Asset tokenization is changing how we think about owning and investing in things. By using blockchain technology, it lets real-world assets — like real estate, stocks, or even artwork — be split into digital tokens, with each token representing a part of ownership. This new way of doing things makes it easier to buy and sell assets, provides more transparency, and makes investing more accessible to everyone.

In this guide, we explore the fundamentals of asset tokenization, its benefits, and how it could shape the future of global finance.

What is Asset Tokenization?

Asset tokenization is the process of converting ownership rights in an asset into a digital token that exists on a blockchain. Think of it as creating a digital version of something valuable. This can include anything from a piece of property to a share in a company or even a work of art. By turning these assets into tokens, they can be traded easily, similar to how you can trade stocks or cryptocurrencies.

Each token represents a fraction of the asset, which means that instead of needing a large amount of money to buy a whole property, for example, you could buy just a small portion of it. This makes it possible for more people to invest in high-value assets that would otherwise be out of reach.

Benefits of Asset Tokenization

There are several key benefits to asset tokenization:

1. Increased Accessibility

Tokenization allows people to invest in assets that were previously difficult to access. For example, buying real estate usually requires a large amount of money upfront. With tokenization, investors can purchase smaller portions of a property, making real estate investment possible for more people.

2. Greater Liquidity

Tokenization makes it easier to buy and sell assets, which increases their liquidity. Liquidity refers to how easily an asset can be converted into cash. Since tokenized assets can be traded on digital marketplaces, they are often easier to sell than traditional assets.

3. Transparency and Security

Because tokenized assets exist on a blockchain, all transactions are recorded in a secure and transparent way. This means that ownership records are easy to verify, and there is less risk of fraud. Blockchain technology also ensures that these records cannot be altered, providing greater security for investors.

4. Lower Costs

By using blockchain technology, tokenization can reduce the need for intermediaries, such as brokers or banks, which can lower transaction costs. This makes the buying and selling process more efficient and cost-effective.

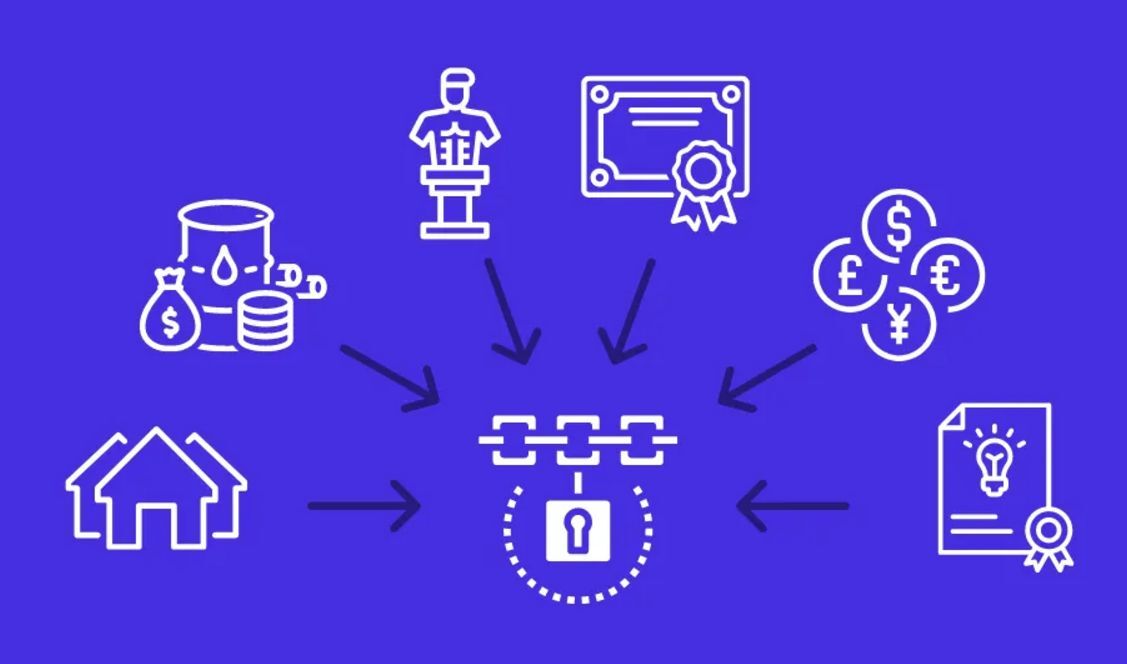

Types of Assets That Can Be Tokenized

Asset tokenization can be applied to a wide range of assets, including:

Real Estate

Real estate is one of the most common assets being tokenized. By dividing properties into tokens, investors can buy and sell fractions of a property. This makes real estate investment more accessible to those who may not have the funds to purchase an entire property. Tokenized real estate also makes it easier to diversify an investment portfolio by owning parts of multiple properties in different locations.

