In the rapidly evolving world of digital assets, NFTFi represents a groundbreaking intersection of two dynamic realms: Non-Fungible Tokens (NFTs) and Decentralized Finance (DeFi). NFTFi, short for NFT Finance, leverages the unique attributes of NFTs within the decentralized financial ecosystem to unlock new financial opportunities and enhance liquidity for digital asset holders.

Core Components of NFTFi

Definition and Overview

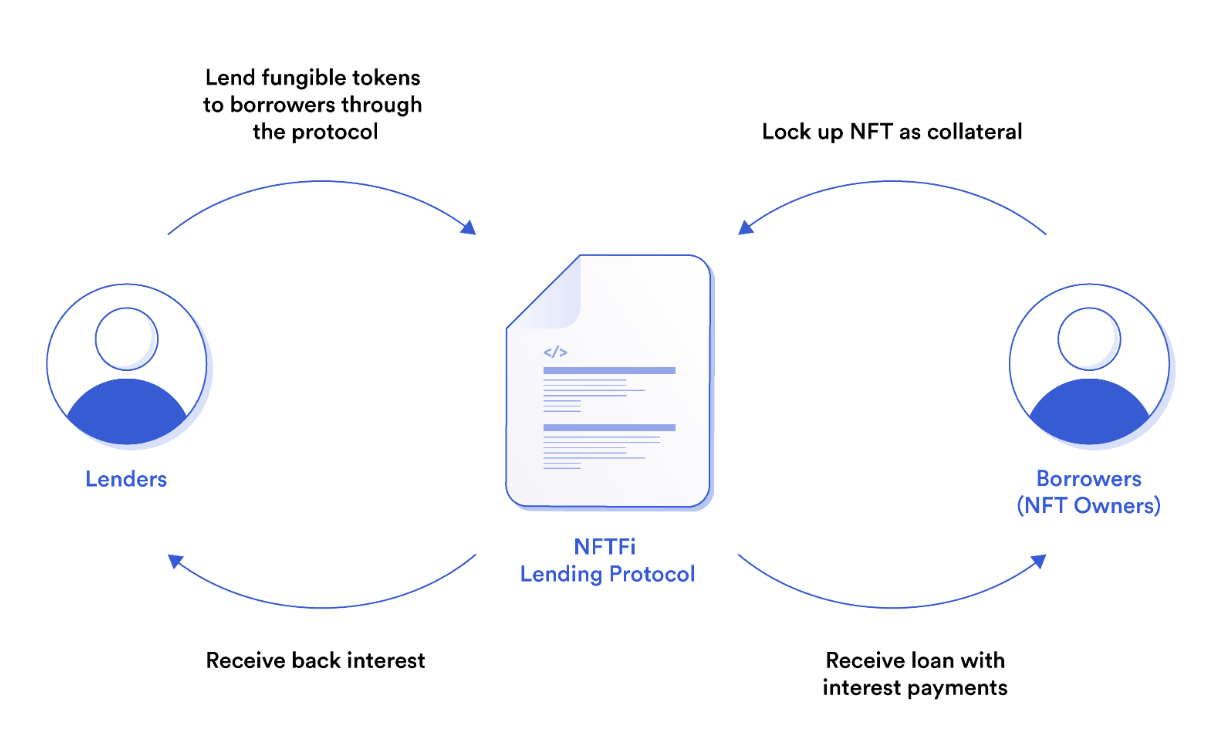

NFTFi encompasses a suite of financial products and services built on blockchain technology that allows users to leverage their NFTs for various financial purposes. These include lending and borrowing, fractional ownership, derivatives trading, and more. By integrating DeFi principles with NFTs, NFTFi provides novel ways to unlock the value of digital assets without the need to sell them outright.

Importance of NFTFi

The advent of NFTFi is pivotal for several reasons. Firstly, it addresses the liquidity constraints often associated with NFTs, which are typically illiquid assets. By allowing NFT owners to use their assets as collateral for loans or to fractionalize them, NFTFi injects much-needed liquidity into the NFT market. This liquidity enables more dynamic trading and investment opportunities, akin to those available in traditional financial markets.

