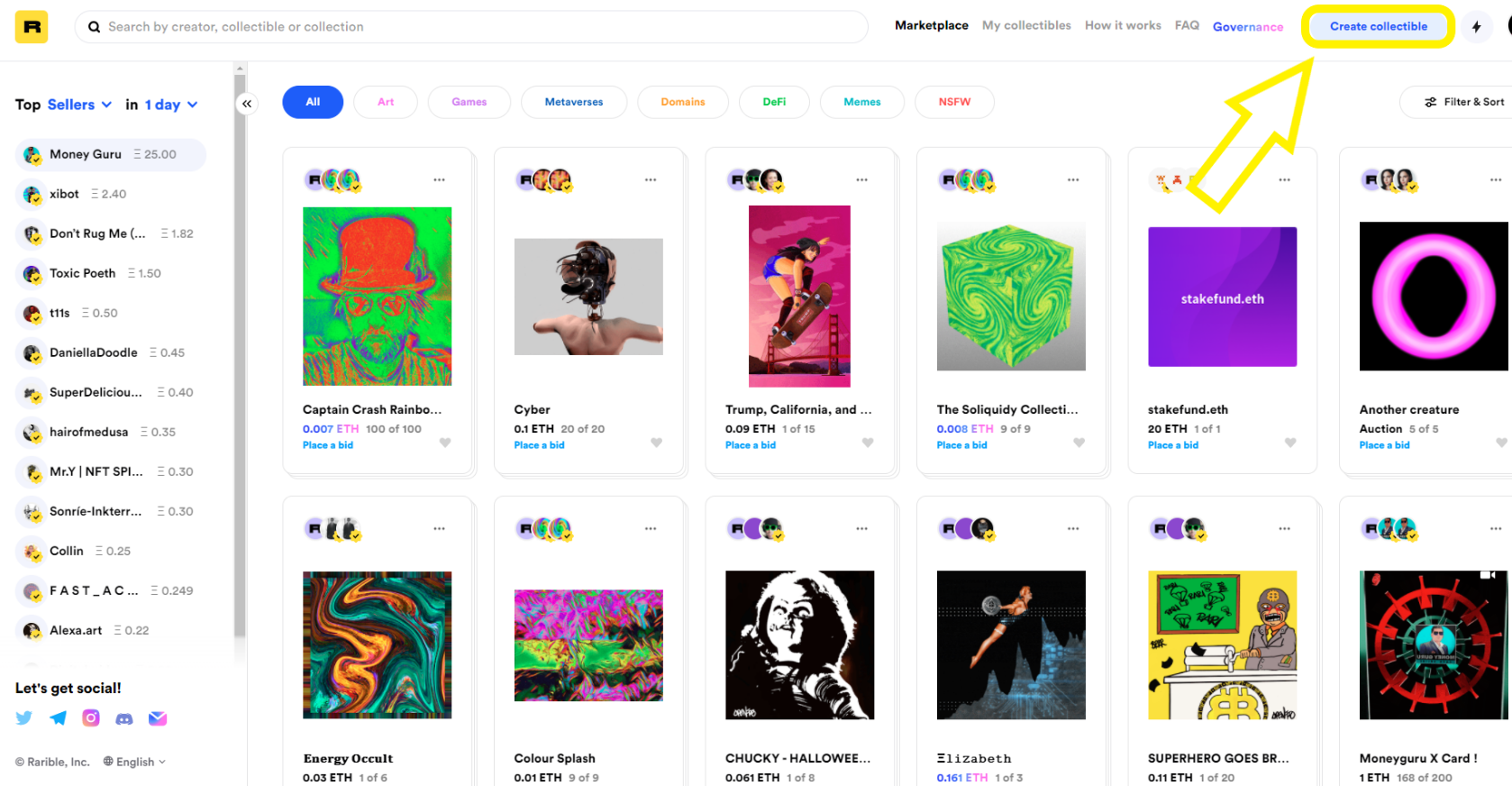

NFT marketplaces and auctions provide a platform for creators to showcase and sell their work.

Minting platforms like Rarible have gained popularity, facilitating the trade of NFTs and providing a space where creators and collectors can interact, buy, and sell unique digital assets.

Summing Up

The future of minting and cryptocurrency is poised at an interesting juncture, where technological advancements, regulatory frameworks, and market dynamics will shape its trajectory. As blockchain technology continues to mature and find new applications, the practice of minting will likely permeate various sectors, transforming how assets are created, managed, and transacted in the digital space. The confluence of technology, art, finance, and law in the crypto space presents a dynamic landscape that holds the potential to redefine digital ownership, creativity, and financial systems.