- Residential properties (e.g., apartments, houses).

- Commercial properties (e.g., office buildings, retail spaces).

- Easier portfolio diversification across different real estate markets.

Stocks and Equity

Companies can tokenize their shares, allowing investors to buy digital tokens that represent a portion of the company's equity. This can make it easier for startups and smaller companies to raise capital, as it provides a more flexible way for investors to participate.

- Tokenized shares provide easier access to equity investments.

- Startups can use tokenized shares for raising capital.

- Increased liquidity compared to traditional shares.

Art and Collectibles

High-value art and collectibles can also be tokenized, allowing multiple investors to own a fraction of a painting, sculpture, or other valuable items. This not only makes art investment more accessible but also provides artists with new ways to monetize their work.

- Fractional ownership of high-value artworks.

- Tokenization of collectibles like rare stamps or coins.

- Provides artists with new revenue streams.

Commodities

Tokenization can also be applied to commodities like gold, silver, and oil. By creating digital tokens that represent ownership of these commodities, investors can easily trade them without needing to physically store the assets.

- Digital tokens for gold, silver, and other precious metals.

- Easier trading without the need for physical storage.

- Accessible to small investors who want exposure to commodities.

Intellectual Property

Intellectual property, such as patents and copyrights, can also be tokenized. This allows creators to sell shares of their intellectual property rights, providing them with a new source of funding while giving investors a chance to profit from royalties and licensing.

- Tokenization of patents and copyrights.

- Investors can earn royalties from intellectual property.

- Provides creators with additional funding opportunities.

How Asset Tokenization Works

The process of asset tokenization typically involves the following steps:

Asset Identification and Valuation

The first step in tokenizing an asset is to identify and value it. This involves determining the asset's worth and ensuring it meets the criteria for tokenization. For example, a property must be legally verified and appraised before it can be tokenized.

Smart Contract Creation

A smart contract is then created to govern the rules of the tokenized asset. A smart contract is a self-executing contract with the terms of the agreement directly written into code. It defines how ownership is transferred, how dividends are paid, and any other conditions related to the asset. Consider working with smart contract audit companies to ensure the contract's security and compliance.

Token Generation

Once the smart contract is in place, digital tokens are generated to represent shares of the asset. These tokens are then recorded on the blockchain, ensuring that all ownership and transaction records are transparent and secure.

Listing on a Digital Marketplace

The tokens can then be listed on a digital marketplace or exchange, where investors can buy and sell them. These marketplaces function similarly to stock exchanges, providing a platform for investors to trade tokenized assets.

Use Cases of Asset Tokenization

Real Estate Tokenization

Lofty AI: This platform enables investors to purchase fractional ownership in rental properties across the United States. Investors can buy RWA tokens representing shares in properties, earning rental income and benefiting from property appreciation.

Financial Instruments

Janus Henderson: The asset manager plans to tokenize securities, starting with the $11 million Anemoy Liquid Treasury Fund, which invests in short-term U.S. Treasury bills. This initiative aims to enhance efficiency by reducing intermediaries in the investment process.

Commodities

Realize T-BILLS Fund: An Abu Dhabi-based firm, Realize, launched a fund that tokenizes units of ETFs focused on U.S. Treasury bills. This fund purchases ETFs from BlackRock's iShares and State Street's SPDR, converting them into digital tokens tradable on the blockchain.

Art and Collectibles

Securitize: This financial technology company provides a platform for businesses to raise capital by issuing shares in the form of digital tokens recorded on the blockchain. Notably, Securitize facilitated the tokenization of shares for Oddity, the parent company of online beauty brand Il Makiage.

