Dive into the digital wave with our essential guide to navigating the intricate world of cryptocurrency and its palpable global impact, driven by secure and transparent blockchain technology like Bitcoin and Ethereum. As cryptocurrencies reshape financial landscapes by enabling seamless transactions and stirring global regulatory debates, understanding the vital role of regulations becomes imperative to ensure stability, mitigate risks, and foster trust in this decentralized financial realm.

This guide aims to illuminate the complex regulatory challenges, explore the dynamic global frameworks, and provide you with strategic insights to orient effectively through the regulatory mazes of the cryptocurrency world, ensuring a harmonious blend of innovation and compliance. Let's embark on this enlightening journey together, decoding, understanding, and navigating the cryptic path of cryptocurrency regulations.

Unveiling the Regulatory Challenges in the Crypto Industry

Legal Compliance and Jurisdictional Issues

Navigating the intricate web of legal compliance and jurisdictional matters in the cryptocurrency industry is akin to traversing through a labyrinth, where each turn presents a new challenge and learning curve. The decentralized and global nature of cryptocurrencies introduces a myriad of legal complexities that stakeholders must meticulously understand.

Legal Definitions and Classifications of Cryptocurrencies

- Varying Legal Status: The legal status of cryptocurrencies varies significantly across jurisdictions, with some nations embracing them, while others impose stringent restrictions or outright bans.

- Classification Challenges: The classification of cryptocurrencies - as a commodity, currency, asset, or otherwise - differs globally, influencing regulatory approaches and legal obligations.

- Regulatory Ambiguity: In certain jurisdictions, the absence of clear definitions and classifications creates ambiguity, making compliance a challenging endeavor.

- Legal Frameworks: Understanding and adhering to the diverse legal frameworks that govern cryptocurrencies, such as securities laws, commodity trading regulations, and more, is pivotal.

Jurisdictional Challenges and Cross-Border Transactions

- Global Operations, Local Laws: Cryptocurrency businesses, often operating globally, must navigate the legal frameworks of each jurisdiction they operate in, ensuring localized compliance.

- Cross-Border Transactions: The ease of conducting cross-border transactions with cryptocurrencies poses challenges in determining applicable laws and adhering to multiple regulatory frameworks.

- Legal Risks: Engaging in global cryptocurrency operations exposes businesses to various legal risks, including non-compliance penalties, litigation, and reputational damage.

- International Cooperation: The need for international cooperation in regulating cross-border crypto transactions is paramount to mitigating risks such as money laundering and terrorist financing.

Insights and Implications

- Navigating Legal Nuances: Stakeholders must adeptly navigate through the legal nuances of different jurisdictions, ensuring that their operations are compliant with local laws and international standards.

- Legal Expertise: Engaging with legal experts, particularly those specializing in cryptocurrency and blockchain technology, is vital to deciphering the complex legal and jurisdictional challenges.

- Advocacy and Engagement: Participating in advocacy efforts and engaging with regulatory bodies can facilitate a more conducive regulatory environment and foster understanding between regulators and industry participants.

Financial Compliance and Anti-Money Laundering (AML) Protocols

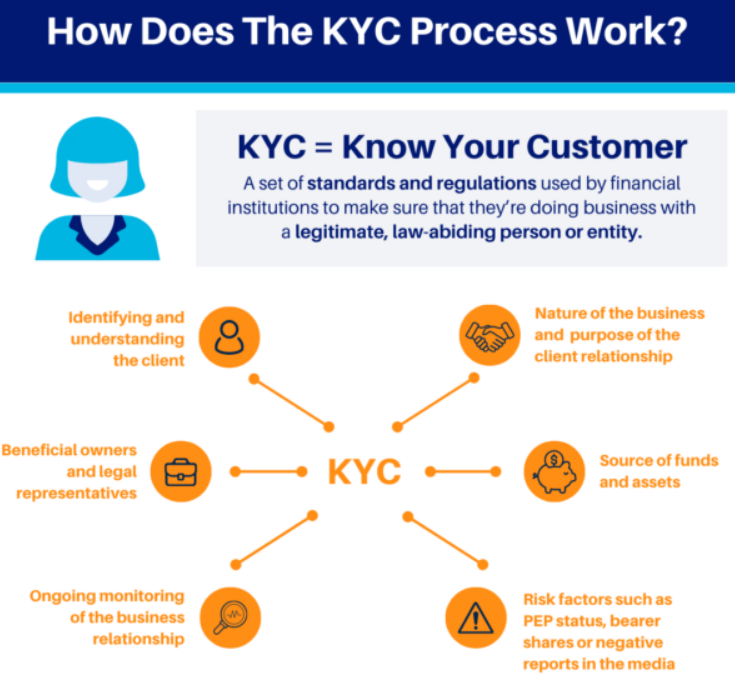

Know Your Customer (KYC) Requirements

Know Your Customer (KYC) refers to the process whereby businesses verify the identity of their clients either before or during the time they start doing business with them. In the context of crypto projects and Web3 companies, KYC is crucial to ensure that the entities involved in transactions are legitimate and to safeguard the platform from being utilized for illegal activities like money laundering or financing terrorism.