Moreover, NFTFi enhances the financial utility of NFTs by creating sophisticated financial instruments around these digital assets. This not only benefits NFT holders but also attracts a broader range of participants to the market, including institutional investors who seek diversified exposure to digital assets.

The integration of SocialFi principles into the NFTFi ecosystem highlights the increasing importance of social connections and interactions in driving value and engagement within digital communities."

Unlocking Liquidity and Financial Utility

NFTFi protocols and platforms facilitate the unlocking of liquidity in several innovative ways. For instance, NFT lending and borrowing platforms allow NFT owners to secure loans against their NFTs, providing immediate access to funds without selling the underlying assets. Fractionalization platforms enable owners to split their NFTs into fungible tokens, making it easier to sell shares of high-value NFTs to multiple buyers.

Additionally, the development of NFT derivatives introduces new avenues for speculation and hedging in the NFT market. By creating tradable contracts based on the future prices of NFTs, these derivatives offer investors the ability to gain exposure to NFT markets without owning the assets outright.

Introduction to DeFi

Overview of DeFi and Its Principles

Decentralized Finance (DeFi) refers to a burgeoning ecosystem of financial services built on blockchain technology, aiming to recreate traditional financial systems like lending, borrowing, and trading in a decentralized, transparent, and permissionless manner. Key principles of DeFi include:

- Transparency: All transactions and smart contracts are publicly accessible on the blockchain, ensuring accountability and reducing the risk of fraud.

- Interoperability: DeFi platforms and protocols can interact with each other seamlessly, allowing users to combine different services for complex financial operations.

- Accessibility: DeFi is open to anyone with an internet connection and a digital wallet, eliminating the need for intermediaries and reducing barriers to entry.

Key Components and Benefits of DeFi

The core components of DeFi include decentralized exchanges (DEXs), lending and borrowing platforms, yield farming, and stablecoins. These components work together to provide a comprehensive financial ecosystem:

- Decentralized Exchanges (DEXs): Platforms like Uniswap and SushiSwap enable peer-to-peer trading of cryptocurrencies without relying on a central authority. Users maintain control of their assets, enhancing security and reducing the risk of hacking.

- Lending and Borrowing Platforms: Services like Aave and Compound allow users to lend their crypto assets to earn interest or borrow against their holdings. This creates opportunities for passive income and liquidity.

- Yield Farming: By providing liquidity to DeFi protocols, users can earn rewards in the form of additional tokens. This incentivizes participation and enhances the overall liquidity of the DeFi ecosystem.

- Stablecoins: These are cryptocurrencies pegged to stable assets like the US dollar, providing a reliable medium of exchange and a hedge against market volatility.

By leveraging the principles of DeFi, NFTFi aims to unlock the financial potential of NFTs, creating new avenues for liquidity, investment, and financial inclusion.

Use Cases and Market Growth of NFTs

The rise of NFTs has transformed various industries by providing a new way to own, trade, and monetize digital content. Key use cases include:

- Art and Collectibles: NFTs have revolutionized the art world by allowing artists to tokenize their works, ensuring they receive royalties on secondary sales. Platforms like OpenSea and Rarible have become popular marketplaces for trading digital art and collectibles.

- Gaming: In-game assets, such as characters, weapons, and virtual land, can be owned and traded as NFTs. Games like Axie Infinity and Decentraland are pioneering the integration of NFTs into their ecosystems.

- Music and Entertainment: Musicians and entertainers are using NFTs to release exclusive content, concert tickets, and merchandise. This direct-to-fan approach provides new revenue streams and strengthens fan engagement.

The NFT market has seen exponential growth, with sales reaching billions of dollars. This surge reflects the increasing acceptance and adoption of NFTs across various sectors, driven by their potential to democratize access to digital assets and empower creators.

Technical and Security Considerations

Smart Contracts in NFTFi

Role of Smart Contracts

Smart contracts are self-executing contracts with the terms of the agreement directly written into code. In the context of NFTFi, smart contracts facilitate various transactions, such as lending, borrowing, and trading of NFTs, by ensuring that the predefined conditions are met without the need for intermediaries. They play a crucial role in maintaining the trustless nature of NFTFi, enabling seamless interactions between users while ensuring security and transparency.