Banking and Financial Services

ANZ Bank: The Australian bank used Chainlink's Cross-Chain Interoperability Protocol (CCIP) to demonstrate the cross-chain settlement of tokenized assets. This initiative showcases how clients can trade and settle tokenized assets across various public and private blockchains.

These examples illustrate the diverse applications of asset tokenization, highlighting its potential to enhance liquidity, transparency, and accessibility across multiple sectors.

Challenges of Asset Tokenization

While asset tokenization offers many benefits, there are also challenges that need to be addressed:

1. Regulatory Uncertainty

The regulatory environment for tokenized assets is still evolving. Different countries have different rules about how tokenized assets should be treated, which can create confusion and make it difficult for tokenization to be widely adopted. Regulators are still trying to determine how to classify tokenized assets, whether as securities, commodities, or something else entirely.

2. Legal and Ownership Issues

Tokenizing an asset involves dividing ownership, which can raise legal and ownership issues. For example, determining the rights of token holders, such as voting rights or rights to income, can be complex. Additionally, cross-border ownership of tokenized assets can lead to complications with different legal systems.

3. Technical Complexity

Tokenizing an asset requires a good understanding of blockchain technology and smart contracts. This technical complexity can be a barrier for some people who are not familiar with how these systems work. There is also the risk of bugs or vulnerabilities in the smart contracts, which could lead to financial losses.

4. Market Adoption

For tokenization to become mainstream, more people and institutions need to trust and adopt the technology. This requires education, as well as proof that tokenization is a safe and effective way to invest. Additionally, the infrastructure for trading tokenized assets, such as digital exchanges, needs to be developed and regulated to ensure investor protection.

How to Get Started with Asset Tokenization

If you're interested in getting started with asset tokenization, here are the key steps you need to take:

1. Identify the Asset to Tokenize

The next step is to decide which asset you want to tokenize. This could be real estate, stocks, artwork, or any other valuable item. The asset should be evaluated and verified to ensure it is suitable for tokenization.

- Decide on the type of asset (e.g., property, art, equity).

- Ensure the asset meets legal and regulatory requirements.

- Evaluate the asset's value and potential for tokenization.

2. Choose a Tokenization Platform

There are several platforms that offer asset tokenization services. These platforms provide the tools needed to create digital tokens, set up smart contracts, and list the tokens on a marketplace.

- Research different tokenization platforms.

- Compare features, fees, and services offered.

- Choose a platform that meets your needs (e.g., Ethereum, Polymath).

3. Develop a Smart Contract

A smart contract is the backbone of asset tokenization. It defines the rules for ownership, transfers, and payments. You will need to work with developers or use tools provided by the tokenization platform to create a secure and transparent smart contract.

- Work with developers to create a smart contract.

- Define ownership rules, dividend payments, and conditions.

- Ensure the smart contract is audited for security.

4. Token Generation and Listing

Once the smart contract is created, you can generate digital tokens that represent ownership of the asset. These tokens should then be listed on a digital marketplace where they can be bought and sold by investors.

- Generate digital tokens representing fractions of the asset.

- List tokens on a digital marketplace or exchange.

- Facilitate buying and selling of tokens by investors.

5. Comply with Regulatory Requirements

Compliance is a critical aspect of asset tokenization. Depending on the asset and your jurisdiction, there may be regulations that you need to follow. This could include registering the tokens as securities or meeting certain investor protection requirements.

- Understand the regulatory requirements for your jurisdiction.

- Ensure compliance with securities laws and other regulations.

- Work with legal experts to navigate the regulatory landscape.

6. Market the Tokenized Asset

To attract investors, you need to market your tokenized asset effectively. This could include creating a website, social media presence, and reaching out to potential investors through marketing campaigns.

- Create a marketing strategy for the tokenized asset.

- Use social media, websites, and investor outreach.

- Highlight the benefits and opportunities of investing in the asset.

- Use fintech marketing strategies to effectively reach your target audience and build trust.

Final Takeaways

Asset tokenization is an exciting development in the world of finance that has the potential to make investing more accessible, transparent, and efficient. While there are still challenges to overcome, the benefits of tokenization make it a promising technology that could shape the future of how we own and invest in assets. As technology and regulations continue to evolve, asset tokenization could open up new opportunities for investors and transform the financial landscape.