Key Components:

- Identity Verification: Collecting and verifying user’s personal information like name, address, and date of birth through government-issued documents.

- Risk Management: Assessing the risk level of customers based on their transaction patterns and source of funds.

- Continuous Monitoring: Regularly updating customer data and tracking their transaction behaviors to spot and investigate suspicious activities.

AML Policies and Compliance

AML policies are designed to prevent the use of financial systems for the illicit conversion or concealment of funds. In the realm of crypto projects, AML compliance is pivotal to establishing a transparent and secure trading environment.

Key Aspects:

- Transaction Monitoring: Keeping a vigilant eye on user transactions to detect irregularities or patterns indicative of money laundering.

- Reporting: Filing Suspicious Activity Reports (SARs) and Currency Transaction Reports (CTRs) to regulatory bodies in case of dubious transactions.

- Customer Due Diligence: Implementing stringent customer verification processes, especially for high-risk customers or large transactions.

Taxation and Reporting Obligations

The taxation landscape for cryptocurrencies varies across jurisdictions. However, most governments require individuals and businesses to report their digital asset transactions for tax purposes.

Essential Elements:

- Tax Liability: Understanding how crypto transactions are taxed, including capital gains tax and income tax.

- Record Keeping: Maintaining a detailed record of transactions, including dates, values, and purposes, to accurately calculate tax obligations.

- Regulatory Filings: Submitting necessary documents and reports to tax authorities in compliance with local and international tax laws.

Security and Consumer Protection

Security in crypto projects is paramount to protect assets from unauthorized access and cyber-attacks, while consumer protection ensures that users’ rights are safeguarded.

Crucial Considerations:

- Asset Protection: Utilizing advanced security protocols, like multi-signature wallets and cold storage solutions, to safeguard digital assets.

- Data Privacy: Ensuring that customer data is protected using encryption and robust cybersecurity measures.

- Legal Framework: Establishing a legal framework that outlines the rights and obligations of both the platform and its users.

- Insurance: Considering insurance coverage for digital assets to protect against potential losses due to security breaches.

Strategies for Navigating Through Regulatory Hurdles

Developing a Robust Compliance Program

Knowing the regulatory complexities of the cryptocurrency industry necessitates a robust compliance program, ensuring adherence to legal frameworks, mitigating risks, and fostering a culture of compliance within the organization.

Establishing a Compliance Team

- Importance of a Dedicated Team: Explore the critical role of a dedicated compliance team in struggling with regulatory challenges, ensuring adherence to legal frameworks, and mitigating risks.

- Roles and Responsibilities: Delve into the roles and responsibilities of a compliance team, including monitoring regulatory changes, ensuring adherence, and managing risks.

- Skills and Expertise: Discuss the skills and expertise required in a compliance team, ensuring effective management of regulatory challenges.

- Training and Development: Explore strategies for training and developing the compliance team, ensuring continuous learning and adaptation to the evolving regulatory landscape.

Implementing Effective Compliance Tools and Software

- Technology in Compliance: Discuss the role of technology in enhancing compliance, ensuring accuracy, and facilitating effective management of regulatory challenges.

- Choosing the Right Tools: Explore the factors to consider in choosing compliance tools and software, ensuring alignment with organizational needs and regulatory requirements.

- Implementation Strategies: Delve into strategies for implementing compliance tools and software, ensuring integration with existing systems and processes.

Engaging with Legal and Regulatory Bodies

Engagement with legal and regulatory bodies is pivotal in ensuring adherence to regulatory frameworks, influencing policy development, and mitigating legal risks.

Collaborating with Legal Experts

- Legal Expertise in Navigation: Discuss the importance of legal expertise in navigating through the regulatory complexities of the cryptocurrency industry.

- Choosing Legal Partners: Explore factors to consider in choosing legal partners, ensuring alignment with organizational needs and expertise in the crypto space. Try to work with crypto consulting companies to implement your ideas.

- Collaboration Strategies: Discuss strategies for collaborating with legal experts, ensuring effective communication, and alignment with organizational goals.

Participating in Regulatory Discussions and Forums

- Influencing Policy Development: Discuss the importance of participating in regulatory discussions and forums in influencing policy development and ensuring the voice of the industry is heard.

- Staying Informed: Explore strategies for staying informed about regulatory discussions, ensuring proactive adaptation to emerging regulatory frameworks.

- Building Relationships: Discuss the importance of building relationships with regulatory bodies, ensuring open communication, and collaborative problem-solving.

