In the finance world, technology is rapidly changing the way we conduct transactions, manage our money, and invest. This innovation has given rise to a new industry – fintech – and with it, new opportunities for businesses to reach customers and grow their market share. However, promoting a fintech project requires a carefully crafted marketing strategy that takes into account the unique challenges and opportunities of this rapidly-evolving industry.

A comprehensive marketing plan is essential for businesses looking to succeed in fintech. It is where FINPR Agency comes in – a specialized agency that understands the ins and outs of fintech marketing and can help businesses develop effective strategies for promoting their products or services. From social media advertising to content marketing and SEO, FINPR can assist with every aspect of the marketing process, ensuring that businesses reach their target audience and drive conversions.

In this article, we'll dive into some of the best practices for fintech marketing in 2025, examining examples of successful strategies and exploring new and emerging trends in the industry. Whether you're a startup looking to gain traction or an established business seeking to stay ahead of the competition, this article will provide valuable insights into the world of fintech marketing and how to succeed in this dynamic and exciting industry.

A comprehensive marketing plan is essential for businesses looking to succeed in fintech. It is where FINPR Agency comes in – a specialized agency that understands the ins and outs of fintech marketing and can help businesses develop effective strategies for promoting their products or services. From social media advertising to content marketing and SEO, FINPR can assist with every aspect of the marketing process, ensuring that businesses reach their target audience and drive conversions.

In this article, we'll dive into some of the best practices for fintech marketing in 2025, examining examples of successful strategies and exploring new and emerging trends in the industry. Whether you're a startup looking to gain traction or an established business seeking to stay ahead of the competition, this article will provide valuable insights into the world of fintech marketing and how to succeed in this dynamic and exciting industry.

Things to Consider Before Developing a Fintech Marketing Strategy

There are several key factors to consider when it comes to developing a marketing strategy for a fintech project:

By considering these factors, businesses can develop a marketing plan that aligns with their objectives, resources, and timeline. It ensures that marketing efforts are targeted, effective, and efficient, ultimately leading to increased visibility, engagement, and revenue.

- The project goals should be clearly defined, as they will guide the selection of channels and marketing tactics.

- A budget must also be established, as it will determine the resources available for advertising, content creation, and other digital marketing initiatives.

- The time frame for the project should be taken into account, as this will impact the speed and intensity of marketing efforts.

By considering these factors, businesses can develop a marketing plan that aligns with their objectives, resources, and timeline. It ensures that marketing efforts are targeted, effective, and efficient, ultimately leading to increased visibility, engagement, and revenue.

Best Practices for Fintech Industry Marketing 2025

In the constantly evolving world of fintech, marketing strategies need to adapt and innovate to stay ahead of the curve. As we move into 2025, businesses must leverage the latest trends and technologies to effectively reach and engage their target audience. In this part, we'll explore some of the best practices for fintech marketing in 2025.

From utilizing social media platforms to leveraging data-driven insights, we'll provide actionable tips and insights for businesses looking to take their marketing efforts to the next level.

From utilizing social media platforms to leveraging data-driven insights, we'll provide actionable tips and insights for businesses looking to take their marketing efforts to the next level.

Paid Vs. Organic Traffic for Fintech Project

When it comes to fintech marketing campaign creation, businesses can choose between paid and organic traffic approaches. While paid traffic can generate fast results, it requires a significant budget and ongoing investment. On the other hand, organic traffic is slower to build but can provide sustainable, long-term results.

For businesses with a limited budget, the organic approach is often the best option, as it allows for more targeted and personalized engagement with potential customers, which can lead to increased trust, loyalty, and conversions over time.

To effectively target potential customers in the competitive world of fintech, businesses need to carefully choose their keywords and organize them into a strategic sales funnel. One approach is to balance high-volume, moderately difficult keywords with long-tail, lower-volume keywords that have more targeted search intent.

By assigning appropriate calls to action based on funnel level, businesses can position themselves as industry experts and drive traffic to their website while also hyper-targeting customers who are ready to make a purchase. For example, top-of-funnel articles can cover broader personal finance topics to build brand trust and attract traffic, while bottom-of-funnel articles can focus on specific financial issues such as debt payoff to convert readers into customers.

This unique keyword strategy has two benefits: driving traffic and building brand trust at the top of the funnel and hyper-targeting and converting customers at the bottom of the funnel.

For businesses with a limited budget, the organic approach is often the best option, as it allows for more targeted and personalized engagement with potential customers, which can lead to increased trust, loyalty, and conversions over time.