Security Measures and Auditing of Smart Contracts

Given the significant value often associated with NFTs, the security of smart contracts in NFTFi is paramount. To mitigate risks such as hacking and exploitation, smart contracts undergo rigorous security audits conducted by specialized firms. These audits involve:

- Code Review: Comprehensive examination of the smart contract code to identify vulnerabilities and ensure adherence to best practices.

- Penetration Testing: Simulated cyberattacks to evaluate the contract's defenses against potential threats.

- Formal Verification: Mathematical proofs to verify that the smart contract behaves as intended under all possible conditions.

Leading auditing firms in the blockchain space, such as ChainSecurity and Halborn, provide these services, helping to enhance the reliability and security of NFTFi platforms.

NFT Price Data Feeds

Importance of Accurate NFT Price Data

Accurate price data is essential for various NFTFi operations, including lending and borrowing, fractionalization, and derivatives trading. Reliable price feeds ensure that transactions are based on fair and up-to-date valuations, reducing the risk of under-collateralization and market manipulation.

Solutions for Providing Robust Price Data

NFT price data feeds aggregate and analyze data from multiple sources to provide accurate and timely valuations. One notable solution is the Chainlink NFT Floor Price Feeds, which combine data from prominent NFT marketplaces and employ sophisticated algorithms to filter out anomalies and wash trading. The process involves:

- Data Aggregation: Collecting price data from various NFT marketplaces.

- Outlier Detection: Identifying and excluding abnormal transactions that could skew the average price.

- Price Calculation: Using adaptive algorithms to compute a representative floor price for each NFT collection.

- Decentralized Delivery: Ensuring secure and reliable delivery of price data to smart contract applications through a decentralized oracle network (Chainlink).

This methodology ensures that NFTFi platforms have access to high-quality price data, supporting secure and efficient financial transactions.

Risk Management in NFTFi

Market Volatility and Liquidity Risks

NFT markets can be highly volatile, with significant fluctuations in the value of digital assets. This volatility poses risks for both lenders and borrowers in NFTFi. For instance, a sudden drop in NFT prices could lead to under-collateralized loans, increasing the risk of defaults. To manage these risks, NFTFi platforms implement several strategies:

- Collateral Requirements: Setting minimum collateralization ratios to ensure that loans remain adequately backed even in volatile market conditions.

- Liquidation Mechanisms: Automated processes to liquidate collateral if its value falls below a certain threshold, protecting lenders from losses (The Coin Republic).

Regulatory and Legal Considerations

The regulatory landscape for NFTFi is still evolving, with various jurisdictions developing frameworks to address the unique challenges posed by digital assets. Key considerations include:

- Compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) Regulations: Ensuring that platforms implement procedures to prevent illicit activities and verify the identities of users.

- Intellectual Property Rights: Addressing issues related to the ownership and transfer of digital assets, particularly when fractionalization or derivatives are involved.

- Tax Implications: Providing clear guidelines on the taxation of income and capital gains from NFTFi activities.

Staying abreast of regulatory developments and ensuring compliance is crucial for the long-term sustainability of NFTFi platforms.

Summary of Key Points

NFTFi is at the forefront of financial innovation, continuously evolving with emerging platforms and technologies. As the ecosystem matures, we can expect more innovative solutions that address current challenges, improve user experience, and expand the utility of digital assets. This ongoing innovation is vital for the sustainable growth and resilience of the NFTFi market.

NFTFi holds immense potential to revolutionize how we interact with digital assets, providing new avenues for liquidity, investment, and financial inclusion. As the market continues to evolve, staying informed about the latest developments and actively participating in the ecosystem will be crucial for harnessing the full benefits of NFTFi. With its ability to unlock value, enhance financial utility, and drive innovation, NFTFi is poised to play a central role in the future of the digital economy.

Today, as the NFTFi market evolves, the potential influence of PolitiFi — where political events and policies impact financial markets — could become an important factor in shaping the regulatory and operational landscape of NFT-based financial services.

By bridging the gap between the unique, often illiquid nature of NFTs and the dynamic, liquid environment of DeFi, NFTFi not only democratizes access to financial services but also paves the way for a more efficient, inclusive, and versatile digital asset market. As we move forward, the continued growth and integration of NFTFi will undoubtedly shape the landscape of digital finance, offering exciting opportunities for investors, creators, and users alike.