The Future of Cryptocurrency Regulations

The future of cryptocurrency regulations are poised to be shaped by technological advancements, evolving financial ecosystems, and the continuous push and pull between innovation and regulatory oversight.

Emerging Trends and Predictions in Crypto Regulations

- Decentralized Finance (DeFi) and Regulations: Explore the burgeoning world of DeFi public relations, discussing the regulatory challenges and potential frameworks that could shape its future.

- Global Regulatory Convergence: Discuss the possibility and implications of a more harmonized global regulatory approach towards cryptocurrencies.

- Regulating New Technological Advancements: Explore potential future technological advancements in the crypto space and discuss prospective regulatory approaches.

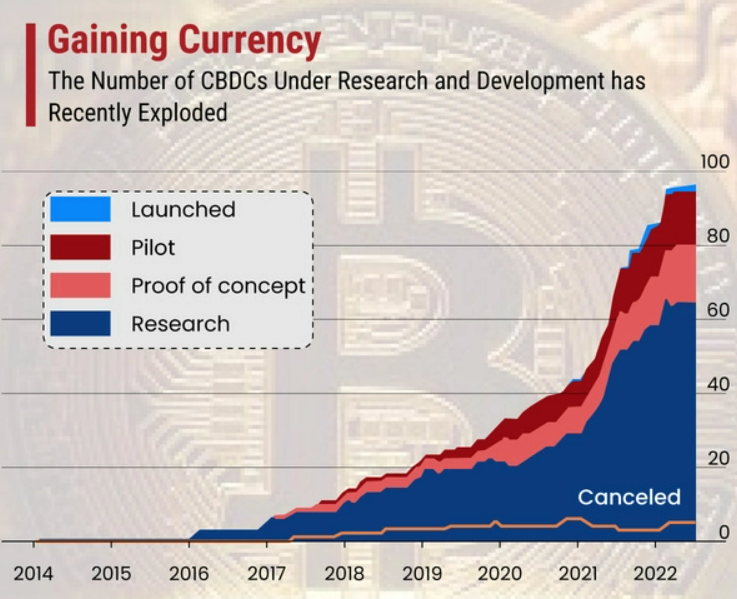

- The Rise of Central Bank Digital Currencies (CBDCs): Delve into the emergence of CBDCs, exploring their potential impact on the cryptocurrency industry and regulatory frameworks.

The Role of Technological Advancements in Regulatory Compliance

- Blockchain Technology and Regulatory Compliance: Discuss how blockchain technology can be leveraged to enhance regulatory compliance, ensure transparency, and facilitate regulatory oversight.

- Artificial Intelligence in Monitoring and Reporting: Explore the role of AI in enhancing monitoring and reporting capabilities, ensuring adherence to regulatory frameworks, and mitigating risks.

- Smart Contracts in Compliance: Discuss the potential role of smart contracts in automating compliance processes, ensuring accuracy, and reducing the risk of non-compliance.

Advocacy and Policy Development in the Crypto Space

- The Role of Crypto Advocacy Groups: Explore the role of advocacy groups in influencing policy development, ensuring the representation of industry interests, and facilitating dialogue between the industry and regulators.

- Influencing Policy Development and Regulatory Frameworks: Discuss strategies for influencing policy development, ensuring conducive regulatory frameworks, and fostering innovation in the crypto space.

- Building Bridges with Regulatory Bodies: Explore strategies for building collaborative relationships with regulatory bodies, facilitating open dialogue, and ensuring a balanced approach towards regulation.

Preparing for the Future: Strategies and Considerations

- Adaptation and Agility: Discuss the importance of adaptation and agility in navigating the future regulatory landscape, ensuring continuous compliance, and leveraging opportunities.

- Continuous Learning and Development: Explore strategies for ensuring continuous learning and development, staying abreast of regulatory changes, and ensuring preparedness for future regulatory shifts.

- Risk Management: Discuss strategies for managing risks in the future regulatory landscape, ensuring proactive mitigation, and preparedness for potential challenges.

Conclusion

In the intricate and dynamic world of cryptocurrency, navigating through the multifaceted regulatory challenges is a journey that intertwines innovation with compliance, and technology with legal frameworks. As we have traversed through the complexities of current regulatory landscapes, explored strategic approaches to compliance, and peered into the potential future of cryptocurrency regulations, it's evident that the path ahead is both exciting and challenging.

The delicate balance between fostering innovation and ensuring robust compliance will continue to shape the industry, requiring stakeholders to embrace challenges as opportunities for enhancing transparency, building trust, and facilitating sustainable growth. As we stand at the confluence of technology and regulation, the continuous evolution of the crypto regulatory landscape beckons us all - investors, entrepreneurs, regulators, and enthusiasts - to engage, learn, and actively participate in shaping a future where the cryptocurrency industry not only thrives but also positively contributes to the global financial ecosystem, ensuring a harmonious coalescence of innovation and regulation.