To effectively target potential customers in the competitive world of fintech, businesses need to carefully choose their keywords and organize them into a strategic sales funnel. One approach is to balance high-volume, moderately difficult keywords with long-tail, lower-volume keywords that have more targeted search intent.

By assigning appropriate calls to action based on funnel level, businesses can position themselves as industry experts and drive traffic to their website while also hyper-targeting customers who are ready to make a purchase. For example, top-of-funnel articles can cover broader personal finance topics to build brand trust and attract traffic, while bottom-of-funnel articles can focus on specific financial issues such as debt payoff to convert readers into customers.

This unique keyword strategy has two benefits: driving traffic and building brand trust at the top of the funnel and hyper-targeting and converting customers at the bottom of the funnel.

What Kind of PR Campaign to Choose?

Choosing the right approach can be challenging when it comes to PR campaigns for fintech businesses.

Additionally, other PR tactics, such as events, partnerships, and thought leadership pieces, can be effective in building brand awareness and establishing the business as an industry leader. Here is the list of things you will need for a PR campaign:

Ultimately, the best PR campaign will depend on the specific goals, target audience, and budget. It's important to carefully evaluate the pros and cons of each approach and determine which strategy aligns with the overall marketing plan and business objectives.

- Influencer marketing can be a powerful way to reach a highly engaged audience, it's important to select influencers whose values align with the brand and whose audience is relevant to the product or promoted service.

- Media publications, on the other hand, offer a broader reach and the potential for increased credibility through third-party validation. However, securing coverage in top-tier publications can be difficult and time-consuming.

Additionally, other PR tactics, such as events, partnerships, and thought leadership pieces, can be effective in building brand awareness and establishing the business as an industry leader. Here is the list of things you will need for a PR campaign:

- Get the emails of the journalists;

- Create press releases;

- Create pitches;

- Networking with the journalists (you can use Meltwater for it).

Ultimately, the best PR campaign will depend on the specific goals, target audience, and budget. It's important to carefully evaluate the pros and cons of each approach and determine which strategy aligns with the overall marketing plan and business objectives.

Partnership Marketing for Fintech

Collaboration marketing, also known as partnership marketing, encompasses a range of sub-categories as

The underlying principle of collaboration marketing is to work with a third party, company, or brand that has a connection to the target audience. By doing so, businesses can expand their reach, establish credibility, and ultimately gain new customers.

A notable example of a company that effectively used partnership marketing is Ripple, a leading US Bitcoin provider. Ripple recognized that new features could be integrated with current products and services to create an "add-on" for customers. As a result, Ripple focused its fintech marketing efforts on partnering with banking and industry giants. Their cryptocurrency and settlement solutions were a perfect complement to traditional banking and payment systems.

Ripple partnered with some of the world's top financial and technology firms, including American Express, to expand its customer base and increase brand awareness. Through collaboration marketing, Ripple was able to tap into new markets and ultimately grow its business. The table below summarizes the various subcategories of collaboration marketing:

- Co-branding;

- Licensing;

- Sponsorships;

- Joint ventures;

- Product placements.

The underlying principle of collaboration marketing is to work with a third party, company, or brand that has a connection to the target audience. By doing so, businesses can expand their reach, establish credibility, and ultimately gain new customers.

A notable example of a company that effectively used partnership marketing is Ripple, a leading US Bitcoin provider. Ripple recognized that new features could be integrated with current products and services to create an "add-on" for customers. As a result, Ripple focused its fintech marketing efforts on partnering with banking and industry giants. Their cryptocurrency and settlement solutions were a perfect complement to traditional banking and payment systems.

Ripple partnered with some of the world's top financial and technology firms, including American Express, to expand its customer base and increase brand awareness. Through collaboration marketing, Ripple was able to tap into new markets and ultimately grow its business. The table below summarizes the various subcategories of collaboration marketing:

Experiment or Not in Fintech?

Experiential marketing provides a unique opportunity for brands to create a personal and emotional connection with their target audience through physical experiences. This type of marketing strategy focuses on creating memorable experiences that evoke positive emotions and associations with a brand.

By immersing customers in an interactive experience, businesses can engage with their audience and leave a lasting impression that goes beyond traditional advertising methods. With experiential marketing, businesses can create a more personal and relatable connection with their customers, leading to increased brand loyalty and customer retention. So, we recommend trying experiential marketing!

By immersing customers in an interactive experience, businesses can engage with their audience and leave a lasting impression that goes beyond traditional advertising methods. With experiential marketing, businesses can create a more personal and relatable connection with their customers, leading to increased brand loyalty and customer retention. So, we recommend trying experiential marketing!

Best Examples of Implemented Fintech Marketing Strategy 2025

Curious to see how successful fintech companies are implementing their marketing strategies in 2025. Look no further! In this part, we'll explore the best examples of fintech marketing strategies and how they've been implemented to drive growth and increase customer acquisition. Keep reading to learn more.

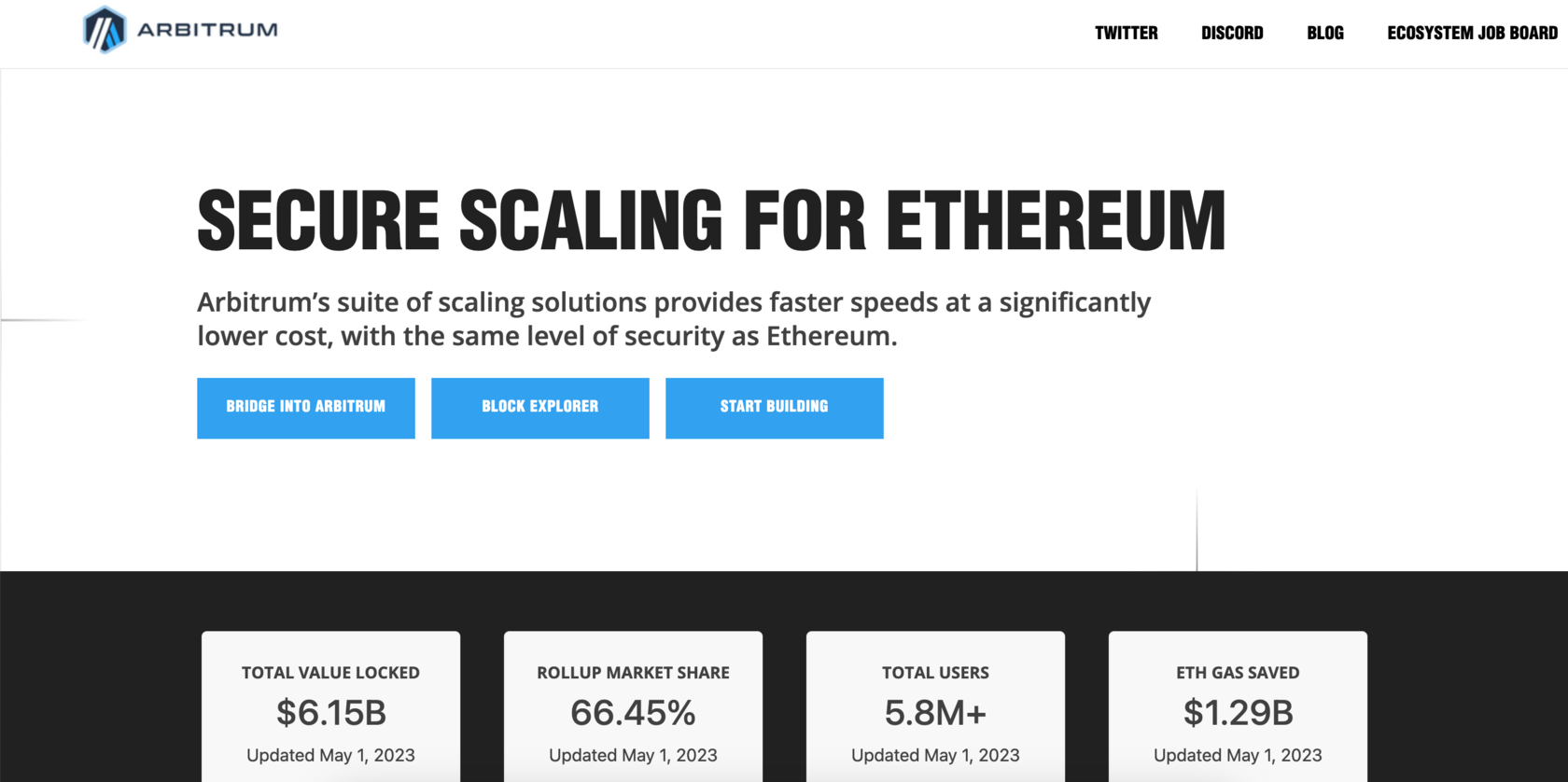

Arbitrum

Arbitrum is a Layer 2 scaling solution for Ethereum that enables faster and cheaper transactions while maintaining the security and decentralization of the Ethereum network. It uses a technology called optimistic rollups to process transactions off-chain and then submit them to the Ethereum network for verification. This approach significantly reduces gas fees and transaction times, making it an attractive option for decentralized finance (DeFi) applications and other Ethereum-based projects.

Arbitrum's marketing strategy focuses primarily on organic traffic and partnership marketing. This approach is a long but effective way of promoting fintech products. Since 2020, the team has been working tirelessly to build a strong brand identity and foster relationships with key industry players. By leveraging partnerships with other DeFi projects and building a community of supporters and developers, Arbitrum aims to establish itself as the go-to solution for Ethereum scaling.

Despite its reliance on organic growth, Arbitrum's technology is more than capable of supporting its marketing strategy. Optimistic rollups are a groundbreaking innovation in the blockchain world, and Arbitrum has been one of the pioneers in their development. The team behind the project includes some of the brightest minds in the industry, with years of experience in cryptography, distributed systems, and software engineering. With this level of expertise and cutting-edge technology, Arbitrum is poised to disrupt the DeFi space and become a leading solution for Ethereum scaling.

Despite its reliance on organic growth, Arbitrum's technology is more than capable of supporting its marketing strategy. Optimistic rollups are a groundbreaking innovation in the blockchain world, and Arbitrum has been one of the pioneers in their development. The team behind the project includes some of the brightest minds in the industry, with years of experience in cryptography, distributed systems, and software engineering. With this level of expertise and cutting-edge technology, Arbitrum is poised to disrupt the DeFi space and become a leading solution for Ethereum scaling.

Optimism Network

Optimism is a Layer 2 scaling solution for Ethereum that uses optimistic rollups to process transactions off-chain and then submit them to the Ethereum network for verification. The technology significantly reduces gas fees and transaction times, making it an attractive option for decentralized applications and projects built on Ethereum.

Optimism's marketing strategy focuses primarily on social media and partnership marketing. Through social media channels such as Twitter, Discord, and Reddit, the team engages with the community, shares updates, and responds to feedback. Additionally, they have formed partnerships with key industry players, such as Synthetix and Uniswap, to help promote the technology and accelerate adoption.

Why Optimism?

- Optimism is a Layer 2 scaling solution for Ethereum;

- The technology significantly reduces gas fees and transaction times;

- Optimism's marketing strategy focuses on social media and partnership marketing;

- The developers' solution to an old problem of Ethereum has made the technology attractive to users and investors alike;

- The project has seen significant growth and adoption, with over 1.5 million transactions and a total value of over $1 billion;

- The network has attracted high-profile partners and investors, including a recent $25 million funding round led by a16z.

One reason for Optimism's success is that the developers have solved a real and old problem of Ethereum. Before Optimism, Ethereum users experienced high transaction fees and slow confirmation times. With Optimism, users can enjoy faster and cheaper transactions without sacrificing the security and decentralization of the Ethereum network.

In summary, Optimism's marketing strategy of social media and partnership marketing has been successful in promoting the technology and accelerating adoption. The developers' solution to a real and old problem of Ethereum has made the technology attractive to all target market participants.

Lemon Card

Lemon Card is a fintech company that offers a VISA in Latin America, enabling users to beat inflation by holding and exchanging cryptocurrency. Lemon Card's marketing strategy relies on partnerships with VISA and local Latin American banks to promote its product. By partnering with these established brands, Lemon Card can leverage their existing customer bases and increase its reach in the fintech market.

The region has a history of high inflation rates, which can erode the value of local currencies and decrease purchasing power. Lemon Card allows users to hold a stable foreign currency, such as USD, and exchange it for crypto (and vice-versa) to avoid the fluctuations and devaluation of local currencies. This feature has made Lemon Card a popular choice for those looking to protect their wealth and preserve their purchasing power in the face of inflation.

To Wrap It Up

The world of fintech marketing is becoming increasingly complex, as new technologies and products continue to emerge at a rapid pace. To succeed in this environment, marketers must have a deep understanding of the products and services they are promoting, as well as a keen awareness of emerging trends and consumer behavior. Keeping a close eye on the latest developments in fintech will be essential for marketers looking to stay ahead of the curve in 2025.

One effective strategy is to work with marketing agencies like FINPR, which can help fintech companies navigate the rapidly changing landscape and develop effective marketing campaigns. In addition to staying up to date on emerging trends, marketers will need to focus on building trust with customers and delivering exceptional user experiences. Leveraging new technologies such as AI and machine learning can also help optimize marketing efforts and provide a competitive edge.

One effective strategy is to work with marketing agencies like FINPR, which can help fintech companies navigate the rapidly changing landscape and develop effective marketing campaigns. In addition to staying up to date on emerging trends, marketers will need to focus on building trust with customers and delivering exceptional user experiences. Leveraging new technologies such as AI and machine learning can also help optimize marketing efforts and provide a competitive edge.